Trade war: Chinese exporters fight to save profit margins at country’s biggest trade fair

Some are dropping prices to share burden of tariffs with US buyers, while government advises diversifying by selling to Asia or Africa

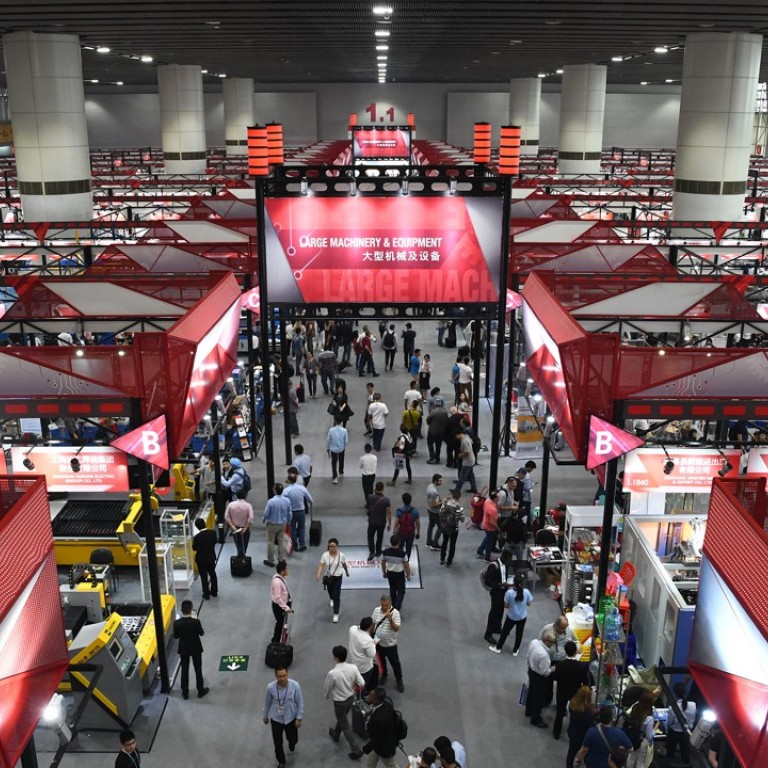

Over 25,000 Chinese exporters gathered this week at China’s largest trade fair wondering what they will do if potential American buyers stop visiting and orders from the US dry up.

Against the backdrop of the escalating US-China trade war, the fair in the southern city of Guangzhou – seen as a measure of China’s overall export robustness – opened its doors on Monday to an estimated 200,000 buyers from across the world.

The 124th China Import and Export Fair, also known as the Canton Fair, traces its origins back to 1957, when the young communist China was isolated by the West, and is now held twice a year.

The exhibition centre, with thousands of booths selling everything from artificial limbs to Christmas trees, looked busy and packed with foreign buyers on Tuesday.

Beneath the surface, however, there was widespread uneasiness among exporters – both those who trade directly with US clients and those who do not – that the dispute with the United States was undermining their negotiating power.

Dozens of buyers – none of them from the US – told the South China Morning Post they were happy to still find quality and affordability with many Chinese exporters eager to find buyers.

Price were similar to what was seen at the previous fair, despite soaring costs on the mainland, and some exporters even offered price cuts to retain clients and make up for drops in orders from the US.

“Thanks to the trade war, I think our buyers have bigger bargaining power with Chinese companies this year,” said an Australian buyer, Kayden Hayes.

Tom Wang, a merchant from Taiwan and a frequent visitor to the fair, said the price was the same for building materials as at April’s previous fair, showing exporters were “sacrificing profit margins because we know the raw material and labour costs have been soaring”.

The US was the second-largest source of buyers after nearby Hong Kong at the previous opening of the fair, as 12,000 US buyers attended. Xu Bing, spokesman for the fair, said the enthusiasm of US buyers for the autumn fair “might be affected by US trade policies”.

Linda Chen, a sales manager of a company producing supporting frameworks for tablets, said conditions had changed too quickly. “In 2016, we were depending on the recovering US market to grow our sale; now we are hit by US tariffs,” Chen said.

She said her company had to cut its prices by 5 per cent for US clients as an arrangement to “share” the 10 per cent tariffs imposed by US President Donald Trump on Chinese imports into the US. However, she said they might lose US clients from next year, when the tariffs are due to increase to 25 per cent.

The US is China’s largest export market, accounting for about a fifth of its total exports. The Chinese government is trying to tell its exporters to diversify sales, especially to countries covered by projects under China’s “Belt and Road Initiative”, namely Asian and African buyers.

Visitors from belt and road countries now make up half of all attendees at the Guangzhou event, but for some Chinese exporters they are not preferable to US ones.

A sales manager from W&S BATT, who declined to be named, said African buyers were “sensitive to” prices and preferred things “as cheap as they could get”.

Although he was not relying on the US market, he said it would be too optimistic for exporters to put all their hopes on clients from belt and road countries. “That’s not possible – everyone knows that,” he said.

Chen agreed. “China has been the factory of the world for decades and the US is always the biggest market – this won’t change overnight,” she said.

Despite this, Chen said her company had opened a factory in Vietnam with the initial aim of cutting costs, and planned to expand the factory soon.

In a Reuters poll of 91 exporters at the fair, 65 per cent of respondents were concerned about escalating trade tensions, fearing the damage it might cause throughout the global economy.

The spring session of the fair brought in US$30 billion worth of orders for Chinese exporters, and if deals for the same amount are signed at this edition, which will last for three weeks, the fair would have accounted for about 2.5 per cent of China’s total exports over the year.