Exclusive | Better watch out: trade war to push up US prices of China-made Christmas decorations – but not until next year

- US relies on China to make vast majority of artificial Christmas trees and festive ornaments, and buyers could face cost increases if they try to shift suppliers in short term

The one thing Chinese manufacturers and US suppliers of holiday decorations want for Christmas is a ceasefire in the US-China trade war, because barring that, festive decorations are likely to be much more expensive for US consumers next year, hurting business on both sides of the Pacific Ocean.

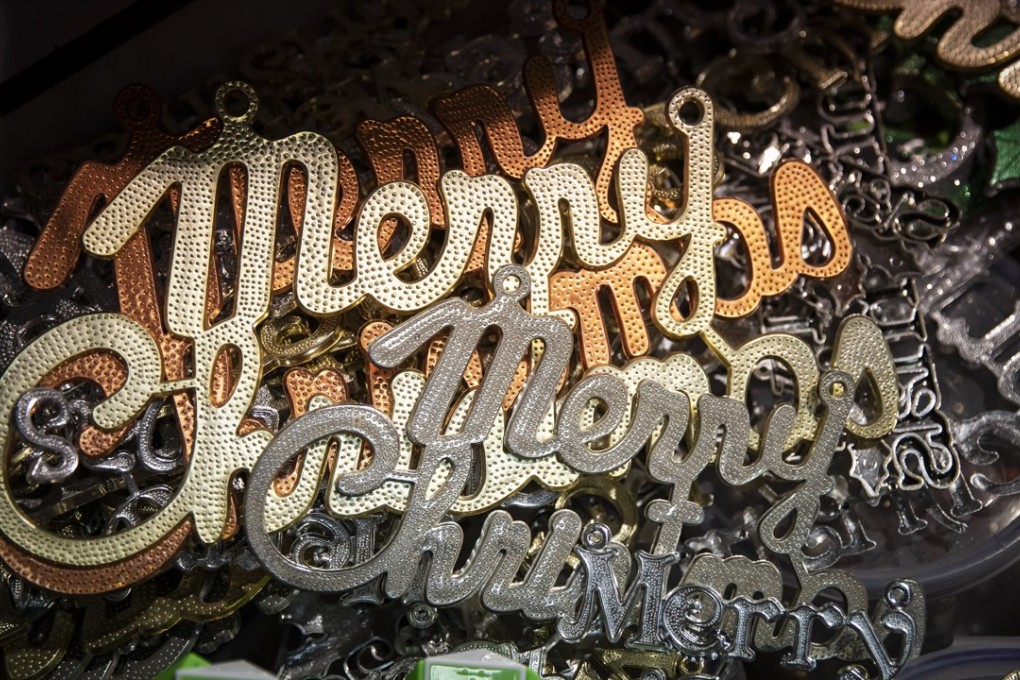

Nine out of every 10 ornaments that decorate US homes is made in China, so this is no small matter.

This year, Chinese suppliers of artificial Christmas trees, Santa Claus ornaments, and glass ball decorations were able to ship most of their goods during the summer, before US tariffs on them took effect in late September.

But next year, not only will those exports face a US tariff, but that tariff is due to rise to 25 per cent from January 1, if US President Donald Trump and his Chinese counterpart Xi Jinping cannot agree to keep the tariff at the present 10 per cent rate.

The prospect of having to compensate for the tariff, and the likelihood that orders will drop, petrifies Chinese ornament suppliers, who rely heavily on the US market.