Advertisement

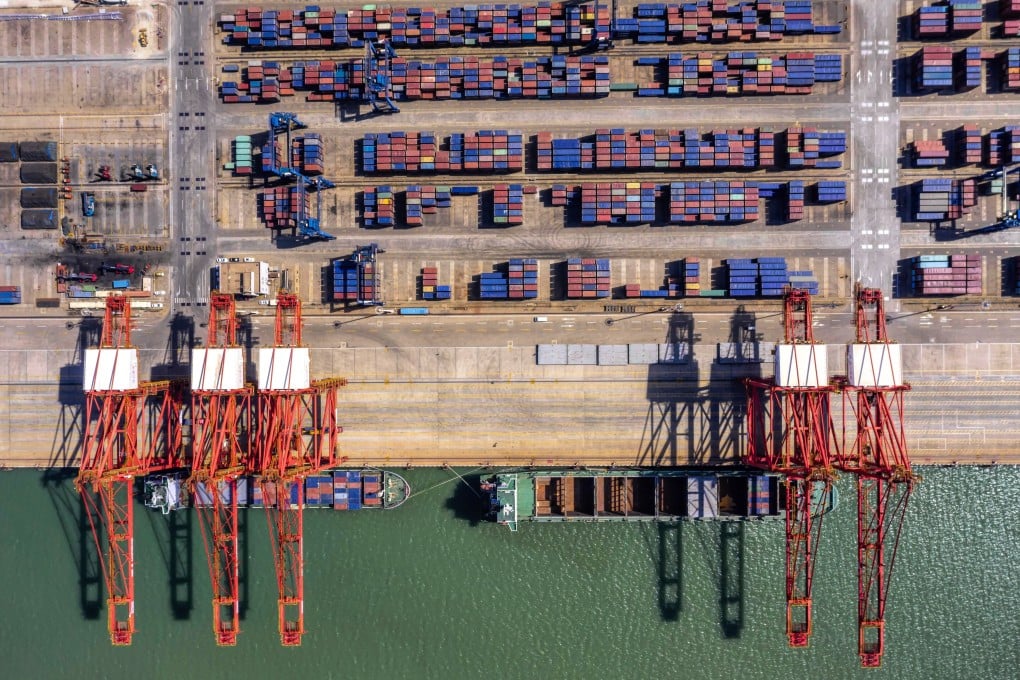

Coronavirus hits China’s farms and food supply chain, with further spike in meat prices ahead

- Many farmers in China’s are unable to access animal feed due to lockdowns across the country, leading to fears for the future of the meat supply chain

- China has been forced to loosen restrictions of agriculture market access, amid fears of a further spike in food prices

Reading Time:4 minutes

Why you can trust SCMP

On his farm in China’s Guangdong province, a chicken farmer named Chen is facing a race against time.

The rapid spread of the novel coronavirus throughout China has led to the shutdown of many marketplaces and cut farmers off from their livestock and the supply of animal feed.

Chen, who wished only to give his family name, keeps around 60,000 chickens, and before the Lunar New Year holiday in January, he could have sold the birds for 20 yuan each (US$2.8). Now he says he will be lucky to get 2 yuan.

Advertisement

“Have you ever seen a chicken sold for 0.5 yuan per kilogram? That is what we are suffering now. Most markets are closed in Guangdong now, we have nobody to sell to if the markets are closed. However, chickens must be sold when they are 70-days old,” said Chen.

Last year, China’s agriculture sector was rocked by an African swine fever outbreak, which reduced the nation’s pig herd by half, sending meat prices skyrocketing around the country and leaving many farmers penniless. If producers had hoped 2020 would be better, the last few weeks is likely to have left those hopes in tatters.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x