Beijing’s small businesses face uncertain short-term future due to tighter tax rules despite vow to reduce burdens

- Around 540,000 small businesses could be affected despite central government saying they will look to help to bolster the slowing economy amid the trade war

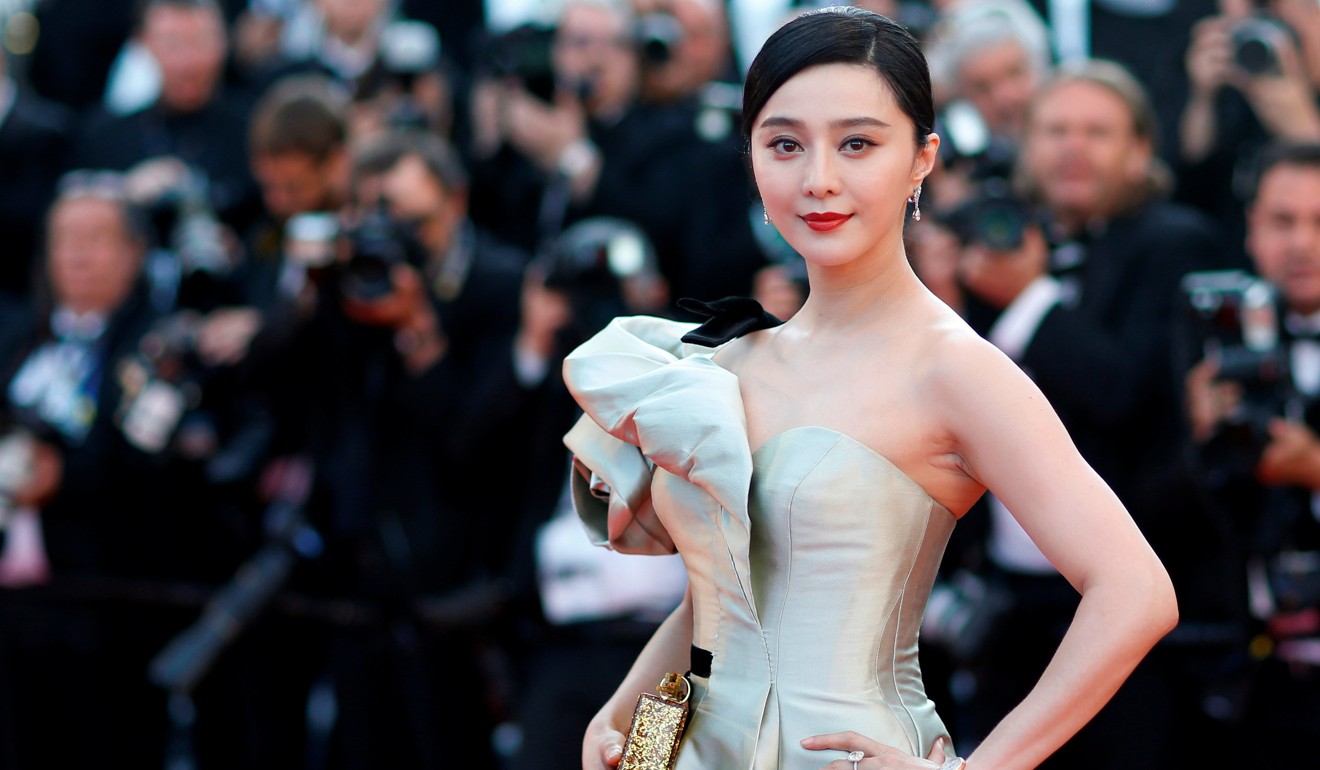

- State Administration of Taxation has already tightened collection methods for the film and television industry after the tax evasion scandal of actress Fan Bingbing

Small businesses in Beijing face an uncertain short term future when a tighter tax collection method comes into force next year, according to a corporate legal and tax consultant in the Chinese capital.

From January 1, small privately-owned businesses will have to pay their business rates based on their actual accounts, rather than the current practice of paying a fixed amount periodically based on revenue estimated by the tax department.

The move, which was announced at the end of last month by tax authorities in all districts of China’s capital city, comes despite the Chinese government vowing to reduce the tax burden of small firms to help bolster the slowing economy amid the trade war with the United States.

The move has the potential to increase payments for around 540,000 small businesses, from tiny restaurants to small industrial factories, who have up to now benefited from often generous estimates.

“If individual business owners want to fully comply, they will need to hire additional personnel to keep accurate account books … the cost [of the new collection method] will be higher in the short term,” said Windson Li, head of the tax group for the Beijing office of law firm DLA Piper.

“It’s easier nowadays for small businesses to earn more profits, that’s maybe why tax authorities think it is the time to change the method, although that will increase the cost on the taxpayer side.”

The new initiative, which is part of a broader move by the central government to take control of tax collection to ensure adequate revenues, is in contrast to a statement earlier this month from the State Administration of Taxation (SAT) that it was studying a new round of “larger, substantial, and inclusive” tax cuts to help the country’s private sector.

On Friday, a week after announcing the policy shift, local taxation bureaus in Beijing published a further statement clarifying that the new collection method was not a “one-size-fits-all” approach, and that small businesses whose sales fall below the threshold could keep paying their taxes based on estimated fixed amounts.

Beijing is tightening tax collection regulations to help plug a fiscal revenue hole this year, with the city set to miss its annual income growth target of 6.5 per cent, with revenue having increased only 5 per cent during the first 11 months of 2018, according to the data from the Beijing Municipal Bureau of Finance.

The revenue growth rate is also declining rapidly as the local economy slows, with figures for January-November showing a 1.1 per cent decrease from the first 10 months of the year.

The experience of Beijing mirrors that of the entire country after the central government’s fiscal revenue fell 3.1 per cent in October compared to the same period last year, the first decline this year, data from the Ministry of Finance showed.

The State Council, China’s cabinet, has repeatedly pledged to cut the business tax burden in recent months after the country implemented its first cut in individual income taxes since 2011 in October.

The only business-related tax cut implemented this year is a mere 1 per cent reduction in the value-added tax rate in May.

However, the sharp slowing in fiscal revenue growth leaves only limited room for further reductions in business taxes, especially when the nation is expanding fiscal spending on infrastructure to spur the economy.

The central government has yet to further simplify the structure of its VAT regime, which it promised in May to do by the end of 2018.

And at the end of November, 28 central government departments, including the SAT, the People’s Bank of China and the National Development and Reform Commission, issued a joint statement threatening to punish firms that failed to make their social tax payments.

“When the tax authorities said we were going to cut taxes, they really meant that they would provide some preferential treatment to certain industries, such as hi-tech, internet, education, and telecommunication, but individual small businesses are not in these specifically encouraged areas,” added Li, a China Lawyer and a China certified tax agent.

So far, only Beijing tax authorities have announced plans to change the collection method for small businesses.

“The move of Beijing is just a beginning,” analysts from Shanghai-based SWS Research said. “It is urgent to widen the tax base, in the context of growing demands for more tax reductions.”

DLA Piper’s Li agreed that the capital city’s measure would spread to other areas of China, at first other big cities and the more economically well-off provinces.

The national tax regulator published revised rules in June to highlight that small businesses with registered capital of more than 100,000 yuan (US$14,500), or monthly sales beyond certain levels for different types of business, would be required to keep their own accounts.

China had a total of 65.79 million privately-owned businesses at the end of last year, employing 142.25 million workers, according to data from the National Statistics Bureau.