Advertisement

Eye on Asia | China’s regulatory crackdown: what Asian credit investors should expect

- Short-term volatility will give way to a healthier credit market eventually, with China’s tech and property sectors likely to emerge with better governance, more sustainable growth and stable cash flows

Reading Time:3 minutes

Why you can trust SCMP

1

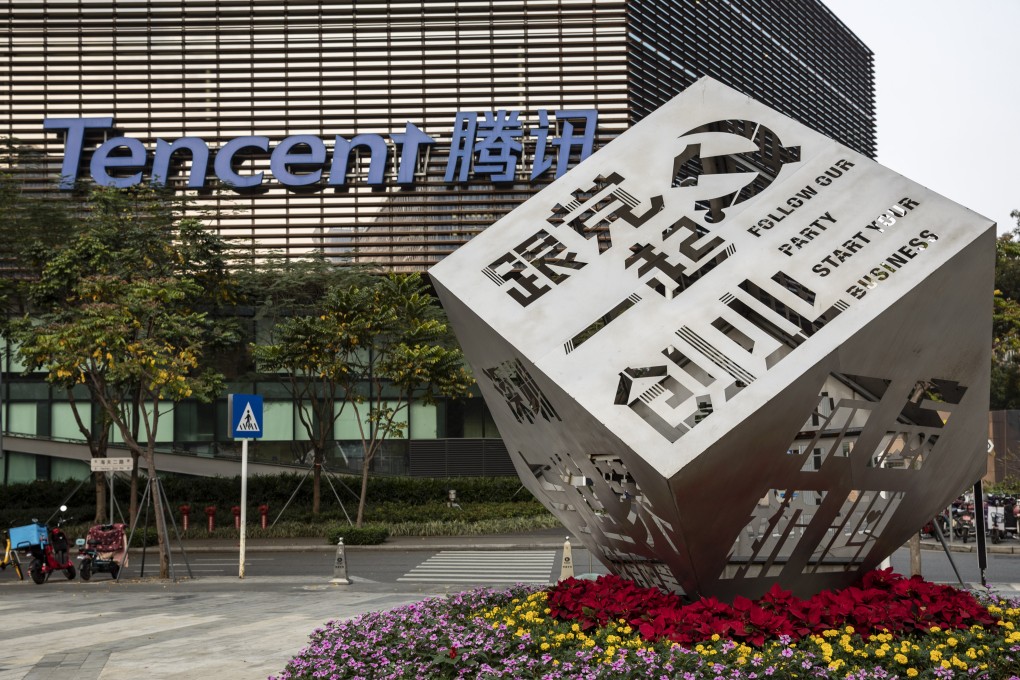

China’s regulatory actions, driven by Beijing’s financial, security and social objectives, have injected volatility into the credit market over the past year.

Despite the short-term impact on companies’ profitability, there might be a window for the affected sectors to formulate a more sustainable growth strategy and emerge stronger in the long run.

For Asian credit investors, being mindful of the dynamic regulatory backdrop while adopting a prudent credit selection can help to navigate the uncertainties and identify opportunities for better risk-adjusted returns.

Advertisement

The prices of some segments of the Chinese corporate dollar bond market have come under strong pressure after Beijing embarked on its regulatory overhaul. Investors could not help but wonder at the direction of regulation and its ripple effect on the wider Asian credit market.

The Chinese government has been supportive of the internet and property sectors for the past two decades, both in terms of favourable regulations and the build-up of infrastructure, as developing these key sectors promoted economic prosperity. The focus has now shifted to achieving more equitable objectives such as social stability.

Additional policy steps towards furthering social objectives – such as repositioning housing as living spaces rather than speculative investments, reducing the education cost burden for families, or deriving better value from the big tech firms and promoting greater profit sharing with small and medium-sized enterprise vendors and employees – have the potential to move markets.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x