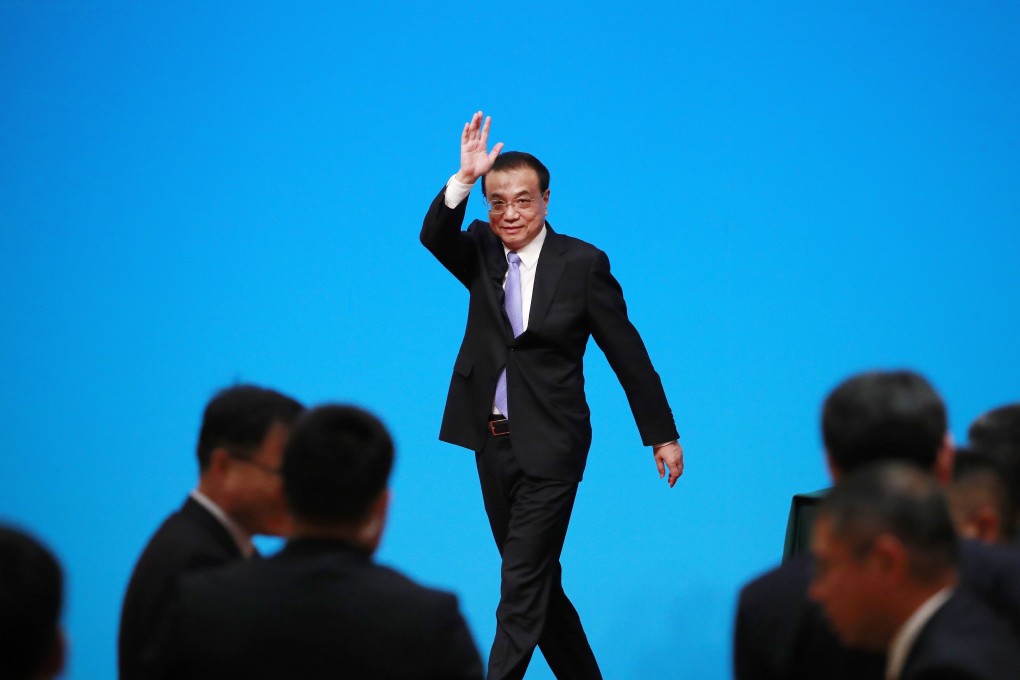

China will not use ‘all-out stimulus’ to boost slowing economy, Premier Li Keqiang says

- Premier Li Keqiang says China will continue opening up its economy to foreign firms at 1+6 meeting with major international economic organisations

- China’s economy is growing at its slowest pace in decades, amid a trade war with the US and slowing domestic consumption

Chinese Premier Li Keqiang again ruled out stronger stimulus measures to boost economic growth during a meeting with leaders from major international economic institutions, signalling Beijing’s top policymakers have reached consensus on how to manage the country’s domestic slowdown.

“No matter how the external situation changes, China will firmly implement a higher level opening-up [of the domestic market to foreign firms]. We’ll implement policies precisely, ensure thorough implementation of [past] tax and fee cuts, and agree not to use all-out stimulus,” Li said at a press conference in Beijing after Thursday’s annual 1+6 Roundtable with the chiefs of the International Monetary Fund, World Bank and World Trade Organisation, among other institutions.

Li’s remarks may help dampen expectations among many private-sector economists who believe Beijing will be forced to implement more aggressive policy easing to halt an economic slowdown amid a trade war with the United States and domestic headwinds.

We’ll implement policies precisely, ensure thorough implementation of [past] tax and fee cuts, and agree not to use all-out stimulus

Many analysts believe Beijing needs to boost growth next year to meet its goal of doubling the size of the nation’s economy over the decade to 2020.