Can China walk out of economic difficulties by relying on its old playbook of debt?

- China’s National People’s Congress Standing Committee authorities a new wave of infrastructure bond issuance worth US$202 billion ‘ahead of schedule’

- A surge in local government debt may complicate Beijing’s long-term goal of reining in financial risks

China is banking on a new wave of debt-fuelled infrastructure spending to arrest a deepening economic slowdown, but the surge in local government debt may complicate Beijing’s long-term efforts of reining in financial risks in its economy.

In an unusual move last week, China’s National People’s Congress Standing Committee authorised the central government to allocate the local government debt quota “ahead of schedule”, breaking what is only a ceremonial arrangement that Beijing has to include a nationwide debt quota in its budget report approved by the parliamentary gathering in March before it can allocate quotas to local authorities.

Beijing is seeking to implement a “proactive fiscal policy” to stimulate economic activities when China’s growth is set to decelerate further after the headline gross domestic product growth rate dropped to the lowest level in a decade in 2018.

The government immediately approved local governments to issue bonds worth 1.39 trillion yuan (US$202 billion), made up of 810 billion yuan (US$117.82 billion) in the special purpose bonds, and the remaining 580 billion yuan in general bonds.

Special purpose bonds differ from traditional local government general bonds in that they are repaid by returns on projects instead of by the government.

At the same time, the jury is still out whether the projects financed by the bonds can generate incomes as expected, especially roads in remote areas, parks and shanty town redevelopment.

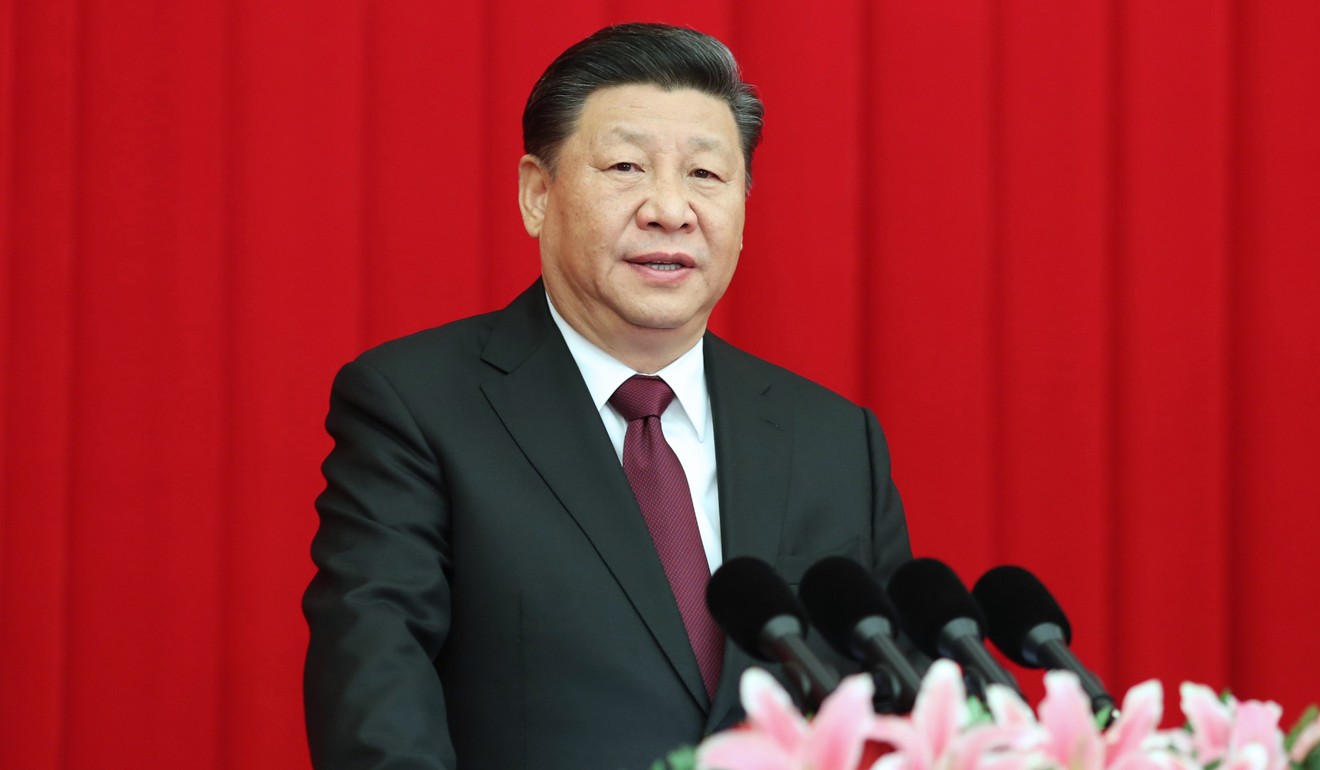

For instance, Xiongan New District, designated by President Xi Jinping as an example city for the future, issued 30 billion yuan (US$4.36 billion) worth of bonds in late December, including 15 billion yuan worth of special purpose bonds, to finance infrastructure development.

As the government also plans to cut taxes again this year, spending on infrastructure is still seen as the favourite method to stabilise China’s economy.

The full gross bond issuance quota in 2019 is expected to be increased to around 3 trillion yuan (US$436.36 billion), analysts said, compared to 2.18 trillion yuan in 2018.

“At the moment, talk is all about pro-growth measures now,” said Iris Pang, Greater China economist at ING Bank.

“The most important issue is to stabilise jobs, and to halt a downward spiral in the economy. We can worry about the debt problem again afterwards.”

Local government bonds approved by Beijing are viewed as a transparent form of “front-door” financing by local authorities compared to murky “back-door” financing activities via so-called local government financing vehicles (LGFVs), a fact that allows Beijing to have a better control and oversight of local government borrowing.

When China’s economy was hit hard by the global financial crisis a decade ago, debts at LGFVs ballooned to create a big threat to China’s economic and financial stability.

In 2014, local governments were allowed to sell bonds for the first time as Beijing aimed replace opaque, high-risk government debt accumulated via LGFVs with bonds.

Nevertheless, the local government debt problem still has not been resolved, and the scale continues to grow with repayment pressure increasing further, especially when repayment abilities of many municipal governments are weakened by slower fiscal revenue growth and smaller land sales incomes amid an economic slowdown.

The rise of local government debt and the fall of repayment abilities have rekindled worries that these local infrastructure projects, some of which are potentially loss-making, often take years to generate investment returns, raising the risk of default as it is poorly collateralised and project cash flow estimates are often overstated.

As most of the local government bonds are sold to state-owned banks via the interbank market, it is binding China’s fiscal risks and financial risks together, analysts said.

Amanda Du, senior analyst at Moody’s Investors Service, warned of risks related to unclear disclosure of special bonds.

Although the lower-tier regional and local governments may be the one using the special bond proceeds, it is their respective higher-tier provincial level government that issues the bond and takes ultimate responsibility for its repayment.

“As such, bond documents are only required to disclose the fiscal and economic data of the provincial level government, and not of the lower-tier government that may use the proceeds, resulting in possible information mismatch,” Du said.

The special bonds will eventually be supported only by the project revenue rather than government implicit guarantees, making them riskier to investors. These bonds do not fall under local government’s fiscal budget.

“Local government debt remains safe as long as the future needs to rely on infrastructure to boost the economy,” said Liu Yi, analyst at Guotai Junan Securities.

“But the size of local government debt keeps growing, and this means once conditions are ripe, deleveraging policies will re-surface again.”