China’s manufacturers express mixed outlook amid rising optimism of US trade war deal

- Views on outlook for smaller Chinese manufacturers varies by industry, with high-end factories more optimistic

- Caixin/Markit manufacturing purchasing managers’ index (PMI) rose for a fourth straight month in October to highest level since February 2017

Smaller Chinese manufacturers expressed a mixed outlook for a rebound in activity and a recovery in export orders amid optimism of a trade deal with the United States.

October’s Caixin/Markit manufacturing purchasing managers’ index (PMI), which surveys 500, mostly smaller private factories, improved for a fourth straight month to 51.7 in October, its highest since reaching the same level in February 2017, and up from 51.4 in September.

This is reflected by an increase in export orders for some firms this year despite the US tariffs, while others said their businesses continued to suffer amid a sharp decline in export demand. In general, producers of high-end products held a more optimistic outlook.

Our exports to the United States increased by about 13 per cent last year, and our export revenue continued to grow in the first half of this year,

“Actually, our exports to the United States increased by about 13 per cent last year, and our export revenue continued to grow in the first half of this year,” said Chen Wei, deputy general manager of Guangzhou Seagull Kitchen and Bath Products, a large contract manufacturer producing products for brands in the US.

The company, which is listed on the Shenzhen Stock Exchange, was forced to issue statements in April and September last year warning investors that the US tariffs could have a sharp, negative impact on the firm’s revenues, since its US sales accounted for over half of the company’s overseas orders and 35 per cent of the firm’s total revenue.

But one year later, export orders have risen, with US clients optimist for the development of the trade deal.

“Some of our products have been included in the tariff increased by the US government, but these additional costs are mainly borne by US buyers after consultation. That meant American consumers are paying totally unnecessary expenses,” added Chen, who said their clients have been explicitly opposing the increase of tariffs at hearings with the Office of the United States Trade Representative.

“We hope that the Chinese and American economies will resume normal development that safeguard the interests of enterprises and consumers of both countries.”

But despite the rise in orders from the US, Chen said Seagull Kitchen and Bath Products have made increased efforts to promote itself in the domestic market as well as with countries involved with China’s Belt and Road Initiative in a bid to reduce reliance on the US.

Overall, China’s economy grew by just 6.0 per cent in the third quarter of 2019, the lowest quarterly growth rate since records began in March 1992.

The growth rate for the home city of Huawei and Tencent slowed to 6.6 per cent in the first nine months of 2019 from 7.4 per cent in the first half of the year.

I see a totally different situation in the footwear industry than in Caixin’s data. Especially in the second half of this year, many small and medium-sized shoe factories across China have closed

Small and middle-sized enterprises contribute about 60 per cent of Shenzhen’s gross domestic product, with more than 80 per cent of jobs in the city created by private businesses

Shenzhen’s private investment growth also plummeted in the third quarter, falling to a rate of only 0.3 per cent year from 12.3 per cent in the first half of the year.

“Frankly speaking, I see a totally different situation in the footwear industry than in Caixin’s data. Especially in the second half of this year, many small and medium-sized shoe factories across China have closed,” said a senior manager of a footwear factory employing around 2,000 workers in Fujian province, specialising in production for domestic brands.

“A few weeks ago, we just shut down two production lines and dismissed several senior managers and a number of workers because we received few new orders in recent months,” added the senior manager who asked for his identity and the identity of his company to be kept anonymous.

“I find no suppliers in the footwear sector have plans to expand production. There is no deal in the [China]-US trade war yet. Who dares to expand production? Very few people are optimistic.”

We expect both domestic consumption and exports will continue to decline in the next few years, causing the entire garment industrial chain to shrink

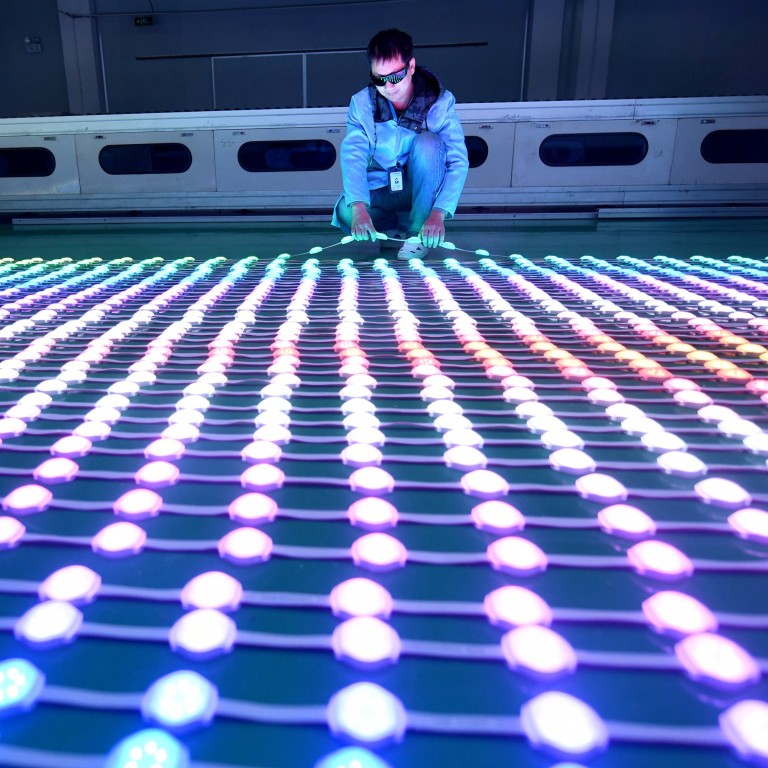

“Our supplier in Zhongshan city in Guangdong [province] that has a turnover of US$80 million annually in low end outdoor lighting products just established a joint venture factory in Thailand last month. Now the Thai factory is expediting construction and will be put into production before the end of the year.” said Jason Liang, sales manager at a Guangzhou-based exporter of LEDs.

Most forecasts put China’s 2020 average growth rate below 6.0 per cent, including the 5.9 per cent predicted by the World Bank and the 5.8 per cent predicted by the International Monetary Fund.

“We expect both domestic consumption and exports will continue to decline in the next few years, causing the entire garment industrial chain to shrink,” said Liu Yi, founder of Ebudaowei.cn, which matches demand for fabrics with thousands of suppliers across the country.

“First of all, the trade war is affecting exports, and actually the impact will spread to all upstream and downstream segments of the industry, whether the factories are export-oriented or for domestic sales. Second, China’s inflation is worsening, so the decline in consumption power is inevitable. With domestic demand is insufficient, who dares to expand production?”