US-China tensions could drive more firms to diversify supply chains to Southeast Asia, AMRO says

- Southeast Asian economies stand to gain further from multinational firms looking to diversify supply chains from China, says a new report from Asean

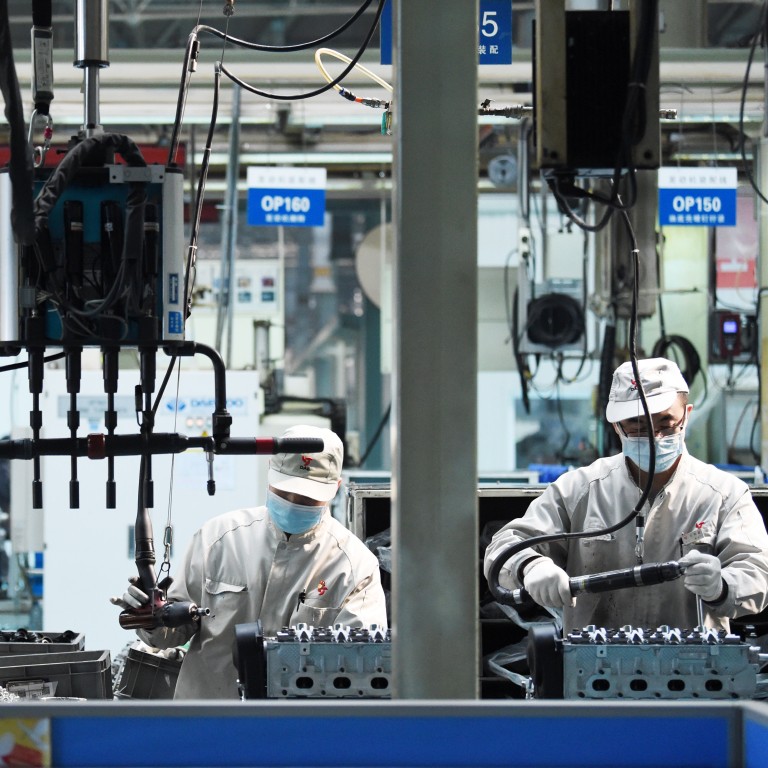

- Labour-intensive assembly operations and some capital-intensive industries like cars, machinery and electronics are most likely to relocate

More multinational companies could yet reconfigure their China-centred supply chains because of manufacturing disruptions during the coronavirus pandemic, a mood of heightened protectionism and changing geopolitics, a new report said on Wednesday.

That is the claim from the ASEAN+3 Macroeconomic Research Office (AMRO), a regional macroeconomic surveillance unit based in Singapore that represents the 10 members of the Association of Southeast Asian Nations (Asean), plus China, Japan and South Korea.

“More multinational enterprises operating in global value chains that are highly dependent on China will seek to diversify suppliers to build resilience,” it said its annual flagship report.

“Asean economies stand to gain in attracting many of the global value chain-related investments.”

What is the US-China trade war?

The report adds to analysis in the past two years that foreign investors are rethinking their operations in the world’s second largest economy as tensions between China and the West ratchet up over issues ranging from trade to Hong Kong to the treatment of Uygurs in Xinjiang.

China has denied foreign businesses are leaving on a large scale, pointing to the fact the country surpassed the United States as the top destination of foreign direct investment last year, raking in US$163 billion.

Still, China remained the world’s main supplier of consumer goods last year after industrial production quickly recovered following its successful containment of the pandemic.

The AMRO report said sharp increase in direct investment in Southeast Asia since 2018 already points to possible reconfiguration of production due to trade tensions.

It cited several cases, including car parts supplier Hyundai Mobis, which moved back to South Korea partly to escape tariffs, and the relocation of GoerTek – a major supplier of Apple’s wireless earphones – to Vietnam.

“These could continue and even accelerate in the post-pandemic period,” the organisation said.

China remains a strong contender for global value chain location because of its huge domestic market and highly developed ecosystem for manufacturing

Labour-intensive assembly operations and some capital-intensive industries like cars, machinery and electronics are more likely to move because they are sensitive to labour costs and easier to relocate, according to the report.

But China’s highly efficient and integrated supply chains will be difficult to replace and replicate in just a few years, it added.

“China remains a strong contender for global value chain location because of its huge domestic market and highly developed ecosystem for manufacturing, which makes decoupling from China difficult,” AMRO said.

The report echoed findings from the American Chamber of Commerce in China earlier this month.

Stabilising the industrial chain and breaking technological bottlenecks is a key focus for policymakers.

China, which is on track to surpass the US as the world’s largest consumer goods market, is forecast to grow more than 8 per cent in 2021.

AMRO expected an 8.7 per cent increase of Chinese gross domestic product this year.