Global Impact: US-China tech war’s toll made visible at world’s largest electronics show

- Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world

- In this edition, we look at what 2023 has in store for US-China relations in the tech sphere

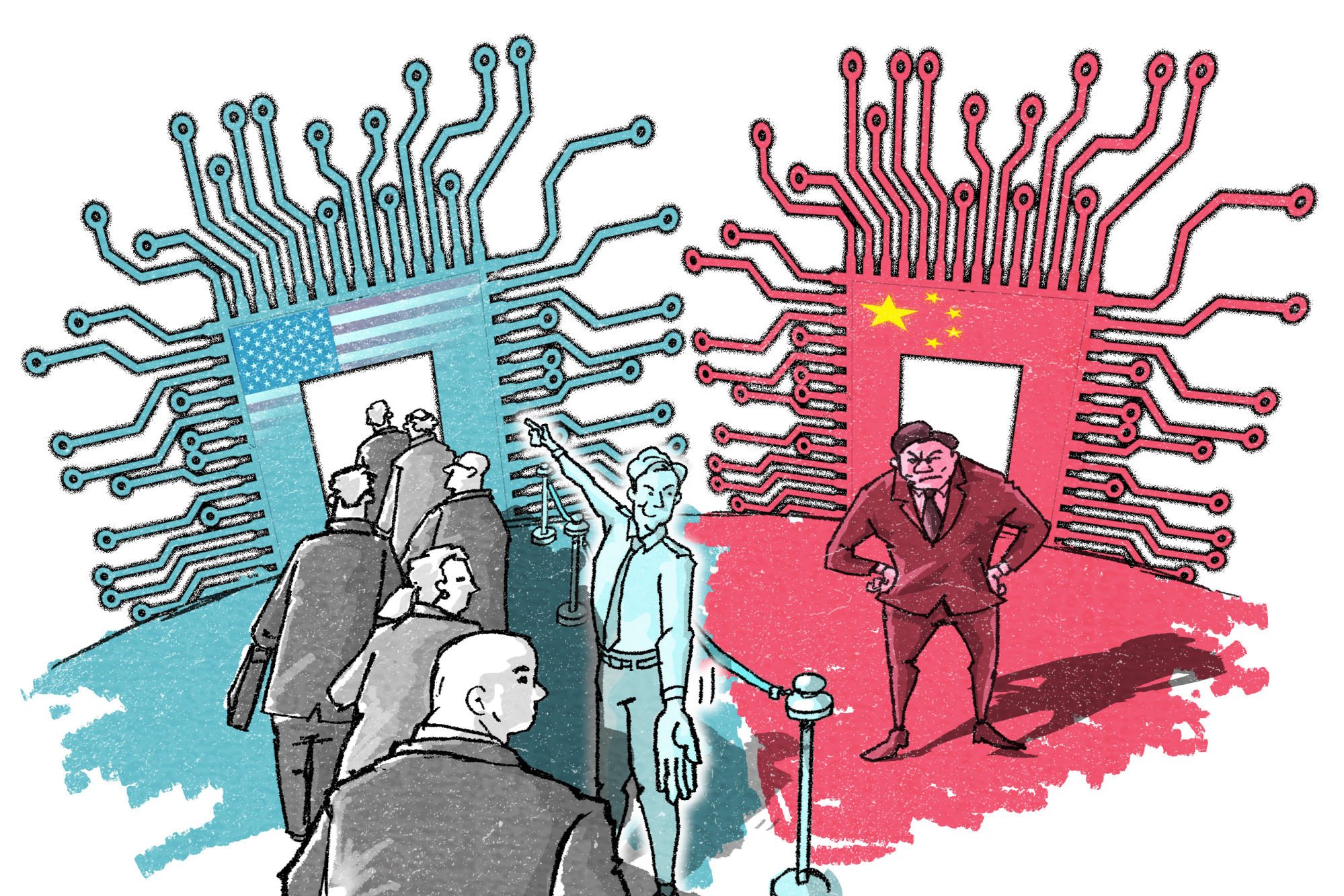

If Washington has one message for China in 2023, it may as well be this: stay in your lane.

And for many companies on display at the world’s largest electronics show earlier this month, it looked like that is exactly what they were doing. The biggest Chinese names at the Consumer Electronics Show (CES) in Las Vegas were Lenovo, TCL and Hisense – all computer and television makers. In other words, not the most hi-tech products on the market.

