China’s strict capital controls may be eased to allow investment abroad as bubble risks grow

- Excess financial liquidity combined with China’s strict capital controls could turn out to be a toxic concoction for the economy, analysts say

- As such, authorities may be considering loosening rules on overseas investment to ease pressure on the yuan and the country’s exporters

Chinese authorities may finally feel the time is right for a new wave of financial opening to allow citizens to invest savings abroad, as pressure mounts from a tidal wave of liquidity resulting from aggressive stimulus policies in developed economies.

Investment is flooding into China thanks to its strong economic rebound from the coronavirus pandemic, while global demand for medical protection gear and electronic devices has boosted export earnings. Improved returns from China’s stock and bond markets have also resulted in strong portfolio investment inflows.

But the ample financial liquidity combined with China’s draconian capital controls could turn out to be a toxic concoction for the country.

Without a release valve, the mixture could push domestic stock and property prices far beyond levels justified by economic fundamentals and fuel credit-based investment booms, despite low returns.

Excess liquidity with better domestic activity has already led to some price inflation in the housing sector, which has implications for social stability and inequality

Capital outflows started to grow in the second half of last year as the government sought to take appreciation pressure off the yuan exchange rate.

However, analysts say Beijing can offset further risk by opening up the capital account to give households investment alternatives outside the limited range of onshore assets currently accessible.

“Excess liquidity with better domestic activity has already led to some price inflation in the housing sector, which has implications for social stability and inequality,” said Carlos Casanova, senior economist for Asia at Swiss private bank Union Bancaire Privée. “China can actually afford outflows, so they are allowing [them] to some degree.”

Casanova said that speculative investment could lead to systemic risks in China’s financial system as long as credit kept flowing into the economy. At the end of January, China’s broad M2 money supply, which includes cash and checking deposits, surged to a record of 221.3 trillion yuan (US$34.2 trillion), while new bank loans also leapt to a record high of 3.58 trillion yuan.

Larry Hu, chief China economist at Macquarie Capital, said the country’s continuing capital inflows and hefty trade surplus was similar to the environment in 2013, when Beijing was forced to intervene in the foreign exchange market to suppress appreciation pressure on the currency.

But this time around, the People’s Bank of China (PBOC) might choose not to directly intervene and instead open up outbound investment channels to ease pressure on the yuan and Chinese exporters who have been hard hit by US-China trade disputes, analysts said.

As such, the PBOC will have to tolerate some appreciation in the yuan, which has already strengthened by 10 per cent against the US dollar since June last year, compared to an appreciation of only 3 per cent in 2013.

“On the other hand, it should allow for more outflows to ease the pressure,” Hu said. “In 2013, the People’s Bank of China added US$500 billion to its foreign reserves to resist yuan appreciation. But it might not be able to buy that many dollars this time as Beijing is trying to improve its relationship with Washington.”

Currently, mainland Chinese residents can convert up to US$50,000 per year on foreign currencies for travel, overseas study or work, but not for buying overseas property, securities or life insurance policies.

Alicia García Herrero, chief economist for Asia-Pacific at securities firm Natixis, said not only was China set to open up portfolio investment for its citizens, it was easing rules for outward direct investment and overseas mergers and acquisitions, given the long-term outlook for lower domestic growth and cheap foreign financing.

