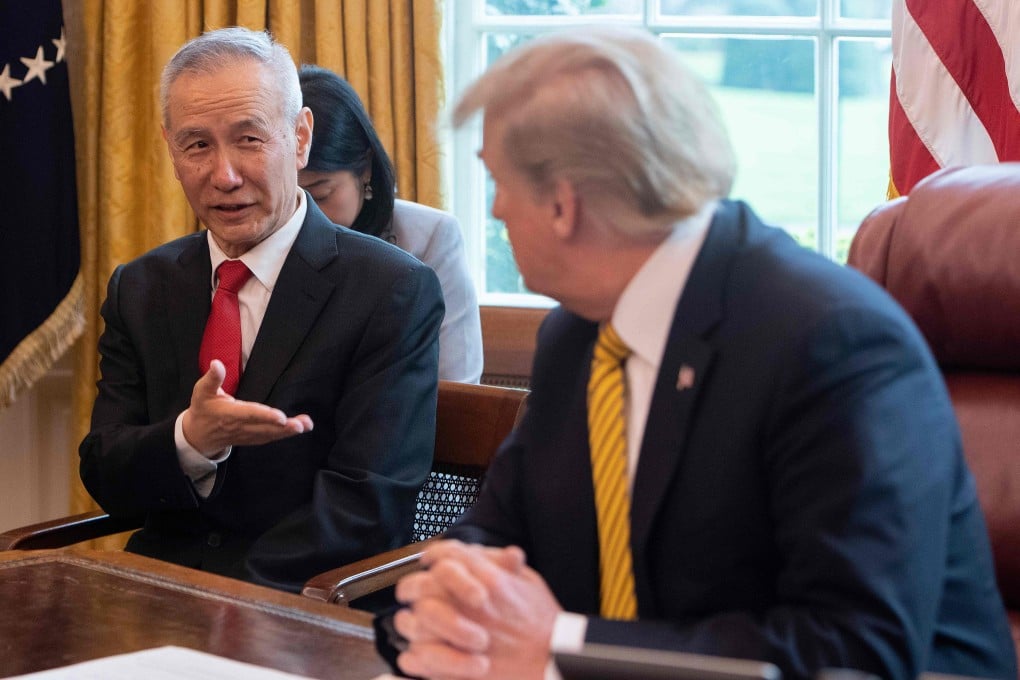

China’s top trade war negotiator handed more control at home as Beijing expands reach of finance committee

- The Financial Stability and Development Committee, under Vice-Premier Liu He, will be upgraded into a de facto governing body with local branches

- China was rocked by three bank failures last year, while the phase one trade deal with the US is set to include chapters about opening up China’s financial services market

Vice-Premier Liu He has been given increasing power and control over China’s financial industry, with the remit of the finance committee under his purview greatly upgraded to become a de facto full governing institution with local branches.

Under the new arrangements, the central bank’s provincial chiefs will be entitled to convene meetings with banking, insurance, securities and foreign exchange regulators as well as local economic planners, financial service and fiscal departments, to discuss matters concerning regional financial stability.

“It aims to strengthen the coordination between central and local governments in terms of financial regulation, risk disposal, information sharing and consumer protection,” said a statement regarding the changes to the committee, which includes members from China’s central bank, the banking regulator as well as the securities market watchdog.

It aims to strengthen the coordination between central and local governments in terms of financial regulation, risk disposal, information sharing and consumer protection