Consumers are ‘unequivocally the losers’ in US-China trade war, says IMF

- Research from the International Monetary Fund finds that US importers ‘almost entirely’ bear the cost of tariffs, which are then passed on to the consumer

- Latest round of tariffs contains goods which are not easily substituted by imports from other markets, which analysts say will further hit consumers

Consumers “are unequivocally the losers” from the US-China trade war, according to new research by the International Monetary Fund, which outlines the damage the long-running dispute is doing to both sides.

The research, published on Thursday, found that “tariff revenue collected has been borne almost entirely by US importers”. Extrapolating that further, the International Monetary Fund (IMF) found that “some of these tariffs have been passed on to US consumers”, highlighting the rising cost of goods such as washing machines.

“A further increase in tariffs is likely to be similarly passed through to consumers,” found the researchers, which analysed price data from the bureau of Labour Statistics on imports from China.

A study by economists at the University of Chicago, published in April, found that a 20 per cent tariff on washing machines resulted in a 12 per cent increase in the cost for US consumers. It also drove up the price of dryers, since the products are often bought in pairs. Researchers found that even US companies such as Whirlpool, which were not subjected to the tariff, used them as an opportunity to raise their prices.

The study noted that the tariffs led to 1,800 new jobs being created in the US, but this was in part due to the opening of a Samsung washing machine plant in South Carolina. However given the price point passed to the consumer, these jobs cost the economy US$815,000 each, the researchers calculated.

Subsequent US tariffs tended to avoid consumer goods, with US President Donald Trump seemingly keen to shelter the average consumer from the impact of the US-China trade war. However, the latest planned list of tariffs, which covers almost all remaining imports from China valued at US$300 billion by the Office of the United States Trade Representative (USTR), includes clothing, computers, smartphones, watches and toys.

A deluge of retailers and importers have released statements over the past two weeks stating that they will be forced to pass the increasing costs of their products onto the consumer, since for many of the goods, alternative markets do not exist.

This is the case with many electronic products, which have been placed on List 4 of the USTR’s Section 301 action. It was not the case with many items on previous tariff lists published throughout 2018.

Tariffs are taxes, and if this latest threat takes effect, this is likely to be the largest tax increase on consumers in American history.

“Tariffs are taxes, and if this latest threat takes effect, this is likely to be the largest tax increase on consumers in American history,” said the US-based Retail Industry Leaders Association when the latest round of tariffs were announced. An open letter from 173 American footwear manufacturers to the White House, meanwhile, read: “The proposed additional tariff of 25 per cent on footwear would be catastrophic for our consumers, our companies, and the American economy as a whole.”

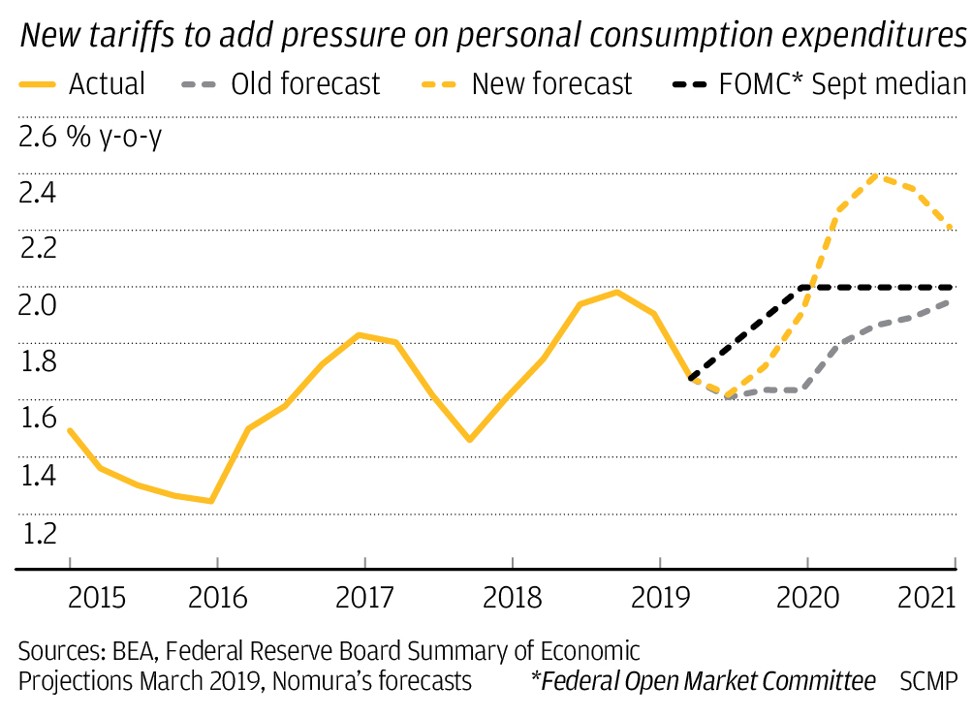

In another report released on Thursday, analysts from Japanese bank Nomura warned that the latest tariff list includes products that are not easily substituted with products from other countries.

