China outbound investment picks up in bid for hi-tech upgrade

- Chinese foreign acquisitions bounce back this year as the country seeks out advanced technology the trade war with the United States

China’s outbound direct investment has gradually recovered this year, as the government encourages acquisitions of offshore hi-tech companies to help move the country up the manufacturing value chain.

Buying overseas talent and experience was seen as the fastest route for China to upgrade its technology and catch up with rivals like the United States and Germany, analysts said.

China plans to dominate 10 hi-tech sectors as part of its state-backed industrial “Made in China 2025” policy but the 10-year programme, which targets emerging industries like robotics, biotech and electric vehicles, is at the core of complaints from Washington that the ambitions are a threat to US national security.

Beijing has been downplaying the policy to avoid triggering further backlash from the West but the plan is still seen as the key to China’s future, even as the protracted trade war with the United States continues to weigh on China’s economic growth and investment returns.

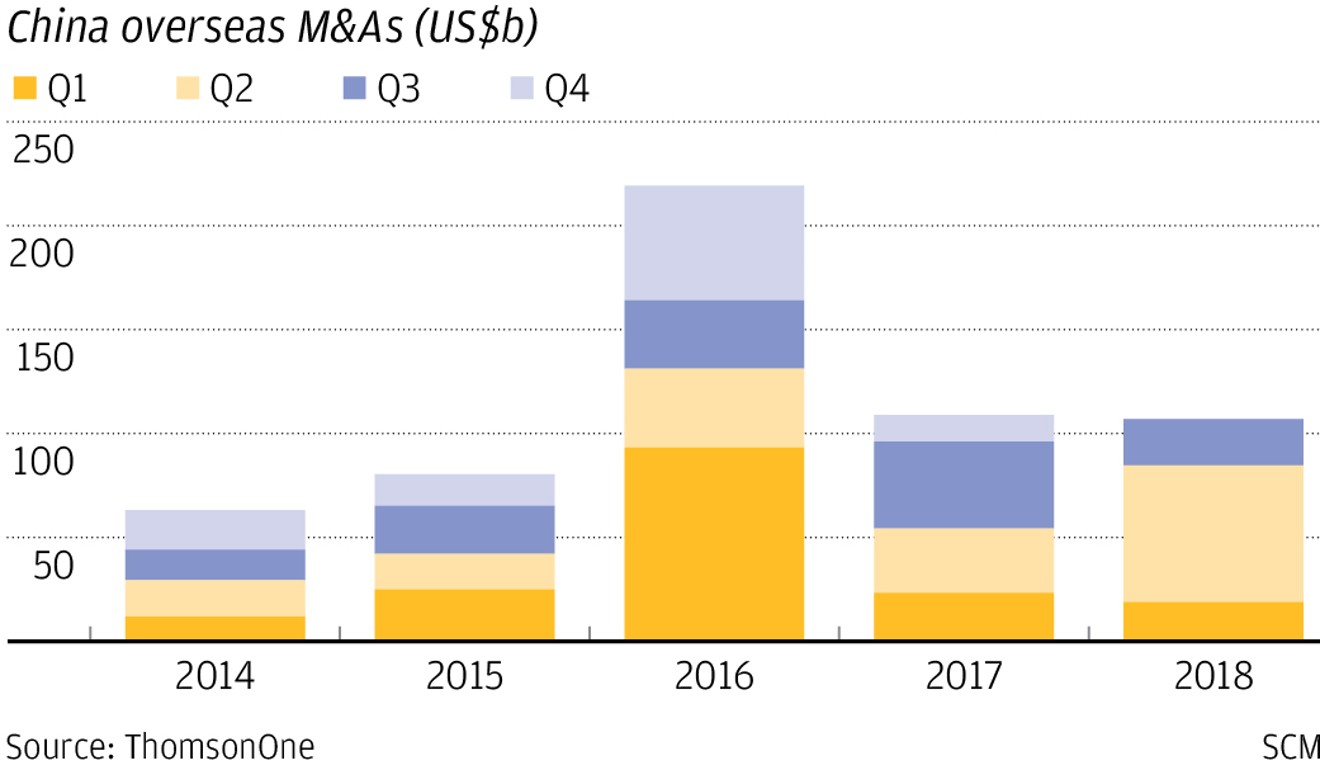

To that end, the value of overseas mergers and acquisitions (M&A) by Chinese enterprises rose 11 per cent year on year to US$106.9 billion in the first three quarters, according to a survey by global consulting firm EY Consulting Services.

