Editorial | More needs to be done if China’s economy is to get back on track soon

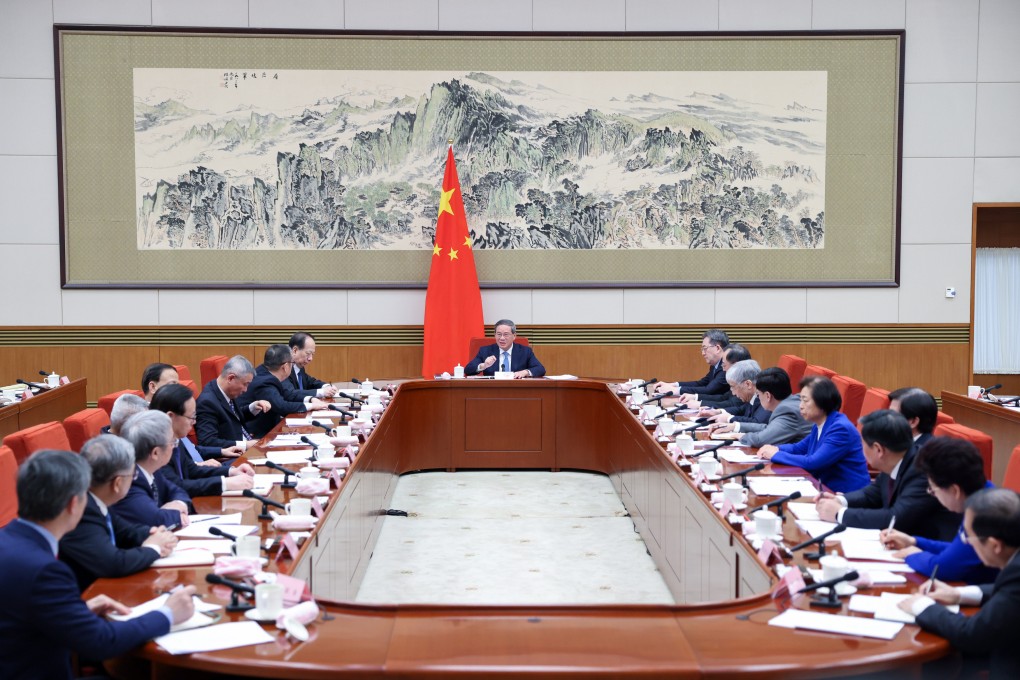

- Authorities quickly answered Premier Li Qiang’s demand for steps to halt a stock-market rout and improve investor sentiment. But uncertainties still remain

It did not take long for China’s financial authorities to answer Premier Li Qiang’s demand for “forceful” steps to halt a stock-market rout and improve weak investor sentiment. The headline measure is a 50 basis points cut in the amount of cash commercial banks must hold in reserve with the central bank to ensure stability – the reserve ratio requirement (RRR). This is expected to inject 1 trillion yuan (HK$1.1 trillion) of extra liquidity into the system. It will fuel credit for businesses, developers and individuals without the central bank having to stimulate demand by cutting interest rates. With funds attracted to the United States by rates of around 5.2 per cent, a cut in mainland rates would have increased the potential for capital flight, a risk China does not want to take.

Cutting the RRR is a relatively easy way to free up money. Next, China’s financial regulator – the National Administration of Financial Regulation (NAFR) – vowed measures to help the ailing property market such as support for cash-strapped developers and mortgage policies that offer more help for households. NAFR deputy head Xiao Yuanqi said the priority is better coordination between local government and financial institutions to support real estate projects. This reflects a perception that the property sector is key to China maintaining last year’s economic growth rate of just over 5 per cent. Its underperformance has not only weighed on local government revenues – and consequent debt burdens – but also on the fortunes of many related sectors from furniture to home appliances to textiles.

Now property must shoulder some of the growth driven by a post-Covid surge in consumer spending. Unless officials can turn the sector around, private investment and consumption could struggle to meet targets. Nonetheless it has to be encouraging that Beijing, Shanghai and Guangdong, three major economic drivers, have set growth goals for 2024 of 5 per cent or slightly better.

Banks can now lend more to small and medium enterprises, key drivers of growth and employment. That does not mean they will pour in billions overnight. The cut in the RRR is a signal of confidence from the authorities. But in the face of uncertainties like geopolitical tension and an American election year, banks can still be expected to lend cautiously. If China’s economy is to get back on track soon, there needs to be other, related measures.

In that regard an external event may have implications for future international capital flows. All eyes will be on a US Federal Reserve meeting this coming week for clues to the timing of an expected downward cycle in interest rates. It is widely expected to begin in the second half of this year. At this stage, strong US fourth-quarter expansion of 3.1 per cent year on year may not hold out much hope of an earlier rate cut, or support fearmongering about a recession.