China economy, coronavirus and trade war on agenda for Xi Jinping at top-level Politburo meeting

- Analysts say big policy changes are unlikely as China recovers from the coronavirus, while bracing for gathering storm in international affairs

- China is expected to maintain a zero-tolerance policy for coronavirus infections while sticking to a relatively easy monetary policy

A meeting of China’s top decision-making body, scheduled for the end of this month, will be closely watched by economists and analysts keen on sussing out signals from the top Chinese leadership over what Beijing will do next, after the nation saw surprising economic growth in the second quarter.

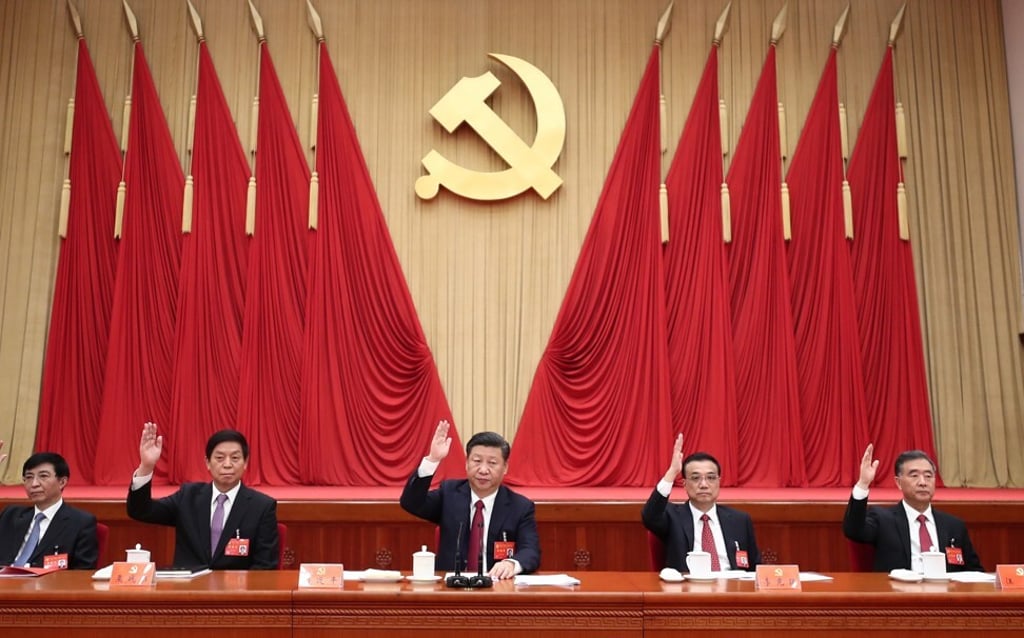

At the mid-year meeting of the 25-member Politburo of the ruling Communist Party, President Xi Jinping is expected to set the tone for future economic policies in the second half of the year and even beyond.

The Politburo has a tradition of hosting the meeting in the last week of July, when it reviews the country’s economic performance in the first half of the year and sets priorities for the coming months.

Analysts say the upcoming meeting is worth watching as China again faces a relatively rosy situation at home and a gathering storm abroad.