As China’s economic recovery from the coronavirus gains momentum, what is the outlook?

- Sales of excavators and heavy trucks used in construction soared in August, with car sales, electricity generation and rail freight also rising from a year earlier

- A growing number of financial institutions have revised up their forecasts for China’s gross domestic product growth rate

From soaring sales of construction vehicles to strong increases in rail freight volume, and from record daily electricity generation and consumption figures to a rebound in car sales, a flurry of indicators provide further evidence that China’s economic rebound is gaining momentum.

And in response, multiple banks, investment firms and rating agencies are revising up their forecasts for China’s economic growth for this year, after a series of economic data beat expectations in the first two months of the third quarter.

But economists have warned that the Chinese economy is simply completing the easiest part of its comeback, and that the unbalanced growth pattern – with industrial production and construction activity strong but consumer spending remaining weak – could linger into next year, meaning it is time for the government to pay more attention to long-term structural risks and challenges.

China’s recovery is undoubtedly impressive, especially when compared to other major economies that are mired in the pandemic

On Tuesday, the National Bureau of Statistics is due to release three further major measures of economic activity – industrial production and retail sales data for August and fixed asset investment data for the first eight months of the year – giving further clues about the nation’s growth in the third quarter.

Industrial output is expected to grow 5.2 per cent in August from a year earlier, accelerating from 4.8 per cent in July, according to the median forecast of a Bloomberg survey of economists.

The annual decline in urban fixed asset investment is projected to narrow to just 0.4 per cent in the first eight months from the 1.6 per cent decline between January and July.

“China’s recovery is undoubtedly impressive, especially when compared to other major economies that are mired in the pandemic,” said Lu Ting, chief China economist at Nomura.

The Japanese investment bank revised up its growth forecasts for Chinese inflation-adjusted gross domestic product (GDP) growth rate in the third and fourth quarters to 5.2 per cent and 5.7 per cent, respectively, from 4.3 per cent and 4.5 per cent. Its forecasts for China’s annual growth rate for 2020 and 2021 were also revised up, to 2.2 per cent and 9.9 per cent, from 1.7 per cent and 8.8 per cent, respectively.

At the end of August, HSBC also raised its forecast for China’s GDP growth rate in 2020 to 2.4 per cent from its previous projection of 1.7 per cent, citing infrastructure and property investment as the most important drivers of growth while expecting consumer spending to continue to lag.

International ratings agency Moody’s, meanwhile, revised up its 2020 forecast to 1.9 per cent from 1.0 per cent, while competitor Fitch raised its estimate to 2.7 per cent from 1.2 per cent.

These changes have been promoted by several leading indicators adding to evidence that China’s steady economic recovery continued in August and increasing optimism about the country’s annual outlook.

The growth rate has now been above 50 per cent for five straight months, and in the first eight months of the year, China sold a total of 210,474 excavators, close to 90 per cent of the total sales from 2019 and already above the figure achieved in 2018.

Sales of heavy trucks, widely used in construction, grew by 75 per cent in August from a year earlier to 128,000 units, a record high for the month, according to car industry information provider, cvworld.cn.

[The numbers] don’t matter, what we are most concerned about is whether the economy is healthy, whether it can solve the employment problem and various contradictions. The data is not worth focusing on

Both rail freight volume and the electricity consumption rate have long been closely watched indicators since Premier Li Keqiang said they were two of the three most trustworthy gauges of Chinese economic growth in a leaked conversation with a US official that took place in 2007.

“The recovery of sectors such as catering and hotels is slower than expected,” said Wang Bing, a vice-director of the consumption promotion division at the Ministry of Commerce.

Zhang Kaihui, general manager of the Beijing branch of China Galaxy Securities, believes China’s economy could grow 2.4 per cent this year and 5.9 per cent in 2021.

“But [the numbers] don’t matter, what we are most concerned about is whether the economy is healthy, whether it can solve the employment problem and various contradictions. The data is not worth focusing on,” he said this week.

“For China to achieve positive growth this year, boosting consumption is vitally important,” Premier Li said on Wednesday during a meeting of the State Council, while conceding that consumer spending was a “weak link” in the economic recovery.

“In the past, when we focused on investment projects, the government is quite experienced. But to increase consumption, frankly, we need to explore new methods.”

