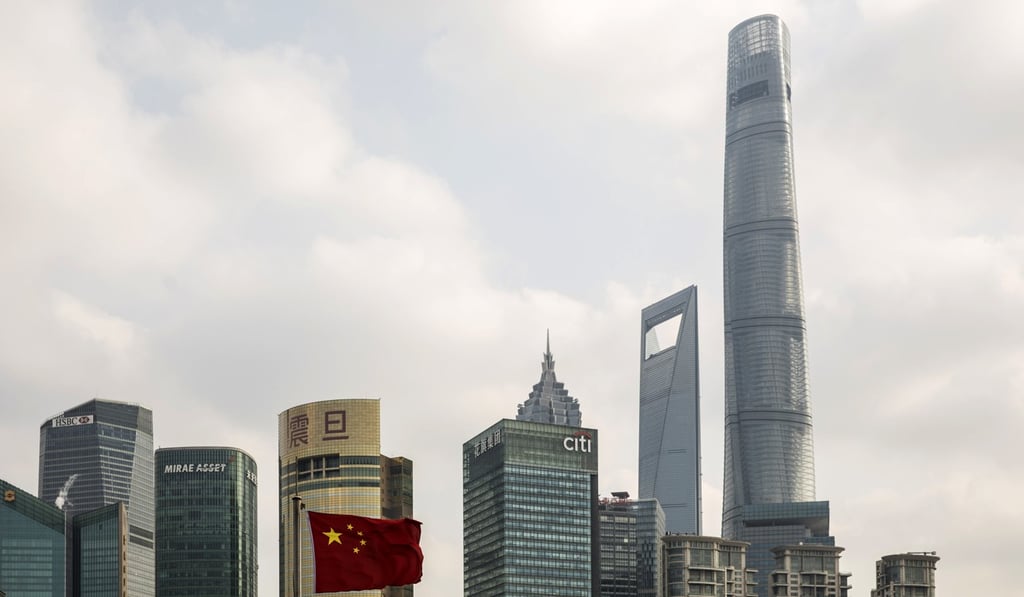

China’s state-owned companies enjoy record profits, even as private sector flounders

- Revenues and profits surge for China’s biggest state-owned industrial firms in 2018

- Stellar performance of state sector contrasts with weak private sector and broad economic slowdown

Revenues and profits at China’s state-owned enterprises hit historic highs last year, even as the country’s private firms fought for their survival amid the slowest period for economic growth in a decade.

Last year, firms owned by the central government booked revenues of 29.1 trillion yuan (about US$4.3 trillion), up 10.1 per cent from 2017, while net profits reached 1.2 trillion yuan, a rise of 15.7 per cent from the previous year, according to figures released by the State-owned Assets Supervision and Administration Commission of the State Council (SASAC) on Thursday.

State-owned firms were able to achieve record high revenues and profits because of relatively stable growth in the domestic economy and supporting measures enacted by the government, according to Peng Huagaung, a spokesman for the state asset oversight agency.

State firms also benefited from cost cutting as well as better efficiency and risk management amid the slowdown in economic growth.

The figures are in stark contrast to the performance of China’s private sector, where many companies are fighting for their lives.