Xinjiang: deadline passes for US firms to cut XPCC from supply chains

- US sanctions had been imposed on the sprawling Xinjiang Production and Construction Corps (XPCC) and its network of majority-owned subsidiaries

- Former Trump White House officials expect movement on the Uygur Forced Labour Bill in the lame duck congressional period, but it will be a race against time

The deadline has passed for American entities to comply with human rights sanctions and rid their supply chains of ties to the sprawling Xinjiang Production and Construction Corps (XPCC) and its network of majority-owned subsidiaries.

XPCC, a quasi-military entity estimated to employ 12 per cent of Xinjiang’s population and generate 17 per cent of its cotton-heavy economy, was sanctioned under the Magnitsky Act on July 31 by the US Treasury Department’s Office of Foreign Assets Control (OFAC) in connection “with serious rights abuses against ethnic minorities” in the northwestern Chinese region.

XPCC has been accused of using forced labour by Uygurs and other Muslim minority groups throughout its various supply chains. Experts say it is impossible to do business with China’s cotton and textile industries without also engaging with XPCC in some way.

The US Treasury Department’s sanctions initially gave companies until September 30 to cut ties with the XPCC, but the deadline was extended by two months, to Monday, after industry groups argued that they needed more time because the Xinjiang supply chain was too opaque for them to quickly comply.

As the extended deadline approached, the US Treasury Department received a negligible number of requests for another extension, an official familiar with US policy on Xinjiang told the Post.

“2,114 of these companies are based in the US and/or appear in US official public records. 71 of these US-linked companies are within 10 layers of ownership from the XPCC,” read a Sayari note on XPCC, although it was unclear how many of these corporate stakes amounted to the 50 per cent ownership level that would make transacting with them a breach of OFAC sanctions.

A company that trades with XPCC could be blacklisted and have to pay a civil financial penalty (the greater of twice the value of the transaction or US$307,922 per transaction). If its executives are found to have wilfully violated the law, they are subject to both civil and criminal penalties. An individual company, however, can still apply for a licence to keep trading with XPCC.

The clock is also ticking on other legislation lingering in the US Congress to punish China for human rights abuses in Xinjiang, where, according to a United Nations report, 1 million Uygurs have been interned in camps by the Chinese government.

The expectation remains that this bill will move this Congress

The bill could effectively ban imports from China’s Xinjiang Uygur autonomous region because of suspected use of state-sponsored forced labour there.

But it is competing for attention in the US Senate with the need to pass a stimulus bill and fund the US government, among other pressing issues. The new session of US Congress is scheduled to begin on January 3, after which all pending bills must be reintroduced.

“The expectation remains that this bill will move this Congress,” said a former trade official who left the administration this year. “Right now, [Senator] Marco Rubio’s team and industry are in the process of shaping the bill to ensure that it’s administrable.”

“The version that passed in the House is not – as I understand [US Customs and Border Protection] cannot implement it. But the expectation is still that this will move before the end of this Congress – timing hasn’t been set yet.”

