Exclusive | Bribes, fake factories and forged documents: the buccaneering consultants pervading China’s factory audits

- A perfect storm of quick-fire, one-off factory inspections and insatiable Western demand for cheap goods is leading to fraud among Chinese manufacturers

- Cottage industry of consultants has popped up in China, helping low-end factories meet high-end Western standards, for a cost

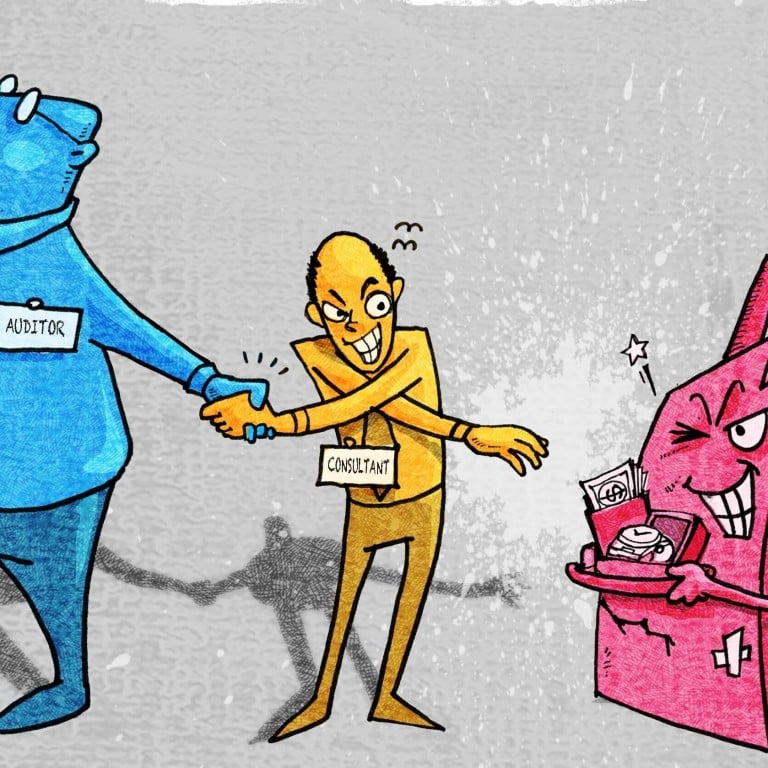

Dotted around China’s industrial heartland, well-connected consultants are helping factory owners flout labour laws to churn out goods that end up on the shelves of well-known Western stores.

Brimming with guanxi – the Chinese term for the strong personal connections that can prise open business deals – this army of advisers openly brag about their ability to guide nearly any factory through inspections designed to ensure that goods are made safely and that workers are paid correctly, a South China Morning Post investigation can reveal.

“As long as you cooperate, keep the troublemakers out of the factory on inspection day, and make sure workers follow our guidance on answering questions, we will guarantee you pass,” a consultant in Shanghai said after the Post posed as a factory owner looking to sell goods to European buyers.

They offer a range of services, from basic coaching of workers on how to answer auditors’ questions, to the provision of additional record books – such as a modified set for auditors claiming that all workers are paid in full, on time, and for any overtime worked – often a different story to the reality inside the factory.

Some say they can use their network of contacts to arrange for a particularly friendly auditor to inspect, at a time of the factory owner’s choosing, to ensure that the facility is well-prepared.

Others have software that can conjure up documents for a full team of seemingly legitimate factory workers and records in 90 seconds, including in cases where the actual workers are not of age or do not have the proper documentation, or where time sheets may not be kept, or may be in conflict with China’s labour laws.

In more extreme examples, they might bring auditors to a “show factory” – someone else’s plant that is more likely to meet Western-set standards. Temporary walls may also be erected in factories to cover up deficiencies.

And common among the consultants spoken to for this article was the most basic form of corruption: bribery.

The Post interviewed five Chinese consulting firms, each of which said a bribe would be necessary to pay off the auditor – many of which are from well-known international companies – and get access to accredited platforms that could open doors to supplying some of the world’s top brands.

“For auditors from one firm, you give them a red packet stuffed with cash on the inspection day. Auditors from another firm dare not take the red packet at the scene, so we would transfer the money to them one week before inspection day,” said a representative of a Shanghai-based consultant, referring to money-filled envelopes traditionally given out on special occasions.