CES made visible the US-China tech decoupling that advanced over the course of 2022. From supply chains to social media, the US has been pushing to move away from reliance on China.

Still, the electronics supply chain is too inextricably linked to China for companies to completely pull out, even as they face increasing political pressure to move operations. Despite the winds in Washington blowing against China, electronics assembly in the country has never really been a problem. Much of that work has been outsourced to Asia for decades, as it is on the lower rung of the manufacturing ladder.

The main concern for Washington is that China will do what Japan, South Korea and Taiwan did before it: turn cheap product assembly into technological advancement that rivals the US.

There may be days when Chinese officials wish they had stuck with former leader Deng Xiaoping’s policy of hiding strength and biding time. But with nearly every piece of tech with ties to China now under scrutiny, it seems there is nowhere left to hide, and the bickering is only getting louder.

60 second catch-up

Deep Dives

Apple looks to India, Vietnam as iPhone maker’s supply chain comes under the spotlight in US-China decoupling

-

Apple reportedly cut back on orders citing weakening demand in potential blow to its Chinese suppliers that are heavily dependent on the US giant

-

Analysts have lowered their shipment predictions across a range of Apple products

Chinese firms try ‘decoupling’ from China as US business climate turns hostile

-

Public relations specialists note a growing trend of Chinese companies trying to localise their image and operations to remain competitive in the US

-

Between perceived security threats and an emphasis on new supply chain alternatives, US policies have left Chinese firms scrambling for cover

The communications manager of a multinational tech corporation that makes sustainable smart devices in China stressed that it is a global company, not Chinese.

The company’s public relations materials say it has “operational headquarters” in the US, Europe and another Asian country, but don’t mention Shenzhen – though its official website names Shenzhen on top under “headquarters”. And the company plans to move its manufacturing somewhere outside China.

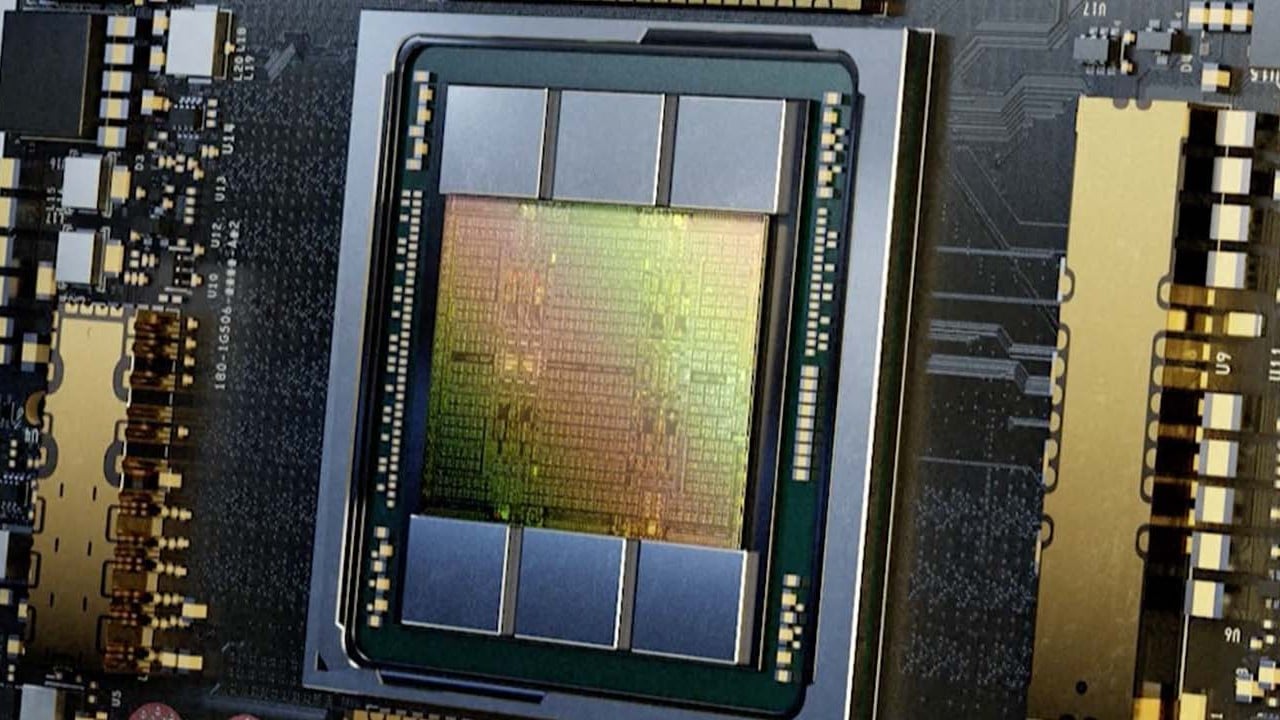

China’s push to forge a chip coalition in Asia falters as Washington expected to tighten the screws in 2023

