China economic work conference: how will Beijing combat US trade war impact on 2019 domestic economy?

- Next week’s Central Economic Work Conference is expected to set higher budget deficit and lower growth target for next year, while policy priorities may also include a new tax cut

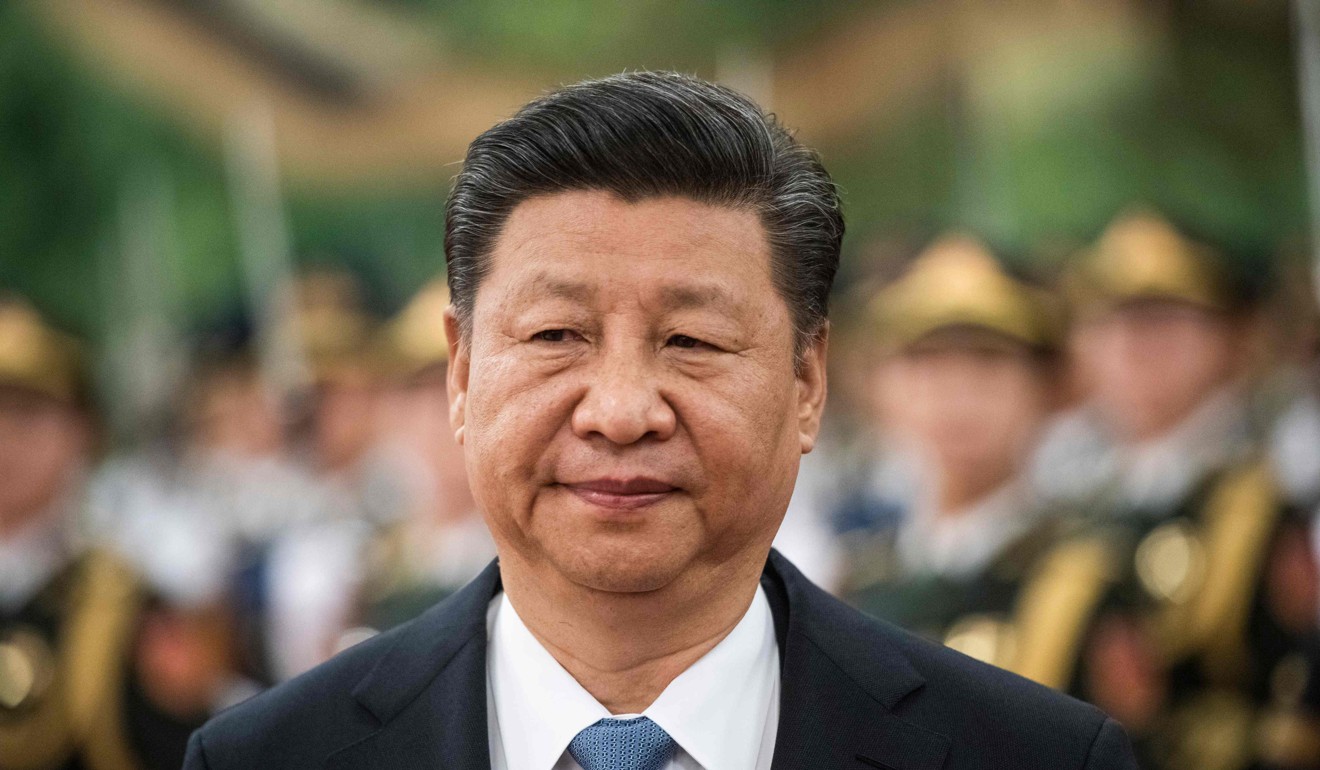

- President Xi Jinping, Premier Li Keqiang and Vice-Premier Liu He all to attend the event at the Jingxi Hotel in Beijing

