It pays to enter China’s green bond market early, before prices take off

- The lack of ‘greeniums’ – the premium that green bonds can command – for China’s products won’t last

- As China aligns its green bond standards with the rest of the world, capital flows will ramp up and the boom should have plenty more room to run

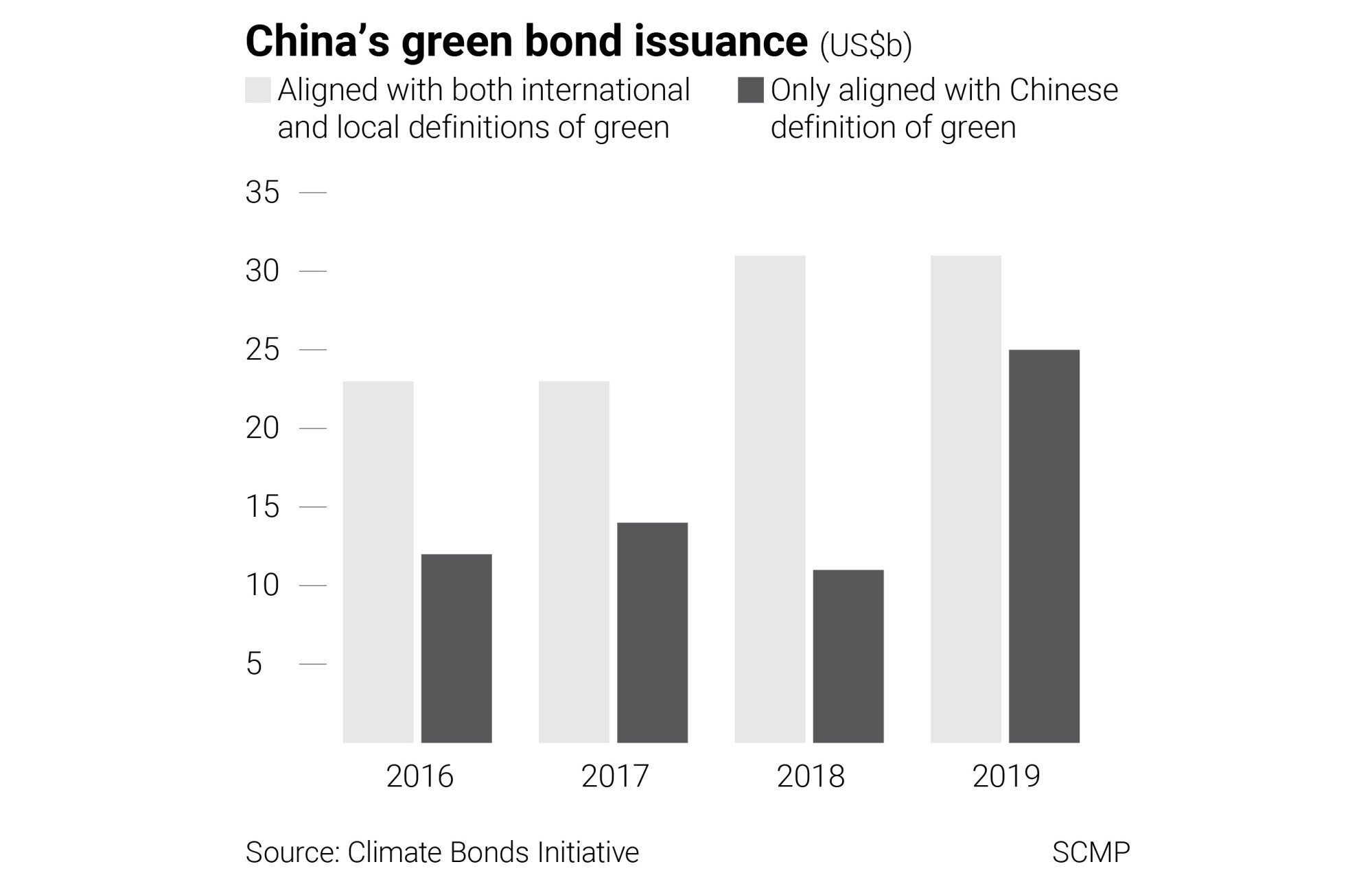

Among the financial market fallout from the Covid-19 pandemic was a slump in green bond issuance in China, where a five-year growth streak was snapped last year.

The government orchestrated the sale of more than 1 trillion yuan (US$156 billion) in pandemic control and relief bonds last year, capturing what remained of investor demand already weakened by the public health crisis.

This has led to China ranking fourth in the value of its internationally aligned green bond issuance so far this year, after the United States, Germany and France, according to the Climate Bonds Initiative.

In the first half of this year, the value of Chinese green bond sales that comply with domestic definitions and criteria surged to 242.5 billion yuan, while those aligned with international standards jumped to a record 141.9 billion yuan.

The question investors must ask is: is this the right time to enter the market?

Green bond yields were often 5 to 15 basis points lower than those of comparable brown issues over the past few years, according to many research groups including ING Think, the Climate Bonds Initiative and Eurasian Economic Review.

Despite the risks, China’s green bonds will prove rewarding for investors

In contrast, in China’s onshore market, our review of the data points to a clear lack of the so-called greeniums, which could be a boon to global investors.

The spread difference between Chinese green bonds and comparable brown issues of the same maturity is negligible. This appears to hold despite differing levels of rating quality, and even across sectors.

Significantly for investors focused on promoting environmental, social and corporate governance (ESG) outcomes, Chinese rules appear looser on the use of proceeds, allowing issuers to allocate up to 50 per cent of funds raised to loan repayment and working capital, while international standards usually require full allocation to green projects. This leaves loopholes for possible fund misuse in the Chinese market.

Recognising these differences, Beijing has been trying to harmonise its green bond standards with international ones.

How China and the EU can work together to drive green finance forwards

Change will take time, but the direction of the market is clear. In the first half of this year, green bonds aligned with Climate Bonds standards, which are based on the European Union taxonomy, accounted for 58 per cent of the value of Chinese green bonds – a small increase on 54 per cent last year and 57 per cent in 2019.

It pays to be early in China’s green debt space, where greenium-free days may well be numbered. The price of entry is bound to rise with demand.

As China further opens its capital markets and aligns its green bond standards with the world, capital flows will ramp up and the boom should have plenty more room to run. This is one case where the grass probably will grow greener, and no less costly, on the other side.

Martin Dropkin is head of Asian fixed income at Fidelity International