China’s top policy panel says government will continue ‘necessary support’ for economy

- The Central Economic Work Conference that concluded on Friday is an annual arena to draft China’s economic priorities for the coming year

- World’s second-largest economy will focus on strengthening strategic technological innovation, ensuring the control of supply chains and boosting domestic demand in 2021

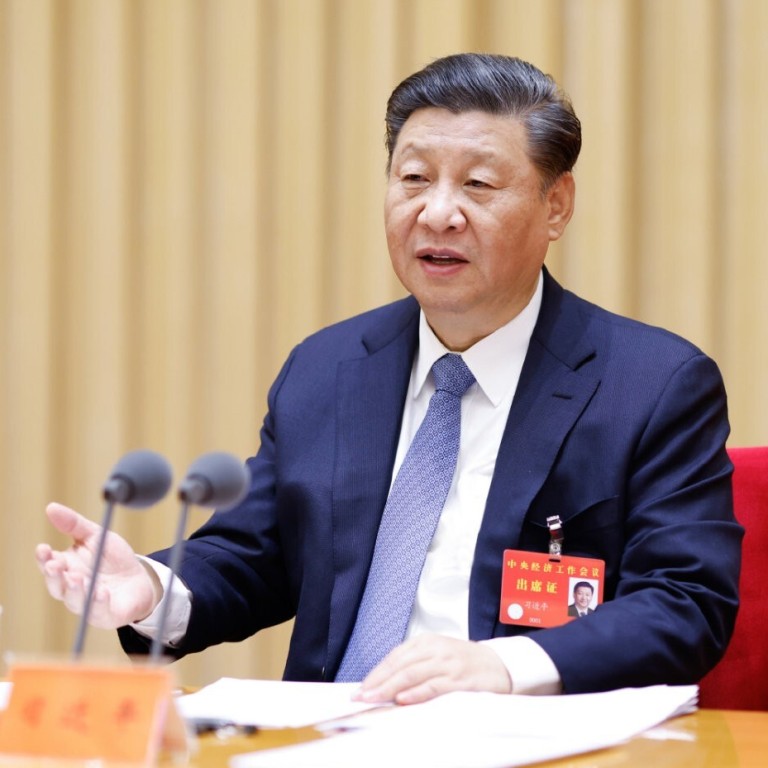

China’s top policymakers have pledged to continue “necessary support” for the nation’s economic recovery and will make “no U-turn” when there are still many outlook uncertainties due to the coronavirus pandemic and the external environment, according to the Central Economic Work Conference that concluded on Friday.

The world’s second-largest economy will put its focus on eight tasks for the coming year, including strengthening strategic technological innovation, ensuring the control of supply chains and boosting domestic demand.

“We must maintain the continuity, stability and sustainability of macro policies … and make policies more targeted and effective,” the official Xinhua News Agency reported, citing a statement after the group’s three-day meeting.

The annual conference is an arena to draft the next year’s economic priorities, attended by hundreds of central government officials, regulators, provincial governors and state-owned enterprise executives. It sets specific targets for economic growth, the fiscal deficit ratio, inflation and government investment for the coming year.

Policymakers often seek to strike a fine balance between risk prevention and economic growth in times of external uncertainty, as is currently the case. The stability of the national economy, financial system and job market will receive higher priority next year, when the ruling Communist Party will celebrate its 100th anniversary, and as the government strives for a strong start to the new five-year plan.

“We must try to keep the economy within a reasonable range,” the statement said.

Xi said in September that China’s carbon emissions would peak in 2030, and he also set an ambitious goal of carbon neutrality by 2060.

And to ensure an adequate food supply, the conference reiterated a goal of having at least 1.8 billion hectares (4.45 billion acres) of arable land.

That was reiterated at the conference, as policymakers stressed the importance of protecting industrial and supply chains, particularly as US technological containment measures have endangered Chinese industries such as chipmaking.

“We must start a campaign to tackle core technologies and solve bottleneck issues as quickly as possible,” the statement said.

In line with the strategic shift, the adjustment of its economic policies has begun.

The 25-member Politburo, the nation’s primary decision-making body, called last week for a new focus on demand-side reforms to unleash the long-term growth potential of the domestic market, while using a new anti-monopoly law to prevent the “disorderly expansion of capital” and keep financial risks in check.

Domestic demand is regarded as a strategic asset that will support the country’s continued development. The authorities vowed to make “effective systematic arrangements” in guiding consumption, savings and investment.

“The fundamental step of boosting consumption is to promote employment, improve the social security net, optimise income distribution, expand the middle-income group and push forward common prosperity,” the statement said, according to Xinhua.

To regulate online platforms, which have been under fire due to monopoly concerns, the authorities said they will make digital economic rules, provide a clear definition of what constitutes a monopoly, and also shed light on proper data collection and use.

“They must be put under [government] regulation. Financial innovation must proceed under the condition of prudential supervision,” the statement said.

Friday’s statement did not disclose the specific economic targets for 2021, which will be officially unveiled by Premier Li Keqiang when he gives the government’s work report at the meeting of the National People’s Congress in March.

[The government must] take actions on technological innovation, economic structural adjustments and income distribution

The leadership hinted that it will gradually move away from fiscal and monetary stimulus, but the pace of that withdrawal will depend on prevailing economic conditions.

“[The government] must keep a moderate level of expenditures to ensure funding for key strategic tasks, and take actions on technological innovation, economic structural adjustments and income distribution,” the statement said.

“Monetary policy must be flexible, targeted, reasonable and appropriate. The macro leverage ratio must be kept basically stable.”

Economists expect the central government budget deficit target to be lowered to about 3 per cent of GDP next year from 3.6 per cent this year. However, local governments may have their special purpose bond issuance quota increased next year from this year’s 3.75 trillion yuan to help fund major multi-year infrastructure projects.

At the same time, the People’s Bank of China, the nation’s central bank, is expected to maintain an adequate level of market liquidity and funding support for small businesses while strictly controlling the rate of money supply growth.

Speaking at a forum on Friday morning, Lu Lei, deputy director of the State Administration of Foreign Exchange, the nation’s foreign exchange regulator, said it was time for global policymakers to examine the effectiveness and cost of short-term stimulus policies while paying more attention to structural issues.

“We must think how, and at what specific time, we should normalise our monetary policies,” he said.

We are facing a dilemma. We have to make a choice. So, I strongly argue that the Chinese government should use a more expansionary fiscal policy

“Should we exit employment-driven stimulus measures if employment indicators turn better? Secondly, will the rise in debt levels and systemic risk lead to a forced market clearing,” he asked, referencing a possible sharp financial market correction.

The fragile labour-market situation amid the uneven recovery – as small service providers have been slower to recover than state-owned industrial firms – has caused many economists to urge caution in the withdrawal of policy stimulus.

Yu Yongding, a senior researcher with the Chinese Academy of Social Sciences and a former central bank adviser, said China still has the capacity, due to a low inflation rate, to continue expansionary policies, and the quick withdrawal of stimulus would risk generating a “vicious circle”.

“We are facing a dilemma. We have to make a choice. So, I strongly argue that the Chinese government should use a more expansionary fiscal policy … and the People’s Bank of China should lower interest rates,” he said at the forum.