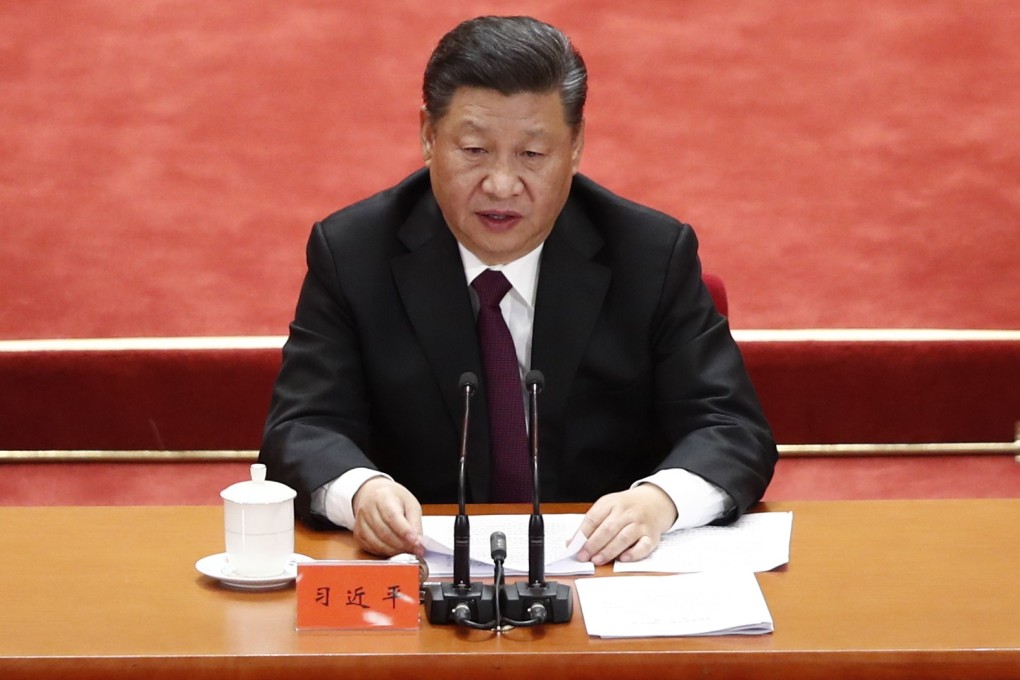

How far should China go to stimulate the economy? That’s a question for Xi Jinping in 2019

- China taking incremental approach to stimulus, based on economic performance and trade talk progress

- With the economy expected to slow further next year, Xi Jinping needs to find ways to put growth on track without worsening China’s long-term economic problems

A debate is heating up among Chinese economists and researchers over how far Beijing should go to boost growth in 2019, as the country braces for additional economic downdrafts from the trade war with the US.

Beijing has so far refrained from the all-out economic stimulus it enacted in response to the global economic crisis a decade earlier.

But it has shifted priorities to “stabilising” growth since the summer by boosting fiscal spending and keeping a modestly looser monetary policy stance, deviating from three key policy goals set earlier this year to cut excess debt and contain financial risks, curb pollution and reduce poverty.

Beijing’s policy response so far has proved too mild to arrest a deepening slowdown. Chinese economic indicators for November painted a gloomy picture of exports, industrial production, consumer spending and foreign investment while almost all financial institutions, both Chinese and foreign, predicted that the growth rate would continue to decelerate to just above, or even below, 6 per cent next year from an expected 6.5 per cent rate this year.

It is against this backdrop that Chinese President Xi Jinping and the country’s top policymakers are gathering in a guarded military hotel in Beijing this week to chart out economic policies for next year.