China’s central bank pledges prudent monetary policy and ‘basically stable’ yuan

- People’s Bank of China statement drops ‘neutral’ for describing monetary policy and also removes reference to deleveraging

- China expected to keep policy relatively loose to support slowing economy amid trade war with the United States

China’s central bank will maintain a prudent monetary policy and keep the Chinese currency “basically stable” while offering “reasonably ample” liquidity to the market.

A statement following a quarterly meeting of the People’s Bank of China’s (PBOC) monetary policy committee did not include the previously-used “neutral” to describe Chinese policy – an omission that could indicate a greater bias for easing at a time growth is slowing.

Also, the latest statement did not include a reference to China’s deleveraging campaign.

Three months ago, the PBOC said it would control the intensity and pace of its structural deleveraging campaign.

“A prudent monetary policy should be more focused on being neither too tight nor too loose,” the central bank said on Thursday.

“[China] will make monetary policy more forward-looking, flexible and targeted.”

Market analysts expect the PBOC to keep policy relatively loose to support China’s slowing economy as it deals with trade frictions with the United States and pressure from a multi-year deleveraging campaign.

China’s top leaders said in an annual economic meeting last week that they will ratchet up support for the economy in 2019 by cutting taxes and keeping liquidity ample, as growth is expected to slow further next year.

This month, the PBOC rolled out a targeted policy tool to spur lending to small and private firms, in the latest step to support the economy amid the trade dispute with the US

However, top policymakers have repeatedly said China will not resort to massive stimulus to shore up a slowing economy.

The government has cut the amount of cash banks have to set aside as reserves four times this year, and on Monday, the State Council flagged the chance of a targeted reserve requirement cut to support small and private firms.

On December 13, PBOC governor Yi Gang said China’s monetary conditions should be relatively loose to support its slowing economy but policy cannot be too loose as falls in domestic interest rates could hit the currency.

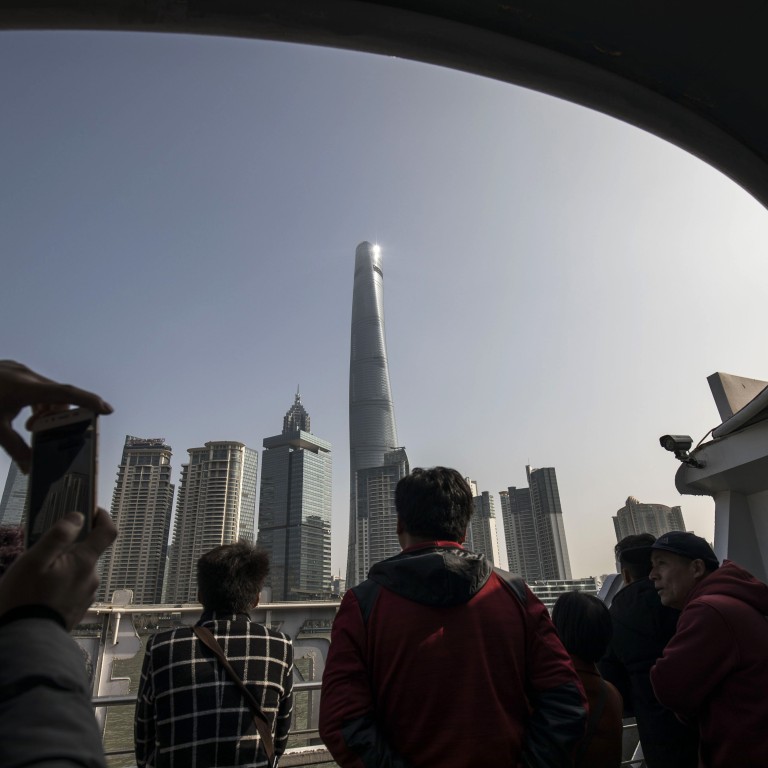

Concerns about the yuan made their way back to the quarterly meeting’s agenda, and the PBOC reiterated that it would keep the yuan “basically stable” on a reasonable and balanced level.

This year, the yuan has weakened 5.6 per cent against the US dollar, hurt by China’s economic slowdown and the ongoing trade row.

In 2017, the currency gained about 6.8 per cent against the US dollar.

The PBOC has outlined five monetary policy stances, ranging from “loose” to “tight”.

China adopted an “appropriately loose” monetary policy after the 2008 global crisis, before switching to “prudent” in late 2010.

The wording was modified to “prudent and neutral” in late 2016 as China launched a deleveraging campaign.