China ‘unsurprisingly’ keeps benchmark loan rate unchanged for second straight month

- The one-year loan prime rate (LPR) remained at 3.85 per cent, while the five-year LPR was also steady at 4.65 per cent

- The People’s Bank of China (PBOC) rolled over some maturing medium-term loans last week, while keeping interest rates unchanged for the second straight month in a row

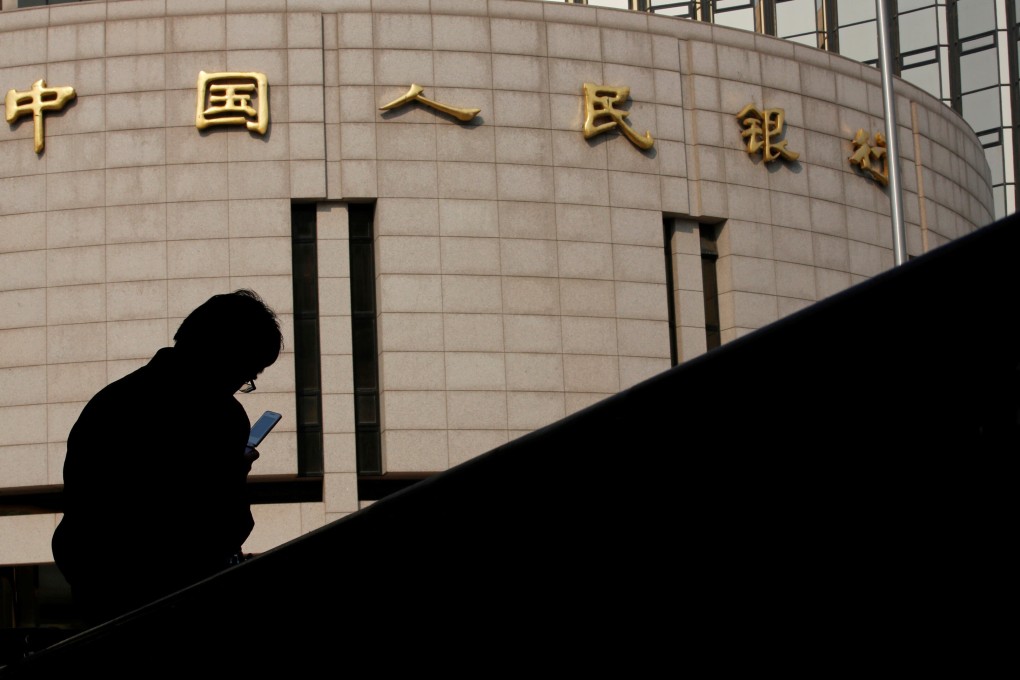

China left its benchmark lending rate unchanged for the second straight month at its June fixing on Monday, matching market expectations, after the central bank kept borrowing costs on medium-term loans steady last week.

The one-year loan prime rate (LPR) remained at 3.85 per cent, while the five-year LPR was also steady at 4.65 per cent.

The move in the LPR affects the price lenders charge companies and households for loans, and the five-year rate influences the pricing of mortgages.

A Reuters survey of traders and analysts conducted last week showed more than 70 per cent of all participants expected China to keep the lending benchmark unchanged this month. Only 20 per cent of all respondents predicted a marginal cut to the one-year LPR.

The inaction is not surprising: the PBOC did not lower the rate on its medium-term lending facility this month as it did ahead of the past three LPR cuts

The People’s Bank of China (PBOC) rolled over some maturing medium-term loans last week, while keeping interest rates unchanged for the second straight month in a row.