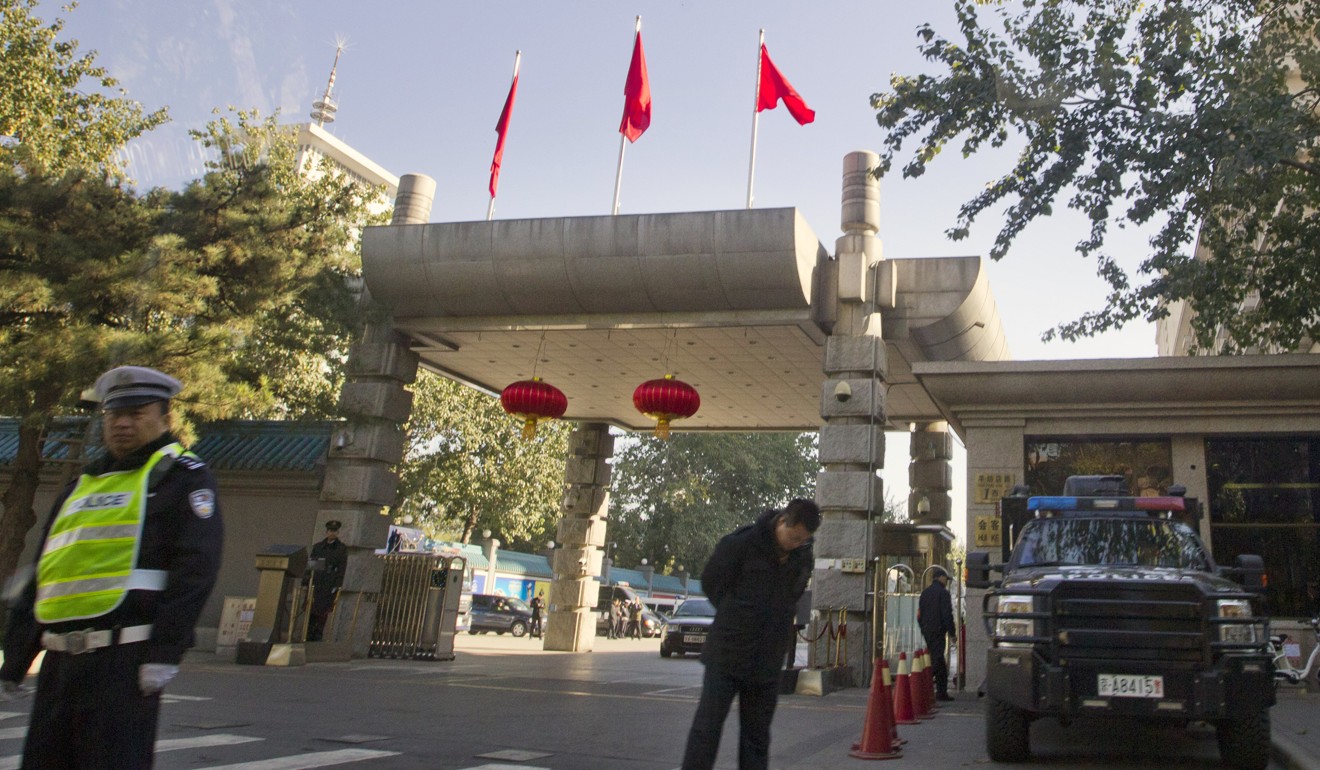

In December each year, security around the Jingxi Hotel in Beijing increases dramatically, indicating that China’s most important economic policy decision-making event is taking place.

The army-run hotel, 3km west of the Communist Party headquarters of Zhongnanhai, is the regular location for the Central Economic Work Conference (CEWC), which will be attended by the likes of President Xi Jinping, Premier Li Keqiang and Vice-Premier Liu He, as well as financial regulatory officials, economic planners and provincial governors.

Unlike past meetings, this year’s agenda for the meeting which begins on Tuesday will be dominated by the question of how to respond to the rising damage being done to the domestic economy by the trade war with the United States.

There is no easy answer to that question, but the policy priorities that Beijing sets will be closely watched by the Chinese public, who are increasingly concerned about the impact of the trade war on their personal finances and jobs.

“The government needs to prepare for both eventualities [of success and failure of trade negotiations] and set particular stress on domestic stabilisation,” said Tang Jianwei, deputy head of research at the Bank of Communications in China.

5 things to know about China’s Central Economic Work Conference

Ahead of the conference, the country’s top leadership headed by Xi, said on Thursday that China will try to develop “a powerful home market” as a way to offset external uncertainties next year, underscoring Beijing’s determination to minimise the impact from trade tensions on its domestic agenda.

China is still in a “strategic window of opportunity period” and “must firmly focus on getting its own goals accomplished”, according to the summary of a meeting of the Politburo, the country’s supreme ruling body, published by China's state-owned Xinhua News Agency.

The meeting chaired by Xi, which set the tone for next week’s work conference, concluded that China should view “latest changes in international environment and domestic conditions” – a veiled description of the trade war with the United States and its increasing impact on the domestic economy – in a “dialectical” manner by discussing various opinions and ideas and stressed that “it’s necessary to keep our strategic focus and proceed in a steady manner”.

Despite the trade tensions with Washington, the annual conference is likely to concentrate on policies to build a strong economic foundation rather than react to the fast changing and unpredictable results of negotiations with the Trump administration, Bank of Communication’s Tang said.