To the auditors, the red packet is clearly the most important thing

The agent referred to two of the more prolific third-party auditing firms in the global manufacturing industry.

In more sophisticated instances, “the auditor might say, ‘I have forgotten my watch, a Rolex, in your factory – once you return it to me, I will ensure that your factory passes’”, said Renaud Anjoran, a Hong Kong-based supply-chain consultant, who said he has watched the trend balloon in China and neighbouring manufacturing hubs.

“If the factory doesn’t hire a consulting company, there would be so many problems with the factory that the auditor dares not give it a pass, which means there is no red packet for the auditor, either. To the auditors, the red packet is clearly the most important thing,” another Shanghai consultant said.

One consultant, who documented his activity over 2016 and 2017 on a Chinese blogging site, fabricated an entire suite of documents on employee attendance, payroll and training for a paper-packaging factory in Dongguan, the owner of which confirmed the blogger’s identity when contacted by the Post.

At a leather factory in Guangzhou, in an audit for a Canadian multinational retailer in 2016, the same consultant covered for underage workers by hightailing it to the nearest print shop to doctor their identity cards before auditors could see them, telling the auditors that the previous employee list was an “input mistake”.

Earlier that year, when the same factory was being inspected by a third-party auditor to gain accreditation for industry platform Amfori BSCI, “all documents, except for its business licence, were substandard”, but it still passed the audit by using “the great power of Grandpa Mao” to bribe the auditors, he wrote, referring to the image of Mao Zedong seen on yuan currency notes.

It is difficult to quantify how widespread this practice is, but industry experts describe it as an “open secret”. A quick Baidu search reveals dozens of firms guaranteeing that a factory will pass inspections needed to supply big-name brands – for a fee.

“It is a dirty business,” Anjoran said of China’s cottage industry of consulting. “Everybody knows about these guys. They are usually ex-auditors who know the rules of the game.”

Sarosh Kuruvilla, a professor of industrial relations at Cornell University who is releasing a book about the industry this year, said “everybody is playing the game”.

“I didn’t think that it would be as extensive as what I’m finding in my investigations,” he added.

In some respects, the thriving consulting sector is an unintended by-product of improving labour conditions in China.

Pre-coronavirus pandemic, the average annual salary in Chinese manufacturing had been ticking upwards each year, from US$6,569 in 2013 to US$10,792 in 2019 – an increase of 64.3 per cent – according to the National Bureau of Statistics.

By this metric, it is better to be underpaid in China than paid normally in Bangladesh, where the annualised minimum wage of US$849.36 is less than 10 per cent of what the average factory worker in China takes home.

According to China Labour Bulletin, a non-governmental organisation, workers in China who log more than 40 hours a week are entitled to fixed overtime rates for a maximum of three hours a day, as well as social insurance covering benefits including pensions and health care.

But sticking to these rules can be challenging for factories producing cheap goods, often at short notice, for Western consumers, particularly in the age of express delivery and fast fashion, where many consumers demand speed but still expect basement prices.

This can be a problem with the ‘comply or die’ audit model; the system can be quite often open to be gamed

Many manufacturers have left China for this reason. But for those who remain, passing a single audit can mean repeat orders for years, while failing could mean the loss of an important client.

“This can be a problem with the ‘comply or die’ audit model; the system can be quite open to being gamed,” said Ian Spaulding, CEO of Elevate Ltd, a global supply chain services and auditing company, adding that the more frequent the inspections, the more likely a factory is going to get caught out.

“Whereas if it’s just one audit a year, and everybody’s reading the same report, the decisions on governance and oversight are largely being driven by the factory rather than the brand, so don’t be surprised if consultants are the grease that make things work,” he said.

The proliferation of audit-sharing platforms over the past decade may have helped create new holes in a sector that was previously plagued by scandals about sweatshops and forced labour. It is into these holes that the cottage industry of consultants has seeped.

These platforms allow member companies to share data on ethical standards at thousands of factories globally. They are commonly used by brands to minimise audit duplication and improve conditions across the supply chain.

