How to tackle the challenges facing the global energy transition

- The adoption of renewables is unequal geographically, investment costs are rising, there is underinvestment in grids and storage, and then there are non-financial barriers

- Governments must tackle administrative hurdles while investors need to better support green energy development

Investments in solar power generation reached nearly US$500 billion last year, an increase of US$80 billion on 2021. Wind investments though, at US$162 billion, fell by 5 per cent. But despite recent cancellations of offshore wind projects, mainly in the United States, 103 gigawatts of wind farm capacity are likely to be established this year, with new investment in renewable energy hitting a record US$358 billion in the first half, up 22 per cent.

Yet challenges remain, in the unequal geographical adoption of renewables, rising cost of investment, underinvestment in supporting infrastructure like grids and storage, and the non-financial barriers that slow the adoption of renewable energy.

China alone contributed 52 per cent of the global investment in clean energy, along with 42 per cent in solar and 55 per cent in wind capacity additions last year. In Asia, only India, South Korea and Vietnam also made the top 10 for renewable capacity additions from 2013 to 2022.

Large parts of the world, especially emerging and less-developed economies, are lagging behind. Take Southeast Asia, for example, where green investments dipped by 7 per cent last year to US$5.2 billion. In particular, the region saw foreign investments in its green sector halve last year.

The second reason for exercising caution about the funding outlook for renewable energy is not so much the availability of finance but, rather, its cost.

The related volatility in financial markets has contributed to an uncertain financing environment, marked by investors’ withdrawals exceeding US$70 billion from emerging market stocks and bonds last year. While there has been an inflow of US$130 billion for the first 10 months this year, investors also withdrew nearly US$33 billion from August to October.

Simplistically speaking, a 4-5 per cent increase in interest rates adds 8-10 per cent to project costs, even assuming a relatively short two-year construction period.

Financial-sector participants, particularly development banks, need to step up by providing local financing at preferential rates whenever possible. Governments can encourage or mandate the financial sector to align their portfolios with national climate commitments over time.

Multilateral development banks must evolve to meet world’s needs

This is especially needed as non-financial barriers can obstruct the flow of finance and hinder the bankability of projects, resulting in a misalignment between viable projects and available capital.

Project bankability is also hampered by the absence of standardised transaction templates, particularly for small undertakings. These can ensure a repeatable process understood by all parties involved.

The absence of such tools leads to delays in planning and execution, contributing to increased costs. This is particularly detrimental given current high interest rates, and hinders investments in smaller projects, widening the gap between the laggards and leaders.

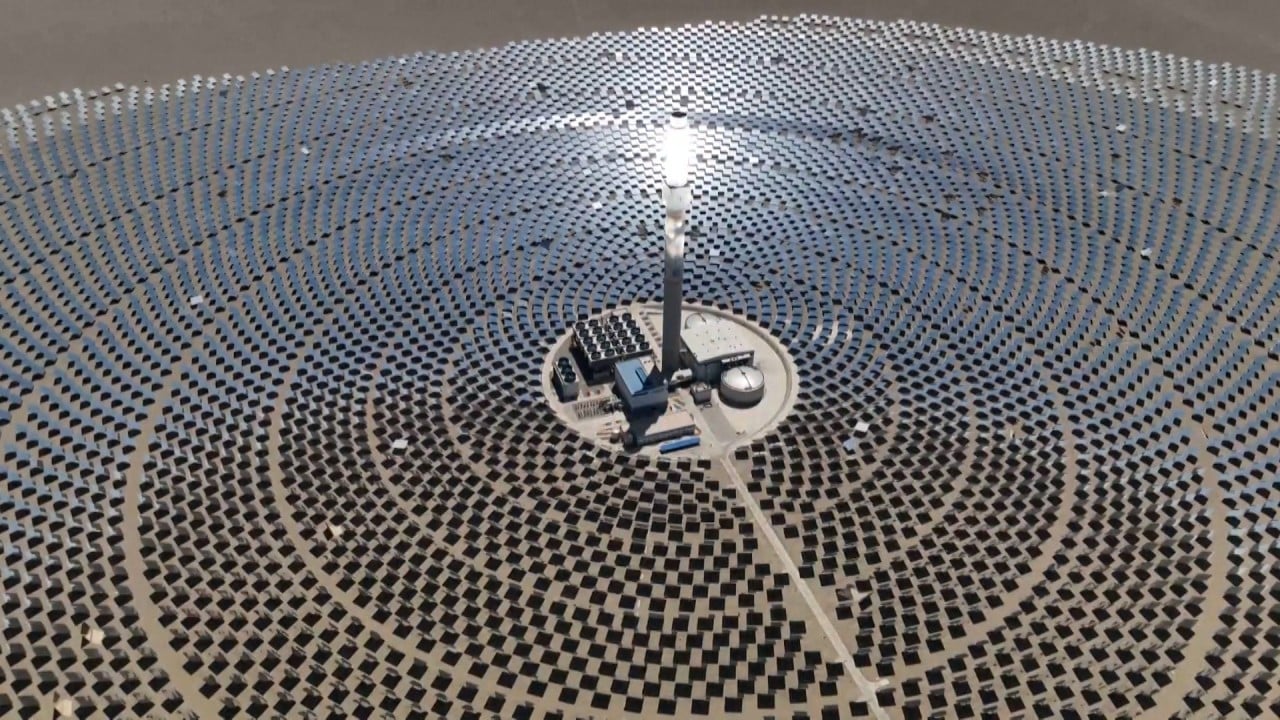

To achieve net zero by 2050, renewable energy must not only substantially meet the world’s energy needs but also do so consistently, irrespective of the weather. The variability in sunshine and wind necessitates significant investments in grids to enhance resilience.

China must invest in power grid and energy storage, not coal plants: analysts

Legacy power systems, characterised by centralised generation and a one-way flow of electricity, are no longer suitable models. The current mix of distributed and intermittent sources requires real-time demand-and-supply matching with a more robust network that allows power flows in both directions. Grids, as conduits for transporting cleaner energy to and from consumers and renewable sources, play a vital role in the energy transition.

Renewable energy relies on storage to address intermittency issues, both at the grid and user levels. As renewable energy integrates more into the grid, the need for storage to ensure reliability is growing.

Under the IEA’s net zero scenario, annual investment in grids and storage must more than double by 2030 to US$900 billion.

Much remains to be done to keep the energy transition on track. Governments must tackle the physical, administrative and procedural hurdles to reduce risks and costs. Simultaneously, investors, financiers and developers need to respond by better supporting faster and truly global renewable energy development.

Ramnath Iyer is the research lead for climate and renewable energy finance at the Institute for Energy Economics and Financial Analysis (IEEFA)