Advertisement

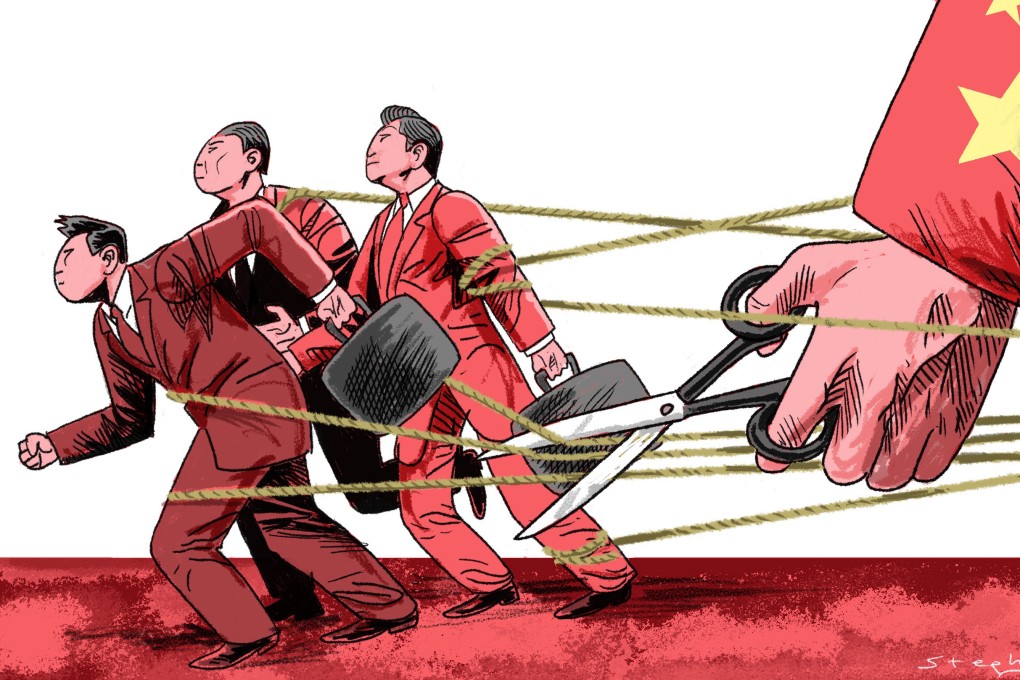

Opinion | Stimulus is simply the wrong cure for China’s ailing economy

- Given high local government debt, low interest rates and a moribund property market, stimulus is ineffective and wasteful

- To fix the structural downturn, Beijing should reach instead for deregulation and supply-side solutions

3-MIN READ3-MIN

2

China’s economy is at its weakest in decades. Every observer seems to be anticipating an economic stimulus plan from Beijing. But I believe China should try deregulation and supply-side solutions for a change.

Economic stimulus is well-suited to addressing the cyclical weakness of the economy. But China’s downturn today is also structural in nature. And China has very limited scope for further economic stimulus, having offered that for over four decades.

First, while the central government budget deficit is still modest, regional governments are buried in debt. And some regional governments are already on the cusp of default.

Advertisement

Massively expanding fiscal spending to build more infrastructure has become an unattractive idea, even to Beijing’s bureaucrats. They are still confronting the diminishing returns of such infrastructure projects, including the white elephant projects across the country.

Some analysts argue that regional governments still have vast assets (such as banks, real estate, and water and electric utilities) to support their continued fiscal expansion in infrastructure building. But most of these assets have been pledged to support their financing vehicles in recent years. Given their heavy and rapidly growing debt loads, one wonders just how much borrowing capacity Chinese regional governments have left at all.

Advertisement

Are they likely to privatise their asset holdings to finance more infrastructure building? There are two hurdles here. For a start, political will is lacking. Regional governments seem determined to secure handouts from the central government.

Advertisement

Select Voice

Select Speed

1.00x