Opinion | Inflation, not a repeat of the ‘taper tantrum’, is the new enemy

- The Federal Reserve must act to ensure stable prices. Global markets need to hear that rates are heading higher and that the US is determined to forestall inflation as it moves to restore financial stability

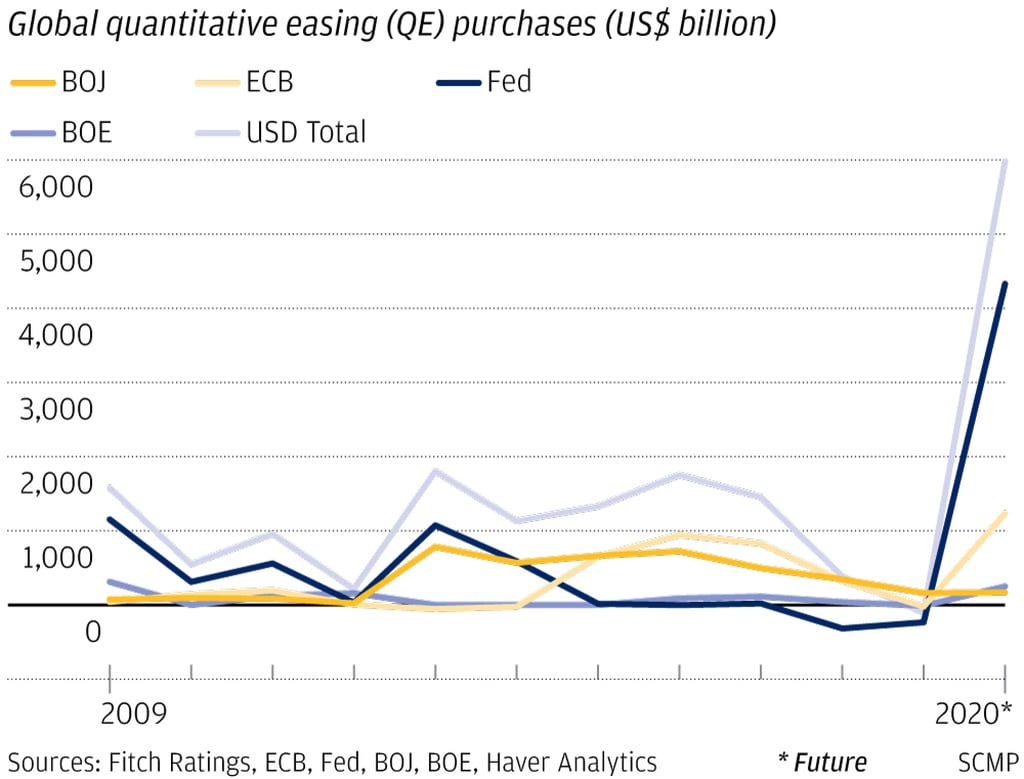

To be clear, since the Covid-19 pandemic struck early last year, the Fed has done the right thing. It acted quickly in March last year to bring interest rates down, rolling out vast amounts of cash. These bold actions calmed financial markets and reassured an anxious public that a health emergency would not drive down living standards.

There is no overstating the danger that was faced. World Bank chief economist Carmen Reinhart looked at the worldwide shutdown and warned of a global depression. Fed chairman Jerome Powell called the pandemic the greatest shock to the economy “in living memory”.

Speaking in mid-October, former treasury secretary and long-time Democrat Larry Summers expressed “very considerable concern” at the ultra-lax monetary policy, surging house prices and exploding budget deficit. “We’re in more danger than we’ve been during my career of losing control of inflation,” said Summers.