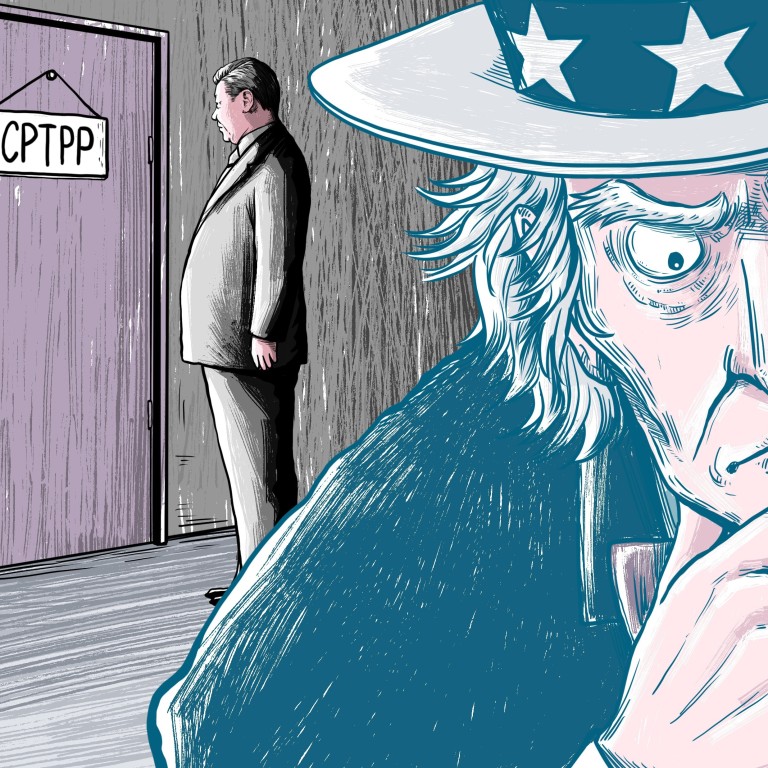

China’s interest in Pacific trade deal sets stage for new US showdown after Xi Jinping ups the ante

- Xi Jinping’s statement of intent on the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) has caught the eye of member states

- Analysts say Joe Biden’s election sparked firming up of Beijing’s interest, but uncertainty remains as to the US direction of travel under new administration

On the heels of signing the world’s biggest free trade deal, President Xi Jinping’s announcement that China “will actively consider” joining a formerly American-backed accord has sent a ripple of intrigue across the Pacific Rim.

In Beijing, Xi’s statement is seen as the surest sign yet of genuine interest in the deal to date, following Premier Li Keqiang’s comments in May that “China has a positive and open attitude toward joining the CPTPP”.

Former officials and analysts say Biden being confirmed as the US president-elect ahead of his inauguration in January may be the galvanising force for Beijing‘s interest.

With the new US government coming in and a lot of uncertainty to follow, Beijing is now first making this stance on being interested in joining CPTPP the country’s official stance on this matter

“With the new US government coming in and a lot of uncertainty to follow, Beijing is now first making this stance on being interested in joining CPTPP the country’s official stance on this matter,” said Wei Jianguo, China’s former vice-minister of commerce responsible for foreign trade, adding that there will be “practical moves by Chinese officials to follow”.

There is only a slim chance of the US rejoining immediately, but nonetheless, Beijing analysts view China’s interest in CPTPP as a “now or never issue” given the political machinations in Washington.

“If the Biden administration brought the US into CPTPP, it would make it much more complicated for China to join later. So the pressure is on, it is a now or never issue for China,” said John Gong, a professor at the University of International Business and Economics in Beijing.

Among some of the 11 member nations of the deal, which includes Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore and Vietnam, Xi’s intervention was met with surprise.

One senior official at a CPTPP member state – who did not want to be named due to the sensitivity of the issue – described Xi’s statement as a “bit of pot stirring”, in the face of the US’ ongoing absence from the region, but added that it was “certainly interesting that [Xi] has now formally signalled interest, that’s certainly a step up in ambition”.

Another senior official in a CPTPP member capital said that they hoped this, along with the signing of RCEP just over a week ago, might help nudge Biden in a direction of engagement with Asia-Pacific as a means of containing China.

“This may include using TPP as a rules framework,” they said.