For the whole of 2017, China’s overseas M&A deal value sank by half from a year earlier to US$109 billion because of the harsh government crackdown on the excessive, risky overseas buying sprees by a number of Chinese companies.

China resumes outbound investment scheme but with tighter controls

But the global landscape changed dramatically this year and China decided to resume its overseas push, with the government setting out goals and explicit strategies for outbound investment.

“Chinese companies are changing their investment models to buy technology-led overseas investments because of the favourable policies,” Hu Zhanghong, rotating chairman of the China Mergers & Acquisitions Association, said.

The association is a State Council-approved non-governmental organisation that provides M&A financial, legal, and management consultation services.

Commerce Minister Zhong Shan said earlier this month that the government would support private companies investing abroad.

“We will guide private businesses to venture abroad in an orderly manner and to take part in the ‘Belt and Road Initiative’,” Zhong said, referring to the central government’s trade initiative to link economies into a China-centred trading network.

The top five sectors by the number of China overseas M&A deals made in the first three quarters of the year, according to E&Y, were: technology, media and telecommunications, or TMT, (138 deals), consumer products (110 deals), financial services (64 deals), life sciences (51 deals), and diversified industrial products (36 deals).

The top five sectors by deal value were: power and utilities (US$31.3 billion), oil and gas (US$19.5 billion), consumer products (US$12.4 billion), TMT (US$11.8 billion) and automotive and transport (US$11.1 billion).

Loletta Chow, global leader of the EY China Overseas Investment Network, said Chinese capital was likely to be directed into target sectors such as infrastructure, TMT and financial services.

But Chinese investors remained cautious and any M&A deal recovery would be constrained by the uncertain external environment. M&A deal growth was unlikely to return to the record levels seen in of 2016, Chow said.

China’s aviation industry has a steep climb to ‘Made in China 2025’ goals

Chinese outbound investment this year and the in the future will encounter more scrutiny in major developed countries.

The US recently passed legislation to expand the powers of the Committee on Foreign Investment in the United States, or CFIUS, to screen mergers with US companies and investment in the US by foreign entities on national security grounds. The law, which is expected to be fully implemented in February 2020, has led to a sharp fall in Chinese direct investment in the US this year.

Given the difficulty in negotiating with the US, China was particularly interested in building alliances with European countries, especially those along the belt and road route, said Alicia Garcia Herrero, Asia-Pacific chief economist at Natixis Bank.

While the European Union is also toughening its stand on foreign capital inflows through state aid and antitrust policies as well as through discussions of creating a CFIUS-like entity for Europe, so far it remains a more benign destination for Chinese overseas M&A deals.

Continental Europe excluding Britain has seen an increase in the number of Chinese deals this year, taking up about 38 per cent of the total deal value from China in the first half of the year. That was boosted by Geely Holding Group’s purchase of a stake in Daimler, the maker of Mercedes-Benz cars, marking the biggest investment in a global carmaker by a Chinese company.

The belt and road’s share of foreign M&A deals was also boosted to about 40 per cent in the first half of the year from about 5 per cent last year after the purchase of Singapore warehouse operator GLP by a Chinese private equity consortium.

“After the tit-for-tat tactics [of the trade war], China is now focused on pushing growth domestically and finding alliances externally while it accelerates its technological self-reliance through acquisitions of technology, especially in Europe,” Herrero said.