Exclusive | US farm brand John Deere at forefront of surging cotton machinery sales to Xinjiang, as human rights sanctions loom

- Sales of hi-tech US cotton-harvesting machinery to be used in Xinjiang rose by more than 4,000 per cent in April from a year earlier, a Post investigation shows

- John Deere has a heavy presence in the western Chinese region, where dominant entities face US sanctions over alleged human rights abuses

At a Chinese government-owned John Deere showroom in the Xinjiang Uygur autonomous region – the heartland of China’s cotton industry – manager Mr Hu worries that coming US sanctions over human rights abuses will cut him off from the “impeccable, super-efficient” cotton-harvesting machines he sells to industrial-scale farms across the region.

Halfway across the world, farm-equipment dealers in the American South describe a jet-setting Chinese buyer who criss-crosses that region with a translator and buys up all the used John Deere cotton-picking machines he can find.

Their stories – combined with extensive investigations of customs data, shipping records and dozens of interviews with cotton-industry employees and experts in both countries – reveal how America’s most iconic farm brand has quietly established itself as a key player in Xinjiang’s immense cotton industry, even as industry and human rights groups warn that the supply chain there is laced with the forced labour of Uygurs and other Muslim ethnic minority groups.

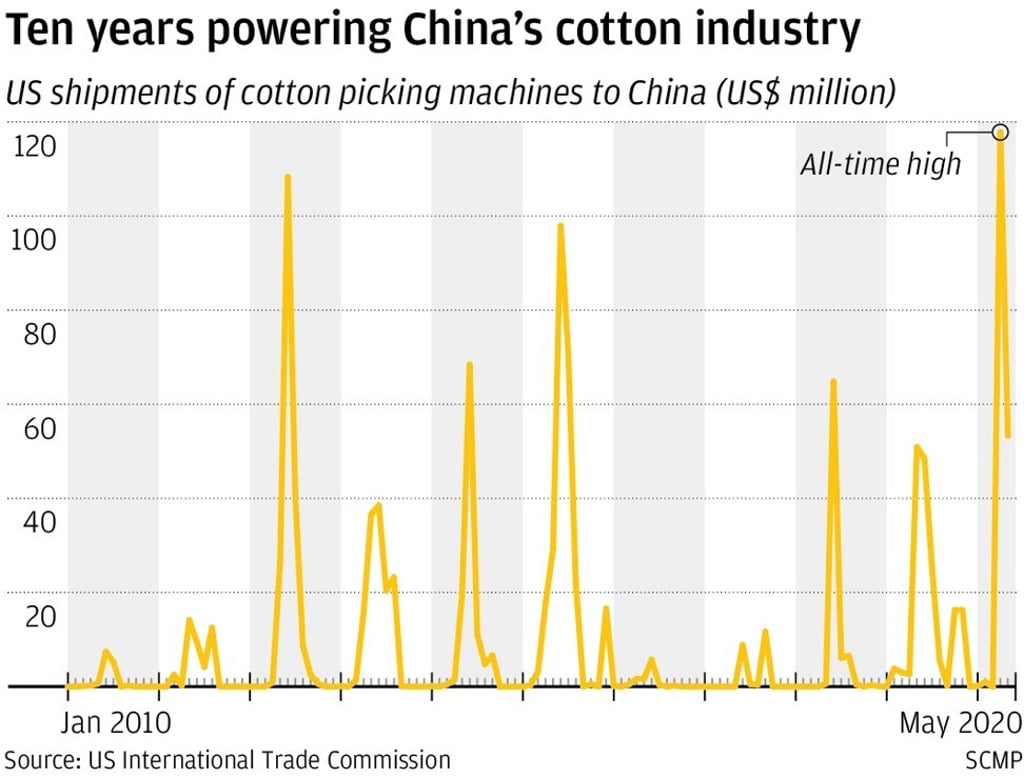

Trade records show that the United States has sold nearly half a billion dollars’ worth of heavy-duty cotton-harvesting equipment to Xinjiang since 2017, helping the region produce one-fifth of the world’s cotton.

Hu – who, like many people interviewed for this story, preferred not to give his real name for fear of repercussions – said that last year his business ordered “around 1 billion yuan [US$144 million]” worth of John Deere cotton-picking machines, made by the parent company Deere & Company.

“I am not saying the Chinese cotton pickers cannot replace John Deere at all, but Chinese brands have a high error rate and much lower efficiency; they cannot compete with John Deere,” Hu said.

Most of the machines were delivered this past spring, adding to a spike in exports from the US to Xinjiang over the first half of 2020. This year’s trade has already surpassed the total value of exports in 2019, which was a record year for US shipments of cotton-picking equipment to China.