Theoretically, the Chinese government would, for example, have to offer the same sorts of financing or loan guarantees to a Japanese, Australian or Mexican firm that it would provide oil and gas enterprise Sinopec or car design and manufacturing company SAIC Motor.

Gong at the University of International Business and Economics said that these steps towards “competitive neutrality” would be challenging, but not impossible.

China could say it is going to abide by these rules in order to join, but the question is whether the current signatories would believe it is credible

“These requirements do not require fundamental structural changes, just changes in the policy towards SOEs, so I think it’s actually not as structural as a lot of people think. I don’t think we have to change the fundamental economic political system,” he said.

“After all, they are the clauses that were put in the original TPP as devices to pressure China to change its policy on IP protection and SOEs should it want to join,” said Ho-fung Hung, a professor of political economy at Johns Hopkins University in Maryland.

Hung described Xi’s rhetoric as a “publicity stunt to shape the world’s perception of China with words that are not followed up by action”, comparable to the president’s famous speech at the World Economic Forum in Davos in 2017, when he suggested China would be the new sponsor of globalisation in the face of America’s inward turn under Trump.

02:10

China scores victory as 15 Asia-Pacific nations sign RCEP, the world’s biggest free-trade deal

“China could say it is going to abide by these rules in order to join, but the question is whether the current signatories would believe it is credible. The bottom line is, the current signatories will have a greater interest in convincing the US to come back than getting China on board,” Hung added.

Bringing the US on board will be no mean feat, even though some tipped to serve senior roles in the Biden government are strong proponents of the deal.

One Obama-era official, who preferred not to be named, recalled negotiating a bilateral investment treaty with China simultaneously to TPP texts being made public.

The Biden administration people must come and learn about the new East Asia that has emerged, and not base their policies on the old assumptions of the past

In a sign of how “China was intensely interested and concerned by the standards” of TPP, Chinese negotiators kept English and Chinese language versions of TPP chapters in front of them during subsequent bilateral investment treaty negotiating rounds.

The implication is that China has long feared the US’ presence in TPP, and many policy analysts still believe a high-grade trade deal may be among the best ways of maintaining US influence in the region, and could build a regional supply chain that is less dependent on China.

But few think rejoining is realistic in the early years of Biden’s time in office, which will be largely focused on the recovery from the coronavirus and rebuilding the domestic economy.

03:29

RCEP: 15 Asia-Pacific countries sign world’s largest free-trade deal

“TPP was anathema to his party when he was the vice-president, and particularly the labour unions. And if you look through all his campaign documents, he made it pretty clear he doesn’t really want to engage in any sort of serious trade negotiation, much less trying to thread the political needle of walking back into TPP,” said Edward Alden, a US trade policy analyst at the Council on Foreign Relations.

In the ongoing absence of the US, China is sure to continue to try and fill the vacuum by pitching itself as a member of the “highest grade trade agreement out there”, which fits in with China’s strategy to be a leader in the region. In other words, America’s loss could be China’s gain.

“CPTPP tackles a number of 21st century challenges, whereas RCEP is an old school agreement. So if China wants to position itself as a 21st century leader, it can‘t just give a big bear hug to the old jalopy,” said Claire Reade, who was assistant United States Trade Representative for China affairs under the Obama administration.

“Instead, it’s got to look at the shiny new Tesla and say, we might test ride that too.”

But ultimately, few seriously expect either superpower to accede to the TPP – the negotiated text of which remains on the shelf – or CPTPP, its replacement, any time soon.

Kishore Mahbubani, Singapore’s former permanent representative to the United Nations, points to the “very toxic political environment within the United States” towards multilateralism, saying that it is “politically inconceivable” that it could rejoin any time soon.

And while much of the focus has been on the struggle to build domestic consensus, Biden will also have a job on his hands to repair a trust deficit with Asia.

“On the one hand, everything will change. And paradoxically, on the other hand, nothing will change,” Mahbubani said, adding that while US policy will no longer be doled out via tweet, the underlying “structural forces” guiding US distrust of multilateral engagement remain.

“East Asia has changed a lot in the last four years, it is in a different place now,” Mahbubani said. “So the Biden administration people must come and learn about the new East Asia that has emerged, and not base their policies on the old assumptions of the past.”

Additional reporting by Kinling Lo