“The final tranche of Chinese goods includes a number of products that US importers may have a hard time acquiring from other countries, most notably personal computers and cellphones. As a result, the overall ‘substitutability’ of the final tranche is relatively low compared to earlier rounds of tariffs,” read the report.

Nomura’s researchers conducted a probability analysis on how the trade war will unfold over the coming months, finding that there is a 65 per cent chance of the 25 per cent tariffs on US$300 billion of Chinese goods coming into effect by the third quarter of 2019.

Neither Trump nor Chinese President Xi Jinping will want to risk escalating the trade war before a potential summit at the G20 summit in Osaka in June, but after that, the banks’ analysts expect a spike in tensions.

“While we expect a short-term truce during and immediately after the G20 in late-June, we think domestic pressures and constraints will drive both sides towards further escalation,” read the report.

“We believe that talks will ultimately break down later in the year, resulting in the US imposing the final round of tariffs, probably in [quarter three of] 2019, with a proportional response from China. Without a clear way forward during an intensifying 2020 US presidential election, we see a rising risk that tariffs will remain in effect through end of 2020,” the analysts added.

The IMF, meanwhile, showed that the burden of the trade war had fallen much more heavily on manufacturers in China than in the US – an unsurprising result, given the make-up of the respective economies and the level of tariffs levied to date.

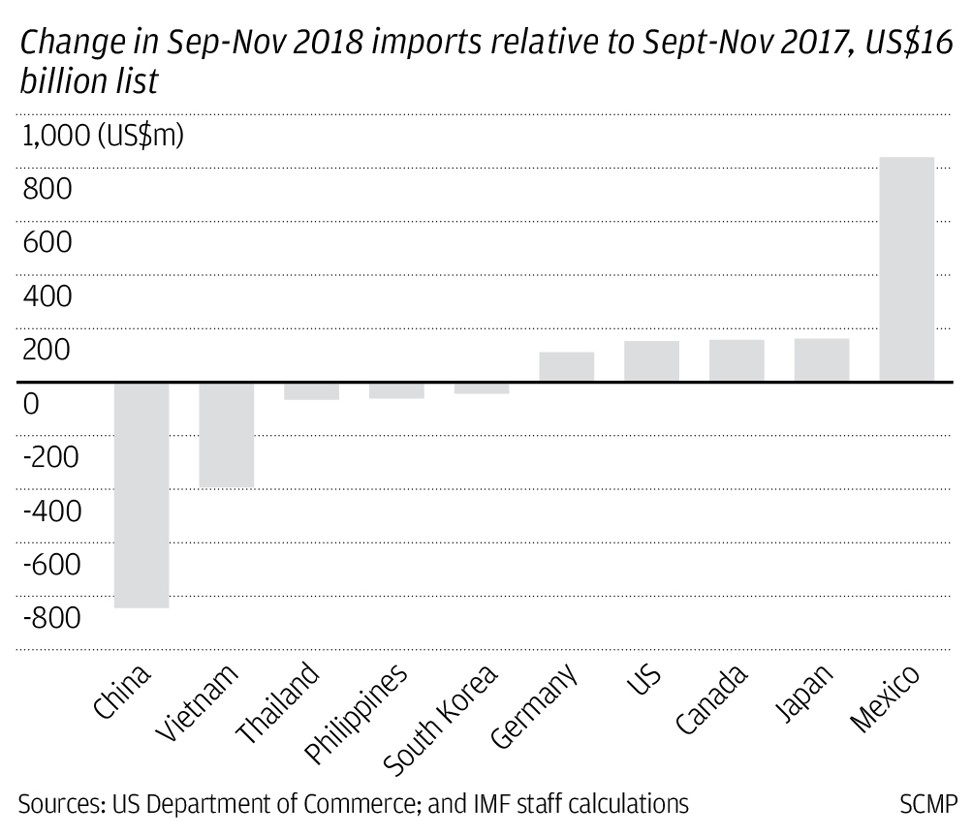

After the first round of tariffs were implemented in August 2018, China’s exports to the US sharply decreased by US$850 million. This was almost immediately replaced by US$850 million in imports to the US from neighbouring Mexico.

The IMF forecasters, meanwhile, predict that the trade war, should it continue and escalate on the scale that has been outlined, will trim 0.33 per cent from global economic growth. Much of this will be due to a dent in market confidence which has seen companies reluctant to make investments or launch new projects, rather than the direct impact of tariffs.