China and world at risk of financial turmoil greater than 2008 crisis, ex-finance minister warns

- Washington is playing a ‘negative-sum game’ with Beijing, and both sides will end up losing if geopolitical strife continues, says Lou Jiwei

- Lou Jiwei urges world’s major economies to rapidly roll back their loose monetary policies or excessive economic stimulus measures will take a global toll

China could be locked into a no-win global situation for years, with the world on the brink of financial turmoil that could surpass that of the global financial crisis more than a decade ago, former Chinese finance minister Lou Jiwei has warned.

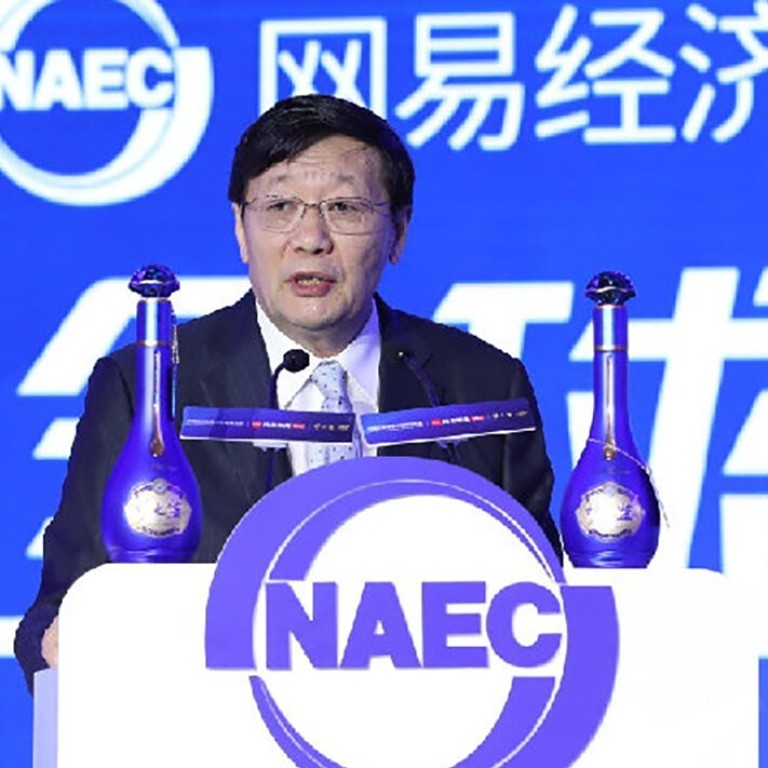

Speaking at an economic forum in Shanghai, Lou, currently chairman of the foreign affairs committee of the Chinese People’s Political Consultative Conference (CPPCC) National Committee, urged the world’s major economies to rapidly roll back their extremely loose fiscal and monetary policies to avoid a major global financial problem.

“It is not unlikely that a global crisis more serious than the one in 2008 could break out if the withdrawal pace is not fast enough,” Lou, long known for his outspoken views, said during a keynote address at the 2020 NetEase Annual Economist Conference on Friday.

Lou is the latest Chinese official to warn of the risks posed by what is seen as excessive global economic stimulus.

His comments came even as the International Monetary Fund last week adopted a more optimistic outlook for the global economy this year, citing the stronger-than-expected performance of China and other advanced economies.

However, Lou warned that global debt levels were too high, and that financial bubbles were accumulating around the world, fuelled by the fiscal and monetary stimulus measures utilised in developed countries to fight the economic damage caused by the coronavirus pandemic. And the results, he said, could be devastating.

The US Federal Reserve earlier this month indicated that it was likely to keep its main interest rate near zero until at least the end of 2023, while the European Central Bank may introduce more monetary stimulus at its next meeting in October.

The People’s Bank of China and the Ministry of Finance were also expected to maintain relaxed monetary and fiscal policy stances to promote a more robust recovery in investment and economic growth.

The US stock market had rallied by more than 50 per cent since bottoming out in March, but notched a fourth consecutive week of decline last week. The debt level of China’s economy rose to 266.4 per cent of gross domestic product at the end of June, up from 249.5 per cent a year ago, while the debt ratio of households rose to 59.7 per cent from 55.3 per cent, according to data from the National Institution for Finance and Development.

The world will keep suffering from circumstances where everyone will be the loser for several years

Lou said that all countries should work together to solve the current risks and challenges caused by the pandemic.

The extent of China’s V-shaped economic recovery will ultimately depend on the performance of the global economy, he said while also warning that the wave of anti-globalisation was cause for alarm in the near-term.

“The world will keep suffering from circumstances where everyone will be the loser for several years,” Lou said. “China’s attitude is very clear, to support and improve globalisation. The question is whether other major countries in the world are willing to sit down together and discuss this.”

Lou said anti-globalisation would also be hard to overcome as it did not emerge suddenly, but rather dates back nearly a decade, when the Occupy Wall Street occurred and the structural reforms of southern European countries ran into obstacles.

A United States-led worldwide decoupling from China has become a major threat to the latter’s economic recovery and future development, he said.

Washington is playing a “negative-sum game” with Beijing, Lou said, noting that both sides, as well as other nations, would end up as losers.

“The only winning player is the one who loses less,” Lou said. “It is even worse than a zero-sum game that aims for a win-lose outcome.”

“Who’s winning? Both are losing. But who is losing more and who is losing less? Everyone has different opinions,” Lou said.

He also warned that the technological decoupling between the world’s two largest economies has made the outlook for the development in Covid-19 vaccines and artificial intelligence hard to predict.

The plight of ordinary people and the potential global crisis will force politicians to return to a win-win mindset, he said, adding however that this was unlikely to happen in 2020.

“It is not certain yet which country will be the winner in the end,” Lou said, “but it is certain that the people and companies are the losers.”