Japanese business leaders tour China to spur investment as political ties turn frosty over Fukushima

- Trade groups from Japan attempt to build rapport with Chinese peers despite growing antipathy over Tokyo’s release of waste water into Pacific

- The two sides take pragmatic approach and avoid hot topics in attempt to insulate trade from hostilities, says delegation leader

Unfazed by frosty ties, a Japanese business delegation is making its way across China to pitch two-way investment while relations between Beijing and Tokyo fester in the wake of the Fukushima water release.

The delegation from a leading chamber of commerce in Osaka, Japan’s second-largest city, arrived in China in late August.

The Japanese foreign ministry’s latest safety advisory urged Japanese nationals in China to exercise caution and avoid speaking the Japanese language in public.

But the business group was not deterred.

What Weibo alarm over Zhuhai radiation says about Chinese reaction to Fukushima

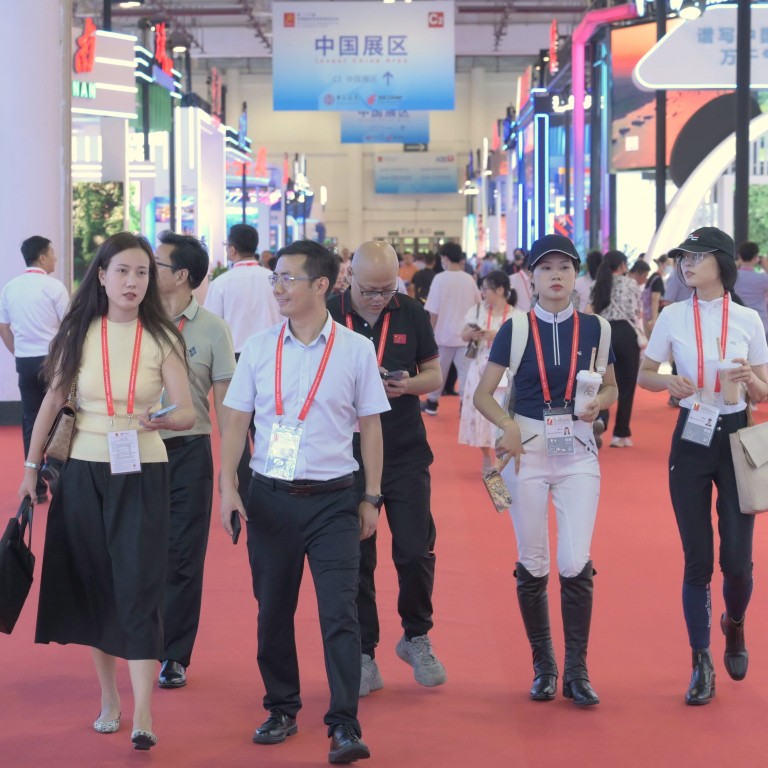

Takayoshi Negoro, director of the international division at the Osaka Chamber of Commerce and Industry, led the delegation to Xiamen in the southeastern province of Fujian for the China International Fair for Investment and Trade.

He praised the pragmatism shown by entrepreneurs and trade officials in both countries in their efforts to “keep business ties ‘business as usual’”.

Stakeholders in both countries are trying to insulate trade from the tensions.

There has been an uptick in visits by Japanese prefectural officials and business representatives since China reopened its borders in late 2022. Several more have been planned and are expected to go ahead despite the Fukushima controversy in an effort to maintain business between Japan and its biggest trading partner.

Negoro said the message he gleaned from his interactions with local officials in Beijing and Xiamen was that their will to uphold trade ties had not faltered, but that the two sides were taking a “more flexible, nuanced approach” and waiting for the “temperature to drop”.

Chinese state media continues to condemn the Fukushima water discharge and Chinese social media platforms are rife with rants against Japan, with some users bringing up Japan’s invasion during World War II.

[We] cannot control if China bans aquatic products from Japan, but seafood represented a tiny fraction of the goods flowing between Japan and China

“[We] cannot control if China bans aquatic products from Japan, but seafood represented a tiny fraction of the goods flowing between Japan and China,” said Yohei Takeda, assistant director at the Osaka Business and Investment Centre, a semi-official body.

China imported 3.38 billion yuan (US$360 million) worth of Japanese seafood in 2022, according to Chinese media reports citing data from the General Administration of Customs.

Last year’s total trade value between the two Asian neighbours was US$357.4 billion. Japanese seafood accounted for a small fraction of the two-way trade, with electronics, auto parts, precision machinery and semiconductor manufacturing equipment among the key items for bilateral trade.

According to Takeda, Osaka and the Greater Kansai Region, Japan’s second-biggest urban area, relies heavily on trade with China, the largest overseas market and manufacturing base for multinationals such as Sharp, Sanyo and Panasonic headquartered in the region, which also includes Kyoto and Kobe.

Meanwhile, Chinese leaders in recent months have pushed local authorities to retain foreign investment to keep the economy ticking. Cadres in charge of cities with a high concentration of Japanese firms are aware of the risk of politicising controversies between the two countries, according to a report by the Japanese Chamber of Commerce and Industry in China.

Japan is China’s second-biggest source of foreign direct investment (FDI), with an accumulated inflow of US$130 billion. While China’s FDI fell 2.7 per cent year on year in the first six months in yuan terms, FDI from Japan bucked the trend and soared 53 per cent in the first half of 2023.

There were 55,805 Japanese-invested companies in the country as of May, according to the Chinese ministries of commerce and foreign affairs.

Given the importance of trade and investment for both sides, Takeda said he was not surprised that “not a single word” about the seafood ban was mentioned in talks with officials and academics in Beijing, Xiamen and other Chinese cities.

However, many existing Japanese firms in China are grappling with costs as well as regulatory and geopolitical challenges.

Why do many scientists oppose Fukushima radioactive waste discharge?

Japan’s trade minster Yasutoshi Nishimura has raised a laundry list of complaints when meeting Chinese trade officials, warning that China was becoming “inhospitable and uneven” for Japanese firms. Common gripes have included rising costs and a fickle regulatory environment.

Japanese companies in China have reported more closures, cost-cutting measures and capital repatriation since the beginning of the year. Mitsubishi Motors and Toyota in June and July laid off more than 1,000 employees at their plants in Guangzhou.

Responding to the waning confidence, Guangzhou officials made unprompted offers of help, including cheap loans and capital injections to bail out ailing subsidiaries of Japanese firms, according to local media.

Takeda said this showed the “realpolitik” approach of local governments in China.

The delegation from the Japanese Association for the Promotion of International Trade was assured that China would support Japanese companies in further expanding their presence in the country.