As US-China decoupling threat mounts, Beijing looks to open up market for foreign services trade

- Ministry of Commerce is compiling ‘negative lists’ for the services trade, outlining sectors and industries that are restricted to foreign firms

- ‘There will be no additional restrictions imposed in the areas outside the negative lists,’ ministry researcher says

China says it is speeding up the drafting of a so-called negative list for cross-border trade in services as part of national efforts to open up key areas of the economy to foreign businesses amid mounting pressure of economic decoupling from the United States.

Foreign-investment access to the domestic market is managed via such negative lists, which detail sectors and industries that are restricted or prohibited to foreign firms.

The introduction of a negative list for the services trade would follow the June publication of an updated negative list for foreign investment access, which saw its listed sectors and industries drop to 33 from 40 last year.

Compared with the negative list for foreign investment, which mainly concerns entry permits, the services trade list is meant to address a wider range of issues, including cross-border payments and consumption in overseas markets, according to the Ministry of Commerce.

Two negative lists in the services trade are expected to be issued. The first is for the new free-trade port comprising the entire southern province of Hainan, and the second is a nationwide version.

“This negative list should be available before the end of this year,” the China Securities Journal reported on Monday, citing Xian Guoyi, director of Department of Trade in Services and Commercial Services under the ministry. It was unclear whether this referred to the Hainan or nationwide list.

Despite the growing threat of economic decoupling between the US and China, there have been calls to make China’s markets freer and more convenient to foreign investors. In particular, policies to develop the services trade could help stabilise China’s foreign trade sector, analysts said.

China adopted the negative list management system for the first time last year, to conduct negotiations on services trade and investment during the second phase of the China-South Korea Free Trade Agreement talks.

“At the moment, the services trade has become the focus of global free trade, becoming the focal point of the restoration of global economic and trade rules,” said Chi Fulin, director of the China (Hainan) Research Institute of Reform and Development.

Pang Chaoran, an associate researcher with the Ministry of Commerce’s Research Institute, said China is using such negative lists to fulfil its promise to open up the services trade to foreign firms.

“There will be no additional restrictions imposed in the areas outside the negative lists, showing China’s confidence and determination to continue promoting reform and liberalisation,” Pang said.

As China’s economy has matured, Chinese consumers are demanding more and better choices in goods and services, offering opportunities for foreign players. The country has run a deficit in the services trade for the past decade, reflecting a net outflow of funds in travel and tourism. The 608,400 Chinese students who are studying abroad also contributed to the deficit in the services trade.

The negative list puts the onus on the government in terms of justifying why a certain sector should be on that negative list

But China’s share of the global services trade is not as significant as in goods, importing US$468 billion worth of services in 2017, equivalent to only 6.4 per cent of global services trade, compared with 11.4 per cent for goods.

“As in most other countries, the process of opening up China’s services industries to cross-border trade has lagged behind the opening up of goods markets to foreign competition,” said Louis Kuijs, head of Asia economics at Oxford Economics, based in Hong Kong. “The negative list puts the onus on the government in terms of justifying why a certain sector should be on that negative list.”

Restrictions on foreign firms in China’s services sector are four to five times higher than the Organisation for Economic Co-operation and Development average, according to a 2019 report by the McKinsey Global Institute titled “China and the World”. The nation is relatively open in the restaurant and hotel sectors, as well as in retail and wholesale trading markets, but it is much more closed off in sectors such as media, telecoms, financial services, health care and education, McKinsey said.

Sun Guojun, a senior member of the State Council’s in-house research office, said that even though the services sector already accounts for as much as 60 per cent of economic growth, there is still room for China to expand the services trade, given its low proportion of overall trade.

The country’s trade services have been hit hard this year due to Covid-19, generating 2.2 trillion yuan (US$322 billion) during the first six months, down 14.7 per cent from the same period last year.

Investments by foreign firms in China’s services operations will promote domestic commerce and trade, Sun said, adding that the negative lists “will make China’s services trade more transparent, more open and more liberal”.

But Iris Pang, Greater China economist at ING Bank, said that more details about the new negative list were needed to be able to see the actual effectiveness of the new policy in promoting the services trade.

Loosening policy regulations for the cross-border services trade market could also make it more difficult for authorities to trace the authenticity of intangible services or prove that the billing amounts are reasonable, Pang said.

“For example, it would be difficult to quantify the consultancy services provided by Hong Kong [companies] to a mainland interior designer or measure its invoice bills,” Pang said. “How can you open up the [services trade] market and at the same time know if this consultancy activity is true?”

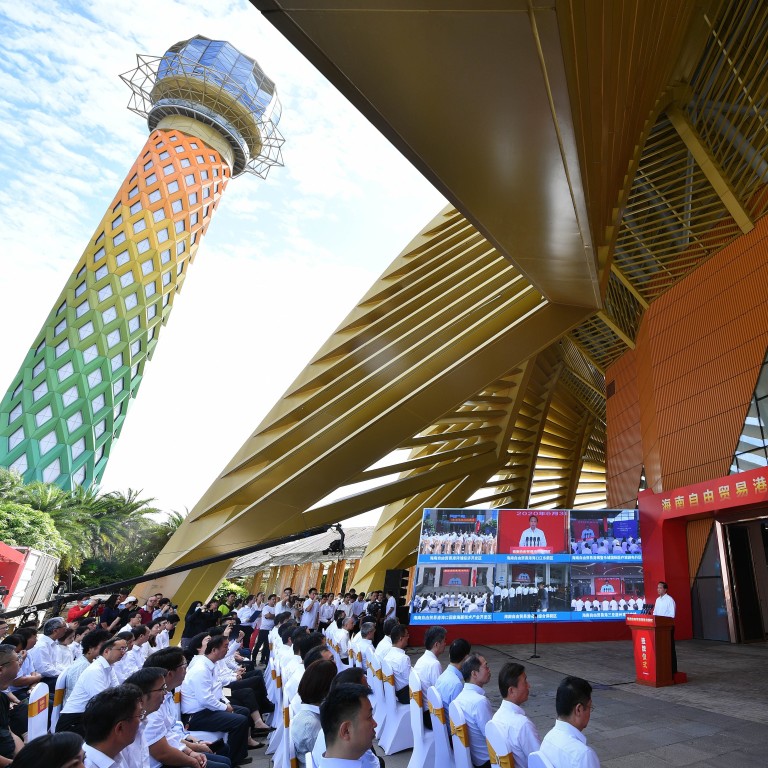

Chinese President Xi Jinping announced in April 2018 that Hainan, a popular holiday destination sometimes referred to as China’s Hawaii, would be made into the nation’s largest free-trade zone. A package of special policies of low tariffs and taxes, intended to turn Hainan into a regional trade, shopping and shipping centre, was announced on June 1 this year.

With fewer restrictions on duty-free shopping, Hainan could see a rise in domestic tourists, especially at a time when international travel remains stalled, analysts said. Chinese consumers who otherwise would have been travelling abroad for tourism and business, could instead spend more money domestically, they said.

But Hainan has yet to become a truly international destination, as foreign tourists accounted for only 2 per cent of its total visitors last year, whereas that figure was 30 per cent for Hawaii, Bank of America said in a report.

And making significant strides in terms of hi-tech and finance will depend on whether Hainan can lure a growing number of talented workers while upgrading its technological capabilities, Bank of America added.