Advertisement

Macroscope | Why Hong Kong should trust more local, home-grown managers with its financial assets

- Asset management is critical to Hong Kong’s success as a financial centre, a reputation that has been battered in recent years

- Instead of trusting most of Hong Kong’s assets to global managers, the government could show greater confidence in the local asset management industry

Reading Time:3 minutes

Why you can trust SCMP

3

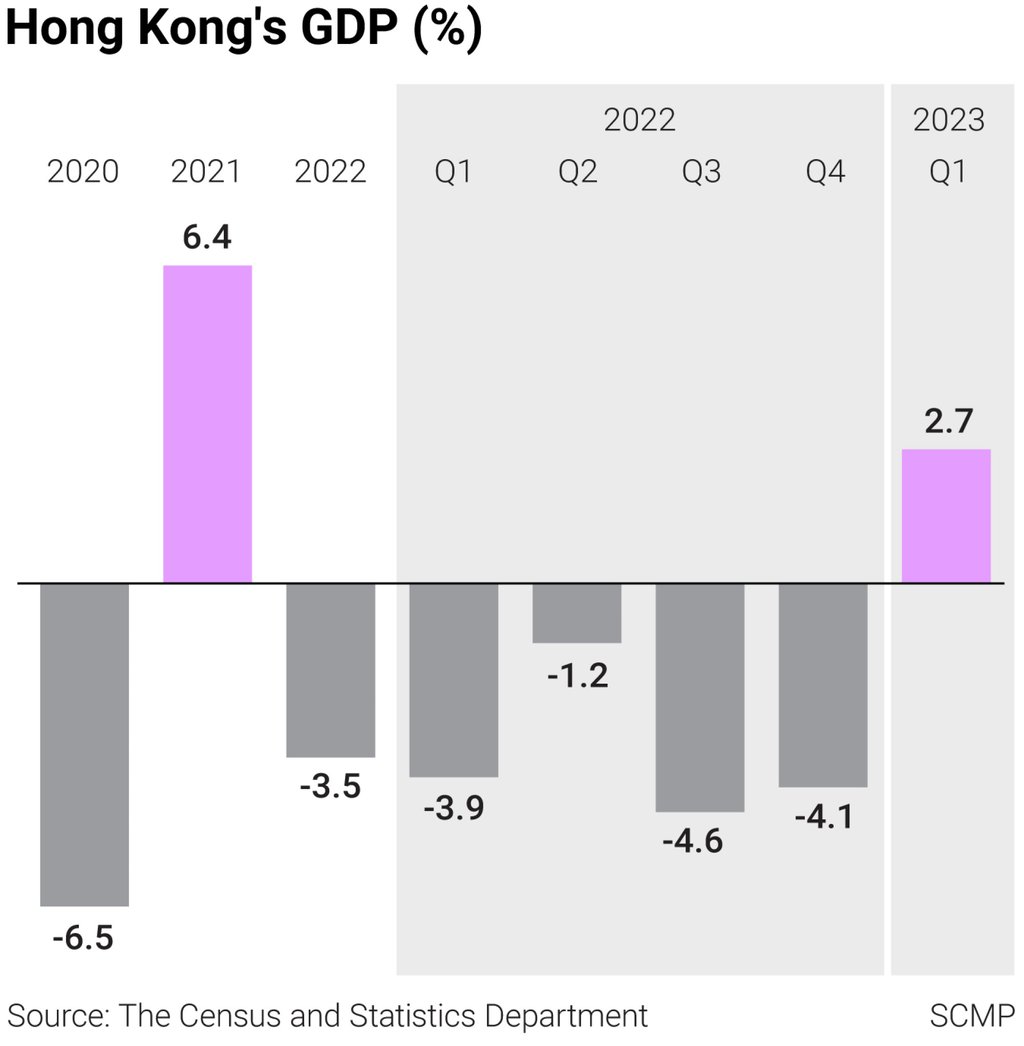

Hong Kong’s position as Asia’s leading financial centre has come under threat after the events of the past few years. This includes the city’s Covid-related policies, wider geopolitical tensions, a slower-than-expected economic recovery and increased competition from other Asian cities. Some reports now rank Singapore ahead of Hong Kong as Asia’s top financial centre.

Yet Hong Kong has long been recognised as Asia’s leading financial centre. Its open economy, strategic location and robust legal and regulatory framework have enabled Hong Kong has become a hub for financial services and a gateway to the vast markets of mainland China and the broader region.

With its national, regional and global connectivity, the financial services industry is also critical to Hong Kong’s prosperity and global standing as “Asia’s World City”. It is a major economic pillar, contributing 21.3 per cent of Hong Kong’s gross domestic product and employing 7.6 per cent of the working population in 2021.

Advertisement

The asset management industry, which encompasses private equity and venture capital, plays a pivotal role in the success of Hong Kong’s financial services sector.

Once a city reaches a critical mass of investment assets, it will spur the growth of financial intermediaries (e.g., banks, securities firms) and professional services companies (e.g., legal, accounting), which in turn attracts a skilled workforce. The cycle is self-reinforcing, as a well-developed ecosystem of intermediaries and service providers will attract even more capital and talent. By promoting the local asset management industry, cities can establish themselves as financial hubs.

Advertisement

While the government has introduced policies to attract more investment funds to be domiciled in Hong Kong, such as the tax exemption on private equity “carried interest” (payments to reward the general partners and managers of private equity funds and venture capital funds for managing their portfolios), these measures are far from sufficient.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x