Rather than conduct the audits themselves, big companies often request that the supplier be accredited by a platform, such as Amfori BSCI, home to hundreds of retailers – including German retail giants Aldi and Lidl – or Sedex, used by many British retailers such as Tesco, Marks & Spencer and Waitrose.

These platform operators do not conduct audits themselves. Rather, a third-party auditor conducts the inspection, and if the factory passes, the supplier is accredited and uploaded to the platform for one or two years. This opens the door to hundreds of potential buyers – each of which can commission spot-check audits to confirm the inspection is legitimate, but industry sources say these checks are not done as commonly as they should be.

Fraudulent documentation is a persistent and well-known problem in China, where there is a long, colourful history of padding official statistics and forging business documents. The incentive to cheat is also strong on the auditor side, according to industry sources.

“Your auditor is travelling across China on buses and trains, doing very long days, having to write up reports. If a factory offers six months’ salary for a good report, there’s a big incentive to say, ‘That works for me’,” said the former director of an audit platform who spoke anonymously due to the sensitivity of the issue.

The scale at which this is happening is difficult to say, but there is definitely money changing hands

A database of more than 5,000 audits conducted in China last year, shown to the Post by an industry whistle-blower, showed that more than 90 per cent of factories audited by third-party auditors for the Amfori BSCI platforms were not transparent in their documentation and had falsified record-keeping for worker pay, working hours and overtime, suggesting they pose a greater risk of cheating on inspections.

Amfori BSCI did not respond to repeated requests for comment.

A veteran European auditor, who wished to remain anonymous, said that because these types of platforms try to be “all things to everyone, covering every industry and every country”, they are vulnerable to being manipulated.

“The scale at which this is happening is difficult to say, but there is definitely money changing hands,” he added.

Spot-checking factories that pump out goods for the likes of Aldi, Costco Wholesale, Lidl Stiftung & Co, and Walmart shows the reality of production-line workers enduring marathon shifts without being paid properly, working for weeks on end without a day off, and not being given insurance coverage as required by Chinese law.

The database also showed that for firms audited for Sedex’s platform, transparency levels were just over one-third, well below the documented industry-wide transparency rate of roughly 60 per cent across China.

Sedex said in a statement that it was “aware of these practices whereby consultants sell illegitimate services to show that factories are meeting social compliance standards, to ‘pass’ social audits” in China and other countries.

“The illegitimate nature of these practices makes it difficult to address this issue, as it is difficult to [find] evidence that this is occurring,” the firm said, adding that it “finds these practices deeply concerning” and has launched initiatives to tighten up audit fraud.

Advocates admit the system is imperfect, but they still insist that it serves to improve sourcing and labour conditions.

“My personal sense is that the system is helping to improve working conditions, but maybe not quickly enough,” said Michael Toffel, a professor of environmental management at Harvard Business School.

But critics of “commoditised” audits, churned out quickly and in bulk, say that many big brands which claim to practice fair trade are passing the buck down the supply chain.

Consumers want the retailer brand to deal with this issue – whether it’s human rights, labour, environmental – they just don’t want to know about it

A growing body of research shows that consumers expect brands to be responsible for ensuring their goods are ethically made.

A 2018 study by the Journal of Consumer Research found that consumers want to buy more sustainably, but have “wilfully ignorant memories” when shopping, meaning products advertising their ethical chops stand out on the shelf, but customers may not be considering how accurate that accreditation process is.

Brands without transparent supply chains, then, are “irresponsibly” pulling the wool over customers’ eyes, said Sean Ansett, president of sustainability consultancy At Stake Advisors.

“Consumers want the retailer brand to deal with this issue – whether it’s human rights, labour, environmental – they just don’t want to know about it,” said Ansett.

An example might be a company ordering 100,000 polo shirts with two buttons, but a week into production, changing the order to one-buttoned shirts, without pushing back the delivery date.

“This often leads to excessive overtime, perhaps entering into forced-labour situations or worse, or even when the production goes out the back door into some other subcontracted facility that you’ve never visited,” Ansett said.

A cross section of 10 original pass-grade BSCI and Sedex audit reports shown to the Post points to problems with accuracy.

