China’s C919 commercial jet aspirations are overblown and no threat to Boeing or Airbus, Washington think tank finds

- Centre for Strategic and International Studies gives a wholesale rejection of Beijing’s dream to break up commercial aircraft duopoly

- Any US sanctions on the Commercial Aircraft Corporation of China also said to be ‘counterproductive’, as China could retaliate by not buying from US companies such as Boeing

Beijing’s plan to make its own commercial aircraft to break up the duopoly of Boeing and Airbus remains a costly pipe dream, according to a Washington-based think tank.

While Beijing has pumped at least US$45 billion into the Commercial Aircraft Corporation of China (Comac) to make commercial planes, including the C919 passenger jet, the odds that China can make the project a success “are between slim and none”, said Scott Kennedy, a senior adviser at the Centre for Strategic and International Studies who is responsible for the research.

“Comac has received massive state funding and global attention, but it is not in the same league as the world’s top commercial aircraft manufacturers – Boeing, Airbus, Embraer and Bombardier,” Kennedy said in a note published on Monday. Comac is not even as capable as its Russian counterparts, including Ilyushin, Sukhoi, and Tupolev, which have more advanced technology but have still struggled commercially, he noted.

[Comac is] a true dumpster fire of an organisation

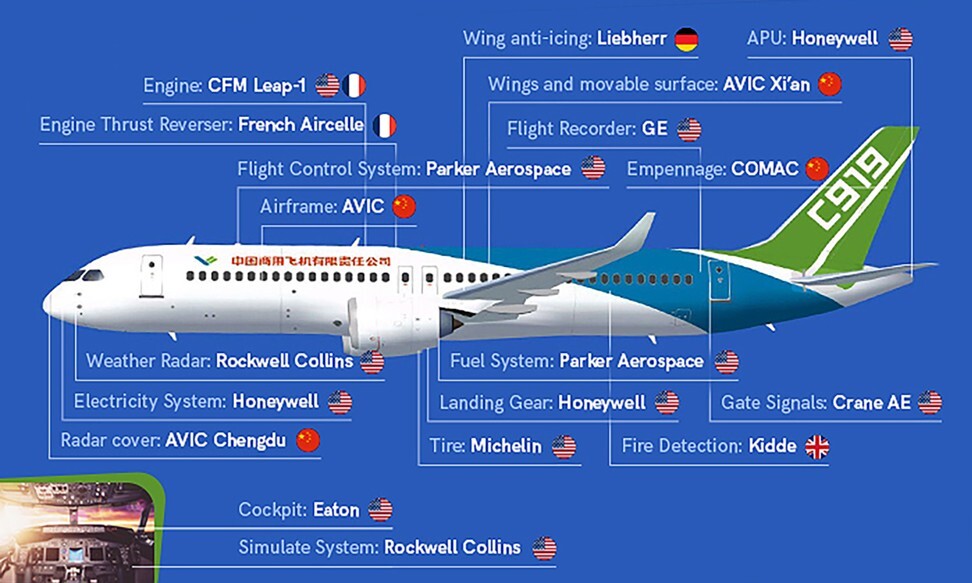

It could be devastating for China’s C919, as the plane relies on imports of a number of crucial parts, from its engines to its flight-control systems, so access to US suppliers such as General Electric (GE), Honeywell International and Rockwell Collins is vital for future deliveries of the new model, which is expected to take place in 2021.

On China’s commercial aviation industry, Kennedy said: “I’ve examined a lot of industries in China, and this is definitely the most pathetic sector I’ve ever encountered.” And he went on to call Comac “a true dumpster fire of an organisation”.

Kennedy also said it is “misleading to call the C919 a Chinese plane, because almost all of its components, including everything that keeps the plane aloft, are imported”.

Comac did not respond to faxed questions on the status of the C919 and potential US sanctions.

The C919 has yet to receive certification from the country’s aviation regulator, the Civil Aviation Administration of China.

At the same time, since Comac appears to be an overblown story, it does not seem in line with US interests to punish it, based on Kennedy’s findings.

“Not only is the C919 not a serious commercial threat to the [Boeing] 737 or [Airbus] A320, its development is not substantially aiding China’s military,” Kennedy said.

Sanctions on Comac would be “counterproductive” because China could retaliate by not buying from US companies such as Boeing, while speeding up self-reliance and moving away from the current aerospace technology hierarchy led by the US and Europe, Kennedy added.

But the US government eventually approved the licence for the jet engine sale after President Donald Trump said that the US should not prevent companies from supplying jet engines and other components to China.

Boeing last month raised its rolling forecast for China’s aircraft demand to 8,600 new planes through 2039, up from its previous estimate of 8,090, given the damage that the coronavirus pandemic has had on the global aviation market.

“While Covid-19 has severely impacted every passenger market worldwide, China’s fundamental growth drivers remain resilient and robust,” said Richard Wynne, managing director in charge of China marketing at Boeing Commercial Airplanes.