Li Xunlei, chief economist at Zhongtai Securities and an adviser to the Chinese government, said this week that it will be very challenging for the government to boost consumption since the deterioration in incomes of many workers caused by the coronavirus is likely to limit spending.

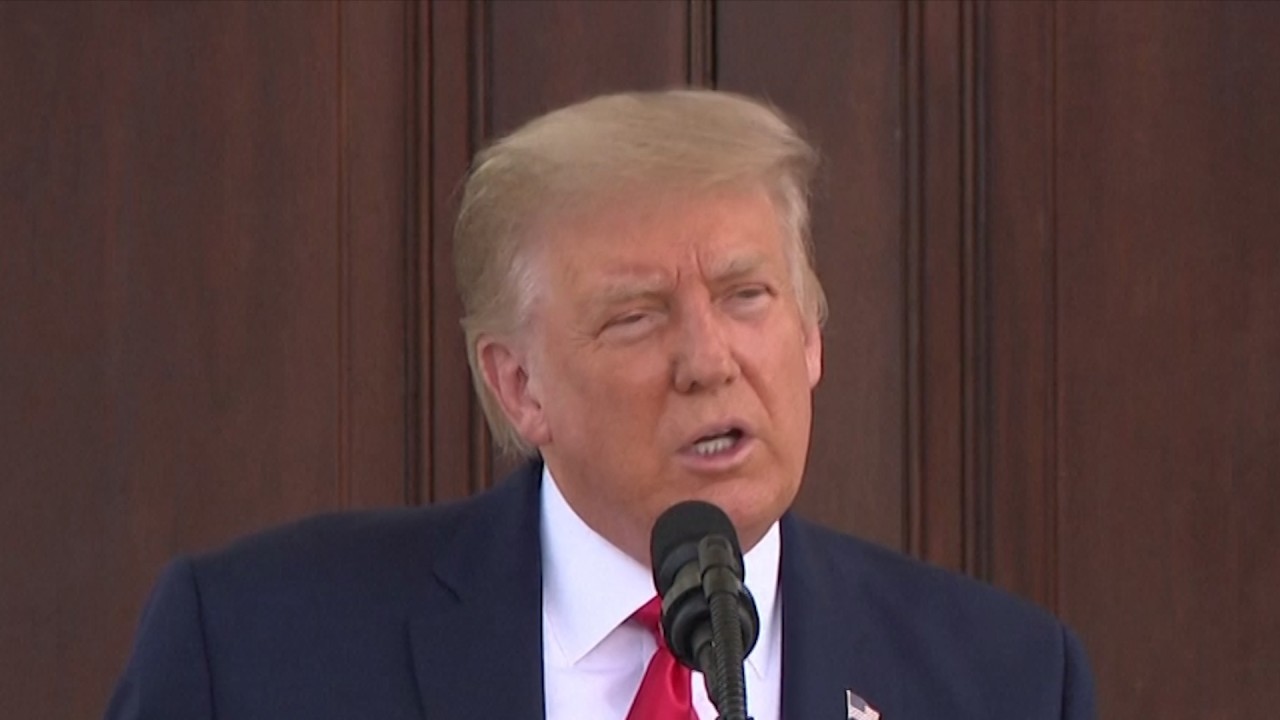

00:49

Donald Trump again threatens to scale back US economic ties with China

He urged authorities to undertake more reforms to increase the income of low and middle-income residents to boost the economy.

His views were echoed by Dong Chen, deputy president of Northeast Securities, who said that China now needs to pay more attention to long-term risks, including the widening wealth gap and high housing prices.

“China’s macro economy is currently in a good state, [but] the pressure in the future will be greater, as trade disputes might escalate further,” he also said this week.

Liu Xiaoshu, chief economist at the Bank of Qingdao, said China’s annual growth rate could possibly slow to as little as 2.0 per cent in the future, and called for more domestic reforms to improve the quality of growth.

“But the more domestically-oriented an issue is, the harder it is to push forward,” he said, noting that one possibility could be that the dual circulation strategy will break down domestic institutional barriers.

Zhang from China Galaxy Securities conceded the biggest near-term risk for the national economy was in the agriculture sector.

“This year, there have been floods in the south, hail and drought in the north, but the reported grain outputs are records year after year,” he added.

“There are some problems, but everyone only says positive words, that is the risk.”