All 10 reports said they found “no inconsistent records issues” and “no wage-underpayment issue”. They had almost across-the-board “C” grades – good enough for a pass, but not enough to draw suspicion.

However, comparisons with follow-up spot checks revealed serious discrepancies, suggesting the original audits did not reflect reality, and that there may have been manipulation involved.

Among those 10 audit reports, nine follow-ups revealed that factories kept incomplete time sheets, while in all 10 cases, wage payments were “either unverifiable due to lack of time records or not compliant for minimum wage and overtime pay”.

In one spot-check audit, a factory in Zhejiang province given a “C” grade in a Sedex audit by TUV Rheinland was found to be using forced labour, with the owners withholding parts of workers’ wages each month, while promising to pay the remainder before the following Lunar New Year holiday.

The factory had been issued an SA8000 certification – a global standard that claims to help secure ethical working conditions for more than 2 million workers – by auditor TUV Rheinland.

Eight months later, the factory was fined 20,000 yuan (US$3,040) by local authorities for failing to provide safety training to workers, and the factory owner was given a three-year suspended prison sentence for falsifying tax invoices.

TUV Rheinland did not respond to requests for comment.

At a garment factory in Hebei province whose owner says it supplies Costco, Aldi and Lidl, a BSCI audit conducted by Intertek, which also did not respond to requests for comment, gave it a “C” grade. But a follow-up inspection by an anonymous auditor found workers putting in more than 80 hours a week, with no overtime pay.

[Commoditised auditing is] a broken tool that’s not delivering much change

Meanwhile, in a series of Chinese factories making Christmas tree lights and listed as suppliers on the website of German supermarket giant Lidl, spot checks by the anonymous company found staff working up to 87.5 hours a week, with juvenile workers on production lines during the peak season, and glaring gaps in documentation and insurance.

Cornell University research by Kuruvilla found that more than 60 per cent of audits examined in the toy industry between 2011 and 2017 were “unreliable” – the highest among industries.

In such unreliable audits, employees worked an average of 53 hours a week and were paid correctly 96 per cent of the time. Reliable audits showed, on average, a 60-hour work weeks and 79 per cent correct pay – a worse, albeit more accurate, depiction.

These commoditised auditors “have created a billion-dollar industry”, said Ansett, who claimed that despite the general improvement in working conditions in China, commoditised auditing was “a broken tool that’s not delivering much change”.

All of the named retailers were contacted for comment. Costco declined to comment, while Lidl did not respond to detailed questions.

Aldi, in a statement, said: “The described working conditions in the production facilities in China and the alleged fraud through audits are unacceptable. We will investigate these allegations in any case and, if necessary, apply sanctions.”

The statement added that “third-party audits like BSCI and Sedex help us to maintain a level of vigilance over our large pool of production facilities, far beyond what would be possible with internal audit processes alone”.

A Walmart spokeswoman said it “has a robust system to assess suppliers’ compliance with our high standards”, including registering third-party audits to be done by auditors under the Association of Professional Social Compliance Auditors, “and verification checks”.

There is no suggestion that the named retailers have knowingly used factories in which suspicious audit practices have been carried out. Rather, there are indications that lapses in the audit system allowed these factories to become accredited.

The fast-paced audit industry is already under pressure following a series of high-profile scandals.

Unless your factory is perfect, a red packet is the most effective way

Top Glove, a Malaysian manufacturer of rubber gloves that has been plagued by forced-labour and child-labour scandals, was awarded an “A” grade by BSCI shortly before its malpractices were uncovered.

Meanwhile, auditors had repeatedly flagged minimum-wage breaches at factories supplying British fast-fashion retailer Boohoo, with no subsequent action being taken, The Guardian reported in August.

“We come across workers in apparel factories who would say they normally do not get to make the same product twice,” said Saif Khan, the founder of labour-standards consultancy Footprints, who added that small firms like his do not try to compete with so-called audit farms – those conducting thousands of short audits each year in China.

But amid pressure to keep costs low and to get goods out quickly, these consultants are likely to continue thriving.

“Unless your factory is perfect, a red packet is the most effective way,” a Shenzhen consultant said. “If you do not give the red packet, you have to provide all of these authentic certificates, which will cost you tens of thousands of yuan. So, most factories will give red packets.”