China economy woes owe more to domestic issues than trade war, experts tell Washington hearing

- China's domestic economic issues are more problematic for policymakers in Beijing than the trade war, experts warn US congressional hearing

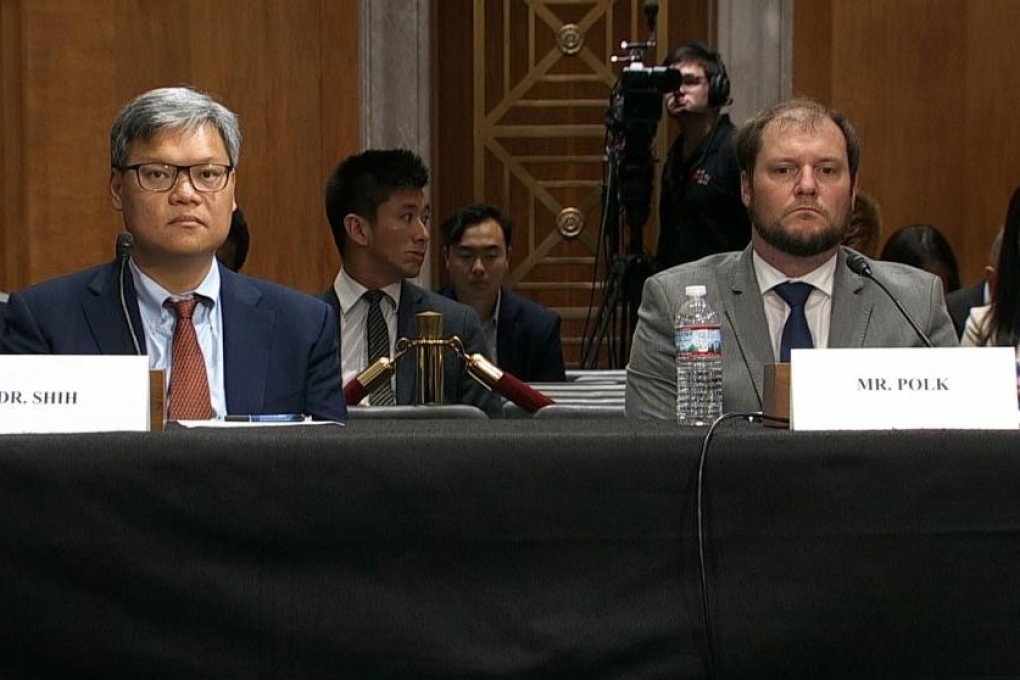

- Victor Shih, University of California expert on China, warned that ‘it would take a truly massive economic shock to threaten’ Chinese President Xi Jinping’s power

Experts on US-China relations have advised that the 14 month-long trade war has had “little direct impact on China's economy” and warned that “it would take a truly massive economic shock to threaten” Chinese President Xi Jinping’s power.

Policy analysts gave written and spoken testimony to the US-China Economic and Security Review Commission annual review just hours before top trade negotiators confirmed a face-to-face meeting in early-October in a step resolve their increasingly bitter trade conflict.

Among them was Victor Shih, associate professor of global policy and strategy at University of California San Diego, who said that the trade war may succeed in creating divisions among policymakers in Beijing as to how to deal with China’s economic slowdown.