Advertisement

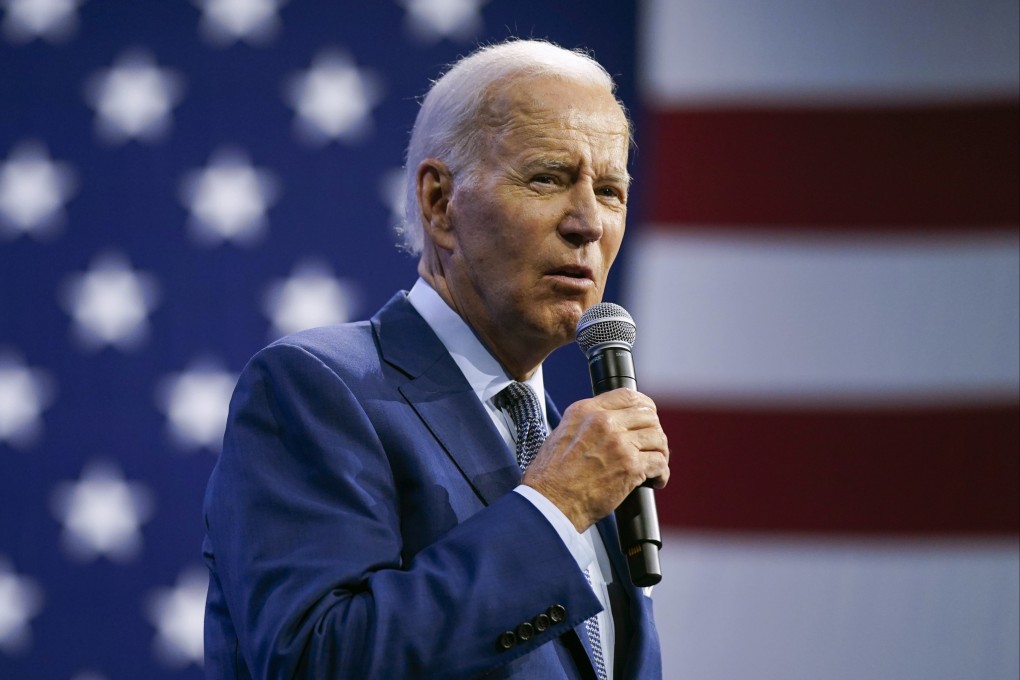

The View | Anti-China push in US Midwest a symptom of Biden’s dilemma

- Fierce public backlash in Michigan and Illinois over proposed Chinese electric vehicle battery factories highlights a conundrum for the Biden administration

- The potential economic benefits are in tension with US national security concerns and the political importance of Midwestern states in next year’s election

Reading Time:4 minutes

Why you can trust SCMP

8

A horse farm in the American Midwest is an odd place for US-China competition to play out. However, that is where protesters gathered with signs reading “No Go on Gotion” and “Don’t Sell Us to China”, expressing their displeasure with the proposed investment by the Chinese battery company Gotion in Mecosta County near Grand Rapids, Michigan.

The residents of Green Charter Township voted out five of the seven members of their board after months of mounting controversy relating to the battery manufacturer’s plans to set up facilities there. The subsidiary of Chinese battery maker Gotion Inc planned to build a US$2.3 billion battery parts plant in Michigan with the support of the state government in the form of a US$715 million investment package that included a 30-year tax break for US$540 million and grants totalling US$175 million.

However, the project has faced resistance from both residents of the county and Republican lawmakers over concerns about the environment and Chinese state involvement in the project. As it happens, the federal investment screening authority – the Committee on Foreign Investment in the United States – had reviewed the proposed project and cleared it.

Advertisement

Not far away, in the small town of Manteno, Illinois, the opposition to a Gotion plant there has been even fiercer and partisan. Local Republican state representatives have accused the Biden administration, the state leadership of Governor J.B. Pritzker and China’s Communist Party of working together to build a plant that they say would cost taxpayers millions.

Electric vehicle (EV) and battery supply chains are front and centre in US-China economic competition. Taking into account Chinese companies’ practice of using intermediaries such as Mexico, the Biden administration has proposed amendments to the criteria to be met to avail subsidies offered under the Inflation Reduction Act.

The US Department of Energy has proposed guidance for what constitutes a “foreign entity of concern” under the Inflation Reduction Act’s electric vehicle tax credits, which provide up to US$7,500 in relief for each vehicle sold to consumers. EV manufacturers won’t qualify for the credits if any company in their battery supply chain has 25 per cent or more of its equity, voting rights or board seats owned by a Chinese government-linked company.

Advertisement

Select Voice

Select Speed

1.00x