-

The past year has seen the emergence of a US-led coalition to thwart China’s access to advanced chips

-

Beijing’s plan to use Europe as a counterbalance to US semiconductor export restrictions has faltered amid rising supply chain concerns there

Chinese strategist Wang Xiangsui published a book in 2017 entitled One of the Three: China’s Role in a Future World, in which he described a global future that sees three main blocs emerge: North America, Europe and pan-Asia.

Borrowing a page from Luo Guanzhong’s literary classic Romance of the Three Kingdoms, Wang says China will take on leadership of the pan-Asia bloc. “China should be happy to have one third of the world under heaven,” Wang said in an interview with the Observer, a Chinese nationalist website, in late 2020.

Normally bellicose China’s meek response to US chip restrictions raises eyebrows

-

Beijing typically ‘retaliates fully plus 10 per cent’, but this time it doesn’t seem to have many punitive options

-

‘It is a puzzle,’ says an American analyst. ‘On everything else, they seem to have skin that’s thinner than Saran Wrap.’

China has a long history of biting back when other countries adopt policies it does not like. In 2020, when Australia called for an investigation into the origin of the Covid-19 virus, it was hit with duties and bans on barley, wine, wheat, wool, copper, timber and grapes totalling over US$1.3 billion.

After Meng Wanzhou, chief financial officer of Huawei Technologies, was detained in Canada in 2018 for allegedly violating US sanctions against Iran, Beijing quickly detained two Canadians in China and blocked or slowed a slew of farm imports from Canada.

Who controls TikTok? ByteDance unable to allay fears in the West over Chinese state influence and data access

-

The future of one of the world’s most influential apps remains murky as it faces pressure from Western lawmakers, Chinese regulations and investors

-

ByteDance founder Zhang Yiming is no longer at the company’s helm, but he is said to still be making the big decisions concerning TikTok

TikTok, the most successful Chinese app outside the country where it was founded, has been unable to allay concerns from the US and its allies about access to user data owing to an ambiguous corporate structure that suggests at least some top decisions are still being handled in Beijing.

The development of TikTok remains under the influence, directly and indirectly, of multiple people and governments across several countries, according to interviews with multiple employees and analysts by the South China Morning Post. As a result, one of the most widely used apps in the world, with more than 1 billion users, has become caught up in a complicated web of technology, money and power as its corporate parent seeks to maintain ownership of its prized jewel.

TikTok’s owner faces critical year as Washington and Beijing weigh on its future

-

A security deal with the Biden administration to continue operations in the US was reportedly delayed by a growing backlash from American lawmakers

-

A forced sale of TikTok’s US operations could be difficult as the Chinese government could technically veto such a deal

2023 will be critically important for China’s largest unicorn, ByteDance, as it faces ongoing political uncertainties from Washington with regard to its hit TikTok app, while at home Beijing’s policies will continue to shape its China operations, according to analysts and executives.

The elephant in the room for ByteDance is the future of TikTok, the first China-owned app with global reach, as its security deal with the Biden administration to continue its operations in the US was reportedly delayed by a growing backlash from American politicians who questioned the platform’s links to China.

How Taiwanese chip tycoon Robert Tsao made an about-turn and angered Beijing

-

Tsao’s shift from cherished visitor to persona non grata on the mainland comes at a time of rising geopolitical tensions over technology

-

Tsao has donated US$100 million to aid the self-ruled island’s defence and pledged to ‘never live to see Taiwan become another Hong Kong’

Robert Tsao is making waves. The founder of United Microelectronics Corp (UMC), Taiwan’s second-largest chip manufacturer, was one of the self-ruled island’s semiconductor gurus to pour money and technology into mainland China two decades ago, upsetting the administration in Taipei at the time. Now he faces Beijing’s ire.

Global Impact is a fortnightly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world.