01:57

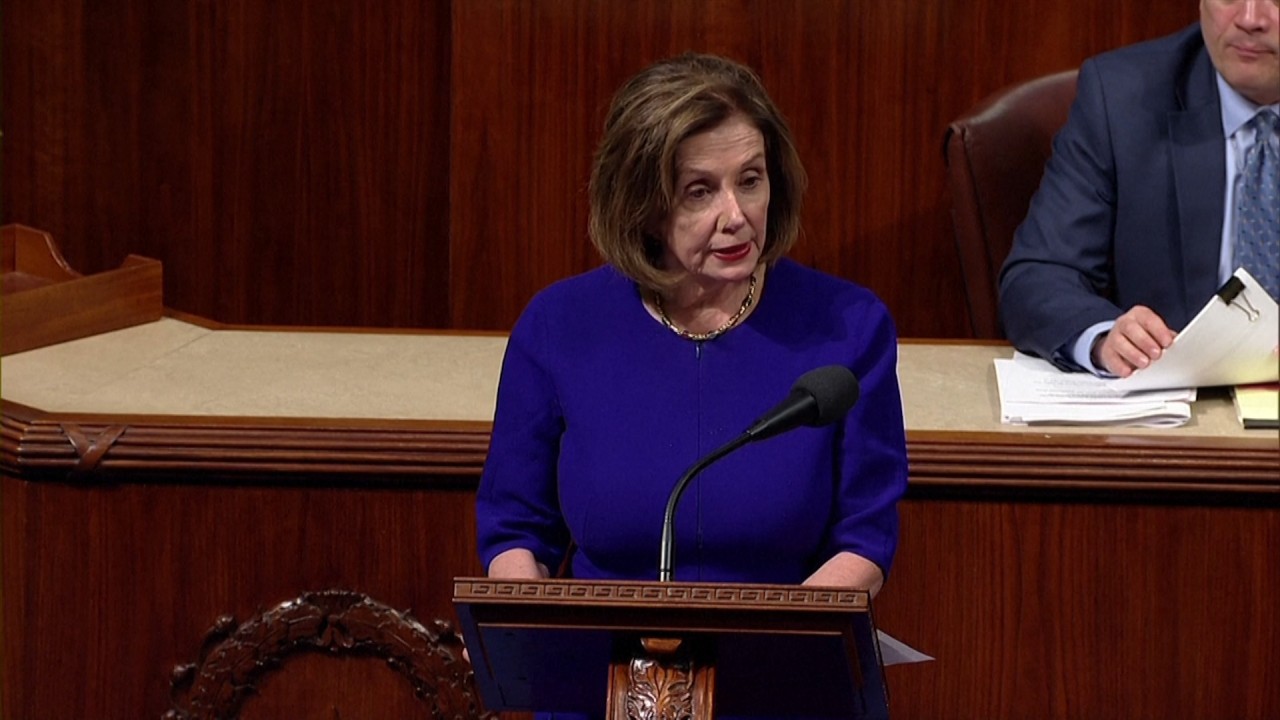

US House passes Uygur law demanding sanctions on China over human rights abuses in Xinjiang

A second source pointed to resistance from various parts of government, including Trump’s chief of staff, Mark Meadows, and US Trade Representative Robert Lighthizer.

A senior congressional aide who was not authorised to speak publicly about the deliberations said the bill was expected to pass as part of a larger spending package at the end of year.

Xinjiang accounts for 20 per cent of all the cotton in the world, 80 per cent of China’s cotton and 50 per cent of global spinning capacity, meaning the legislation has the potential to significantly disrupt textile supply chains.