“Actually, US criticisms have exposed many of our shortcomings in areas we should strive to improve in the future,” Tang added, suggesting further economic reforms are needed for China’s future development.

Zhang Jun, chief economist of Morgan Stanley Huaxin Securities, said all Beijing can do at the moment is to build a fence high enough to prevent the trade war from developing into a risk for the entire China’s economy.

“We’ve seen lots of unexpected things this year. No one can be 100 per cent sure what will happen next year, from the global economy to China-US trade negotiations,” he said.

The government has room for policy adjustment, either additional fiscal spending or a loosening of property market price controls, he said, noting that the Politburo switched the government’s focus to economic stabilisation at the end July, for the first time acknowledging the impact of “external uncertainties”.

“The Politburo discussing more economic work in its quarterly meetings has grabbed a majority of the market’s attention and has certainly lowered expectations for the annual economic work conference,” said Zhang.

Economic policies decided at the conference, which usually lasts two days, will be summarised in a report released by Xinhua once the meeting has finished.

Specific instructions will be then passed internally to government ministries as well as provincial and local administrators in the following two months to ensure proper implementation.

The general consensus among Chinese financial institutions is that the CEWC will announce a government budget deficit that is higher than this year’s target of 2.6 per cent of gross domestic product to allow for more fiscal spending and a bigger tax cut than the 1.2 trillion yuan (US$174 billion) reduction implemented this year.

Morgan Stanley Huaxin Securities’ Zhang added that there could be three or four more cuts of the required reserve ratio – the amount of money banks must park at The People's Bank of China – next year to offset the liquidity impact of the maturing of the central banks medium-term lending facility loans, but the overall monetary policy stance will remain neutral.

The China International Capital Corp, a leading Chinese securities brokerage, said that the value added tax rate could be slashed by 2 per cent and the social security contribution rate by 5 per cent next year, both of which would help support struggling private-sector firms.

The government has spent the whole of November promising to support private sector firms, the major victims of the China-US trade war, with President Xi reaffirming of their importance to the economy and promising credit support from state banks.

The governments latest effort to stabilise the economy was focused on the job market after the social security ministry announced last week that it would waive a portion of unemployment insurance contributions for employers that promise not to reduce their workforce.

Louis Kuijs, chief Asia economist of Oxford Economics, said Beijing has been testing over the past few months how much policy stimulus it needs to offset the negative impact of the trade war.

Beijing on Monday agreed to lower import tariffs on US-made cars from 40 per cent to 15 per cent, the first measurable action to come out of the meeting between US President Donald Trump and Xi on December 1, according to The Wall Street Journal.

On Tuesday, citing industry sources, the US Soybean Export Council also said Chinese importers had bought 1.5 million to two million metric tons of American soy over a 24 hour period, with the shipments expected to occur sometime during the first quarter of 2019.

Despite strong verbal support, including promises of tax relief and lower social security contributions, any further policy easing by Beijing will be incremental and data dependent, according to Kuijs.

“They don’t want to go too far [in stabilisation] and don’t want to be seen as overdoing it,” Kuijs said. “They just want to ensure growth doesn’t go down too much.”

An inevitable topic for the annual conference will whether to lower the government’s 2019 growth target, and if so, by how much.

Chinese growth slowed to a decade-low rate of 6.5 per cent in the third quarter of 2018, with indicators for the first months of the fourth quarter pointing to a further slowdown.

Analysts predict that growth will be hit hardest in the first half of next year when the full impact of US tariffs is felt.

Some bearish views put the growth forecast below 6 per cent in the first hall of next year if damage from the trade war increases and the stimulus measures that the government began implementing in August fail to lift the economy.

Although China is widely believed to have adequate policy tools and fiscal leeway, Kuijs warned that supply side stimulus’ do not always work.

“You can give tax cut to companies, but they are not going to invest more because of low business sentiment. They may just put [the extra money] in their bank account,” he said.

“China is keen to be seen delivering its opening-up promise, but it does not want to give the impression that it was forced to do so,” he said.

Although there will be some language on reform of state-owned enterprises and other structural issues, “there’s really a question mark how much emphasis there will be on the kind of market-oriented reforms that reformers are hoping and called for,” added Kuijs.

At the 2017 CEWC, the government set the tone for a deepening of supply-side structural reforms, while focusing on three key tasks for 2018: reducing risks in the financial system, controlling pollution and alleviating poverty.

The first two tasks have been shelved, for the most part, due to the escalating trade war.