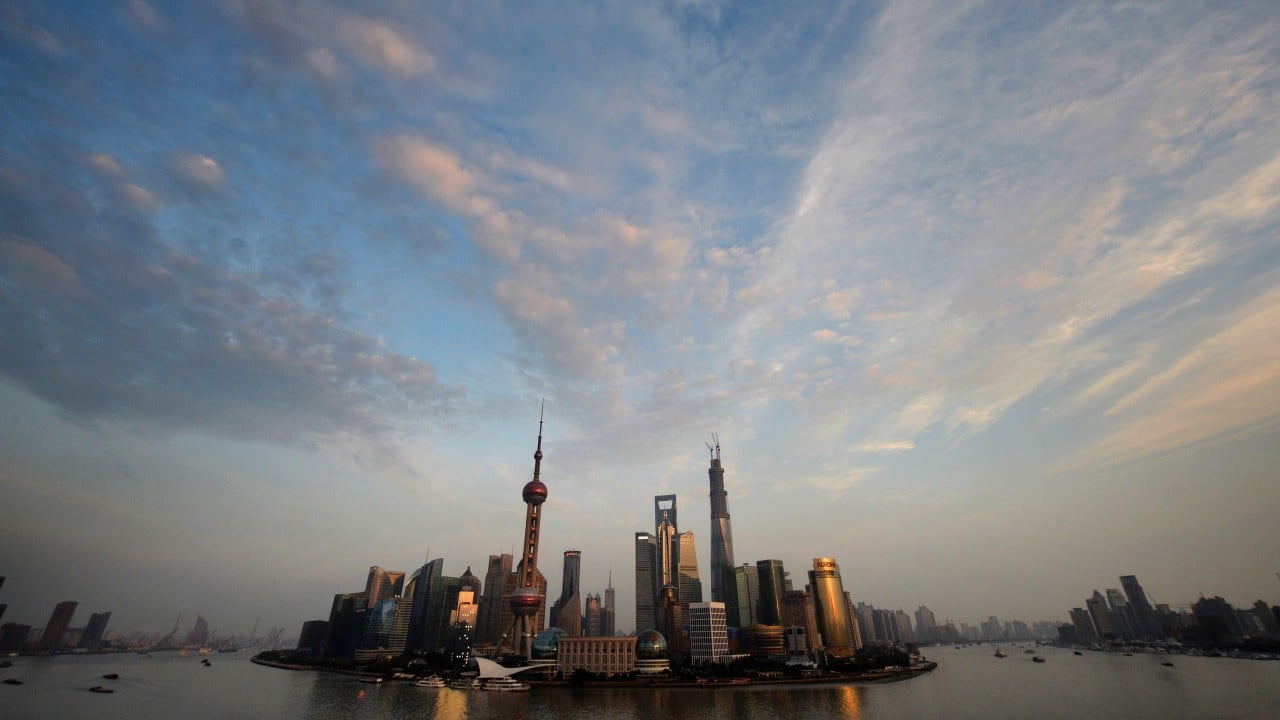

China GDP: IMF cuts 2021 growth forecast citing US tech decoupling, domestic debt, Hong Kong risks

- China economy forecast to grow by 7.9 per cent in 2021 by International Monetary Fund, slower than previously predicted

- Strained US ties could cut off dollar funding in Hong Kong and access to technology, the fund warns, while domestic debt risks also cited

The International Monetary Fund (IMF) has trimmed back its growth projection for the Chinese economy in 2021, citing headwinds from technological decoupling with the United States and domestic financial risks, to restrictions on fundraising via Hong Kong for Chinese companies.

China will grow by 7.9 per cent this year, the fund forecasts, down from its previous prediction of 8.2 per cent growth made in October.

05:59

Coronavirus: What’s going to happen to China’s economy?

Restrictions on financial flows through Chinese financial institutions operating in Hong Kong could adversely affect the country too, the fund said.

China’s GDP grew by 4.9 per cent in the third quarter of 2020, following a rebound of 3.2 per cent in the second quarter, and it is projected by the IMF to be the only economy that would post a positive growth rate in 2020. The IMF’s forecast for 2020 growth is 1.9 per cent, unchanged from its previous review in October.

The pandemic has weakened aggregate private consumption as income dropped, especially for the more vulnerable households

“The pandemic has weakened aggregate private consumption as income dropped, especially for the more vulnerable households, while the better-to-do increased precautionary savings. At the same time, public investment increased significantly, threatening to reverse the progress towards more balanced growth achieved over the last five years,” the IMF said.

Corporate debt is expected to have risen by about 10 percentage points to 127 per cent of GDP in 2020 following a decline of roughly the same magnitude in the previous few years, while household debt is expected to have increased to 58.3 per cent of GDP compared to 55.6 per cent in 2019, the agency estimated.

It also noted that financial pressures on some local governments are spilling over to the corporate and banking sectors. China’s official local government debt is rising rapidly and is projected to reach 25 per cent of GDP by the end of 2020, even as revenues are slowing.

“These debt burdens appear to be affecting financing conditions for local firms and local government financing vehicles with weak debt-servicing capacity, which may be reliant on backstops from the local authorities,” the IMF said.

The agency called for a continuation of the central government’s moderately supportive fiscal and monetary policies until the recovery is on solid ground, while noting that in the medium term, a scaling back of government spending was necessary to ensure debt sustainability.

01:28

China builds over 4,000km of railway in 2020

China announced 10 areas for reform as early as 2013, but little progress has been made in the fields of labour, land, cross-border investment, trade, SOEs and competition.

The agency projected China’s current account surplus would widen to 1.9 per cent of GDP in 2020 from 1.0 per cent in 2019, due to lower commodity prices, the collapse in outbound tourism, and a surge in exports. The surplus is projected to narrow to below 1 per cent in 2021.

The IMF also stressed that greater exchange rate flexibility would help the economy adjust to the changing external environment. Some IMF directors called for further improvement in the transparency of foreign exchange interventions and the phasing out of measures to manage capital flows.