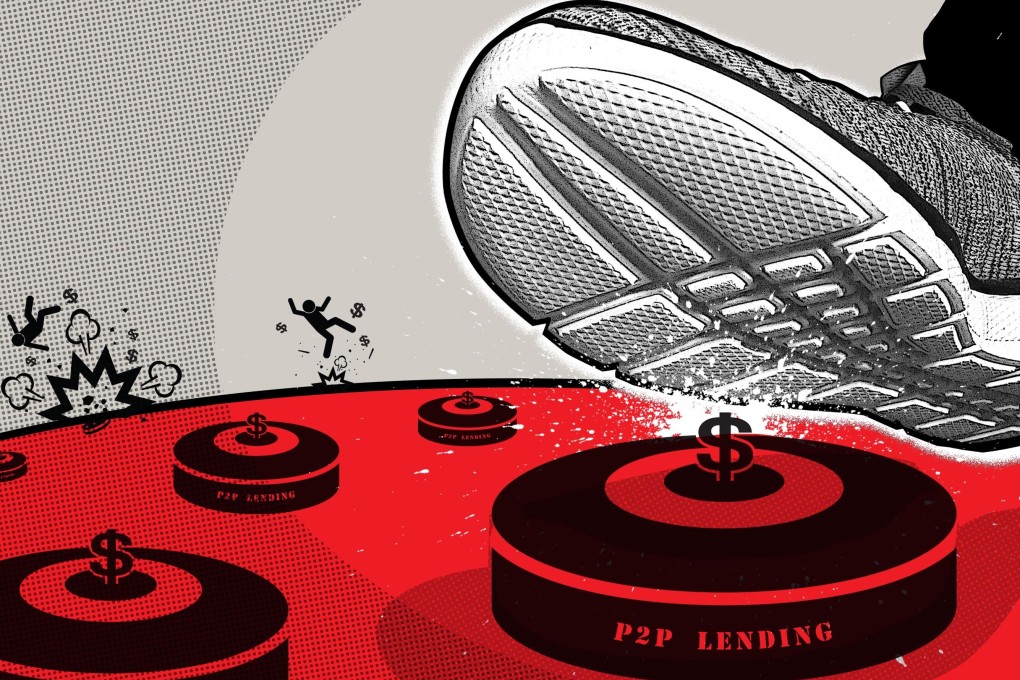

China’s P2P ‘financial refugees’ face never ending wait to recover lost US$120 billion

- Scores of Chinese investors suffered losses due to the collapse of peer-to-peer (P2P) lending schemes, with around 800 billion yuan (US$119 billion) still owed

- P2P firm Ezubao was one of the country’s biggest Ponzi schemes, fleecing more than 50 billion yuan from about 900,000 investors

An exporting company owner in his 40s in the eastern province of Zhejiang, a public relations manager in her 20s in the southern city of Shenzhen and retired state-owned enterprise executive in eastern-central coastal province of Jiangsu would normally share little in common as they blend into China’s 1.4 billion population.

In 2017, Liu Yijia from Zhejiang province, Li Wei from Shenzhen and Feng Mei from Jiangsu joined millions of people who put their savings into investment schemes that promised double digit annual returns – a big temptation compared to a one-year bank deposit rate of 1.75 per cent and a cash account interest rate of 0.3 per cent available at traditional banks.

Three years later, the three have been left frustrated as not only did they not receive the promised returns, but they also lost their principal investments.

Overall, it is estimated that millions, if not tens of millions, of Chinese citizens suffered losses due to the collapse of P2P lending schemes, with around 800 billion yuan (US$119 billion) still owed as the end of June, more than three and half years after the government crackdown on the sector began, according to Guo Shuqing, China’s top financial regulator.

At least eight people I know, including friends, colleagues and relatives, were victims of various P2P apps. We can’t get our money back. We called the police but there is no help

“At least eight people I know, including friends, colleagues and relatives, were victims of various P2P apps,” Li said. “We can’t get our money back. We called the police but there is no help.