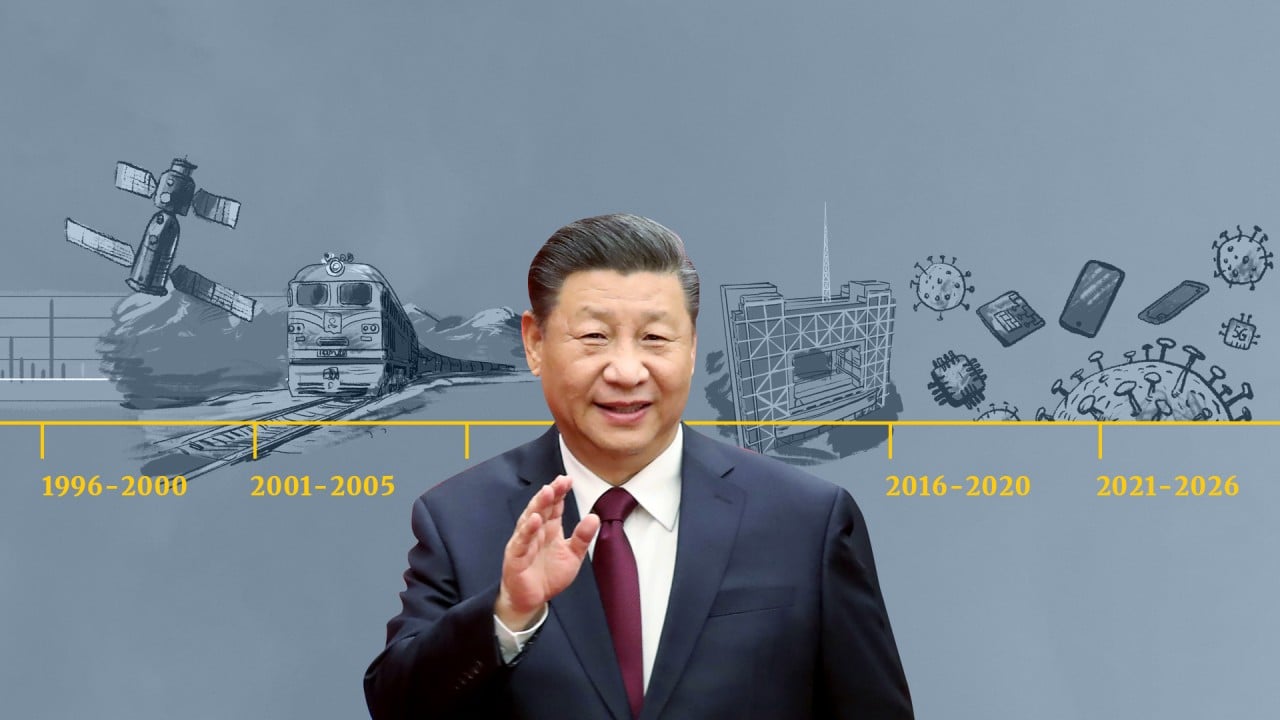

05:57

SCMP Explains: China’s five-year plans that map out the government priorities for development

“This has led to a sharp recovery of the announced [M&A] deals in the fourth quarter of 2020,” Herrero said. “While the number of the US deals were stable compared with 2019, the total value of deals rebounded back to the 2018 level thanks to a few giant deals such as Tencent’s acquisition of a 10 per cent stakes in Universal Music and Shanghai RAAS Blood’s finalisation of the acquisition of a 45 per cent stakes in [pharmaceutical company] Grifols.”

China’s foreign liabilities stood at about 47 per cent of gross domestic product (GDP) in 2019, below levels in the US of 180 per cent, 140 per cent in Japan and 75 per cent in South Korea.

Similarly, the value of China’s foreign assets, 55 per cent of GDP in 2019, was below the 140 per cent level in US, 195 per cent in Japan and 100 per cent in South Korea.

In other words, Chinese households and companies have much lower exposure to global assets compared with their peers in developed countries, underscoring the potential to expand foreign investments in coming years, with Hong Kong likely to continue playing an important intermediary role, said Louis Kuijs, head of Asia economics at Oxford Economics.

The strong inflows, in turn, have led policymakers to ease their stance regarding capital outflows

“The surge in capital flows may be just beginning,” Kuijs said. “The strong inflows, in turn, have led policymakers to ease their stance regarding capital outflows.”

In 2020, capital outflows surged to a record US$213 billion in the third quarter and likely rose further in the fourth quarter.

Foreign direct investment (FDI), portfolio inflows, new bank loans, trade credit and other financing items were all quite large last year, with flows other than FDI and portfolio funds amounting to US$78 billion in the third quarter. This included lending to foreign subsidiaries by Chinese banks and companies.

The “errors and omissions” category of the current account balance sheet – which lists flows not listed elsewhere – showed an additional US$42 billion in outflows in the third quarter.

04:59

Xi Jinping declares ‘complete victory’ in China’s anti-poverty campaign, but some still left behind

Overall, outflows exceeded inflows, with net financial outflows amounting to US$83 billion in the third quarter and US$106 billion in the fourth quarter, Kuijs said.

Beijing is likely to tread cautiously with its integration into the global financial system. In 2015, when it adjusted its exchange rate policy to become more market driven, it resulted in extreme market turbulence as capital inflows turned into outflows and the yuan suffered a sharp depreciation trend.

The outflow policy would be undertaken in several phases, said Zhang Zhiwei, chief economist at Pinpoint Asset Management.

To start with, investors would probably be only allowed to invest in a limited range of assets and funds. The size could come in below last year’s net purchases of 597 billion yuan in Hong Kong stocks by mainland residents through the stock connect.

“The potential of such liberalisation could be much larger, but it would probably take a few years for Beijing to experiment with this policy initiative and get comfortable to expand it,” Zhang said.