03:21

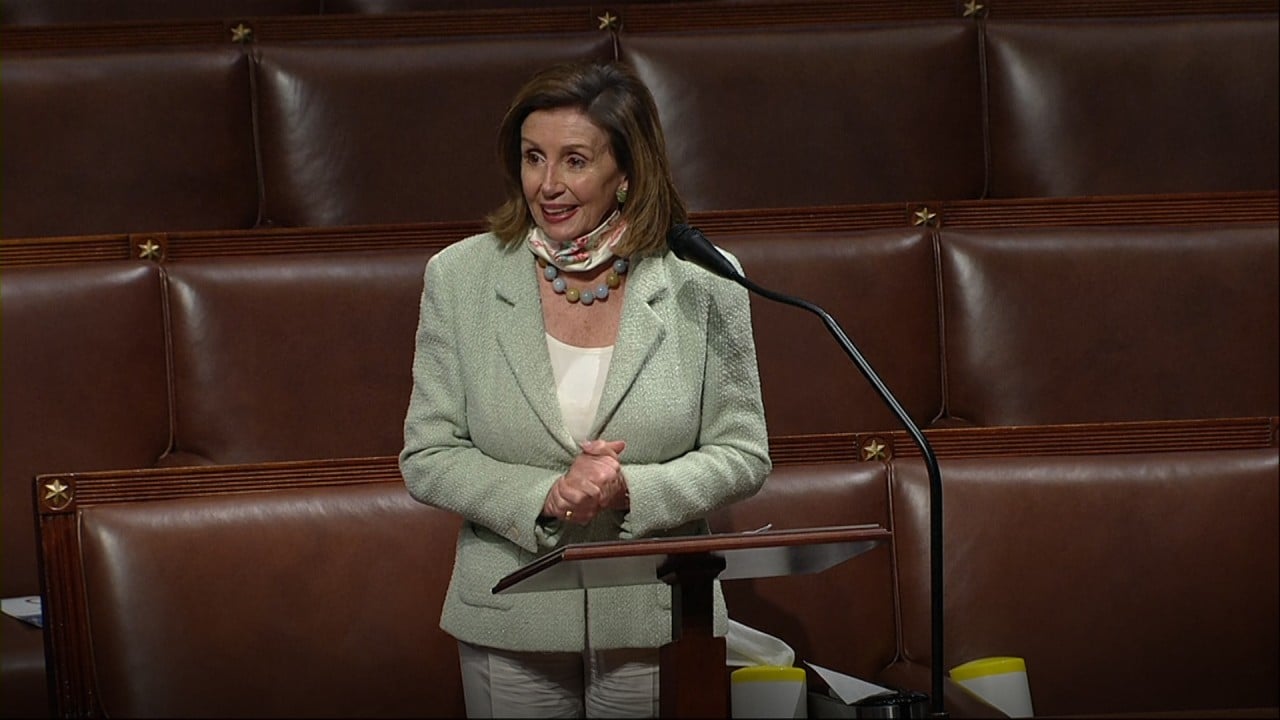

US House of Representatives sends Uygur Human Rights Policy Act to Trump’s desk for approval

A second bill that would require publicly listed companies in the US to disclose commercial links to Xinjiang has also been “languishing in the Senate over complaints from industry on the [Securities and Exchange Commission (SEC)] filing requirements”, said a former US trade negotiator who was briefed on the discussions.

At a US Senate hearing on November 17, Idaho Republican Mike Crapo, chairman of the Senate Banking Committee, told the head of the SEC that he had “grave concerns” about creating a new disclosure requirement at the commission, “rather than utilising the existing pressure channels available to the departments of Treasury, Commerce, State, Defence and others.”

The Uygur Forced Labour Prevention Act was approved by a vote of 406-3 in the House in September, but if it is changed in any way by the Senate, it must return to the House for a new vote, adding to the time constraints.

I think that this is an area where we could see movement because there’s bipartisan interest in doing something about this

Still, observers say they expect at least one of the bills to pass, in one form or another.

“I think that this is an area where we could see movement because there’s bipartisan interest in doing something about this,” said Nasim Fussell, a partner at Washington law firm Holland & Knight and until recently chief trade counsel for the US Senate Committee on Finance.

“It would be a space where they could take action that wouldn’t necessarily draw widespread criticism or pushback given that, politically, it’s a tough one to push back on.”

Lobbyists have been working to adjust the Xinjiang bills to make them more palatable to US business interests. Congressional records show that Nike, Coca-Cola, the Gap and VF Corporation, which owns The North Face and Timberland, have all lobbied on the legislation.

01:54

China hits back at UK claims of forced sterilisations and other human rights abuses against Uygurs

“Predicting what is going to happen in a lame duck is tough. There’s a lot of interest in taking action on this,” said Steve Lamar, president of the American Apparel & Footwear Association, which has also lobbied on the bill.

“Will it happen? Quite possibly. Could it get moved to until the next Congress when they want to embed in some principles, perhaps that the Biden administration want to include? Quite possibly, but at this point, it’s difficult to say.”

Rights groups say it would be a mistake to weaken the bill.

“Without sufficient international and economic pressure, the Chinese government will not change course and the scope and brutality of forced labour and other human rights abuses will continue to worsen for the Uygurs and other Turkic and Muslim peoples,” said Scott Nova, executive director of the Workers’ Rights Consortium.

Additional reporting by Owen Churchill