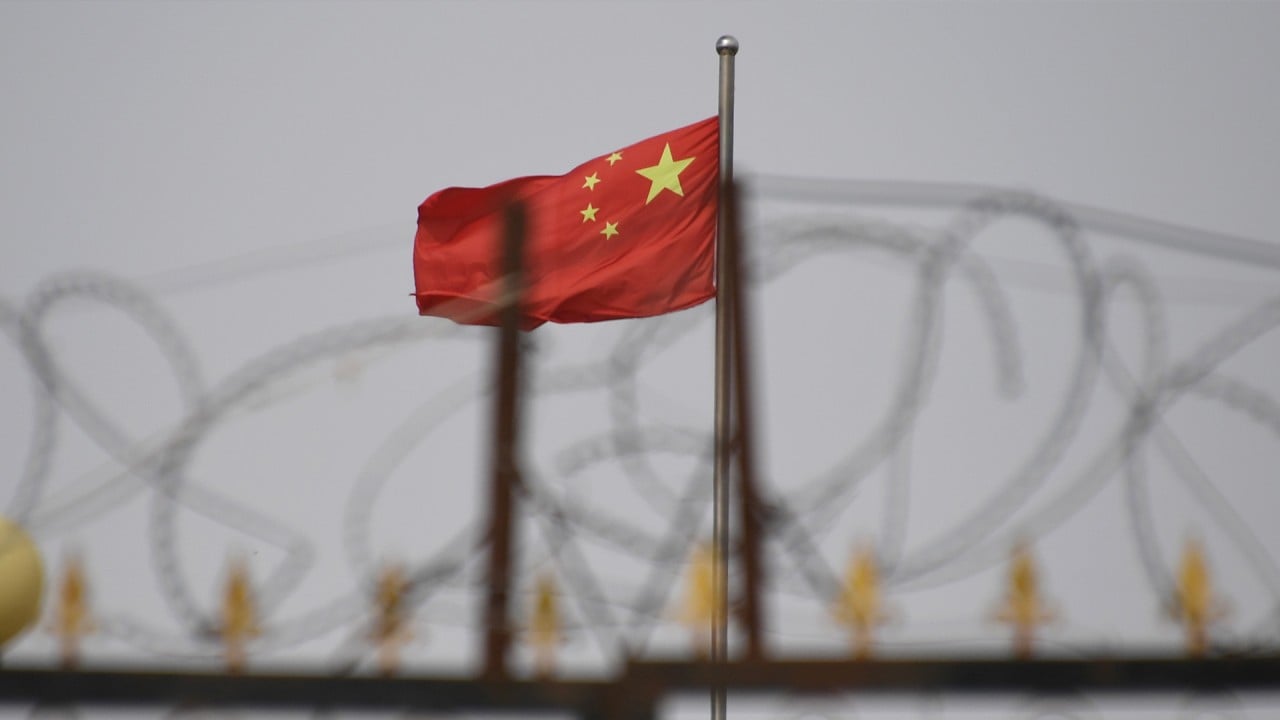

Growing China human rights concerns risk curbing foreign investment needed to support economy

- Foreign investors’ holdings of Chinese government bonds declined by US$2.5 billion in March from the previous month, the first monthly drop since February 2019

- Concerned with social issues and corporate governance, China’s alleged human rights violations in Hong Kong and Xinjiang are weighing on minds of fund managers

International criticism of China’s alleged human rights violations has grown louder in recent months, putting downward pressure on Beijing’s efforts to attract foreign capital into its financial markets to support the economy, analysts said.

So far there is little sign that the current policies point towards a wholesale investment decoupling from China, with only limited impact seen on the stock and bond performance of individual Chinese companies that are politically sensitive, analysts said.

Nevertheless, new sanctions on an increasingly large number of Chinese names are not helping with inflows into China’s financial markets.

If this becomes large scale, it means you are rejecting direct investment into China which would have serious implications. It is something that I’m worried about

“Anecdotally, this has led some investors to not buy Chinese government bonds because of ESG concerns,” Gavekal’s He said. “If this becomes large scale, it means you are rejecting direct investment into China which would have serious implications. It is something that I’m worried about.”

A number of Chinese internet companies have adopted an official schedule requiring their employees work from 9am to 9pm, six days per week, which critics coined as the 996 work culture, with the deaths earlier this year of two employees at e-commerce platform Pinduoduo sparking concerns about the conditions under which they worked.

The much higher yields on offer by Chinese government bonds compared to their US and European equivalents, a strengthening of the Chinese currency that improved returns in terms of foreign currencies and the seeming lack of credit risk made yuan-denominated securities highly attractive.

With Chinese government bonds being included in global bond indices, many global investment funds were required by their operating mandates to invest in Chinese securities, but the factors driving inflows have reversed somewhat so far this year, with a strong rebound in US Treasury yields and an easing of the yuan’s exchange rate.

Moreover, the coronavirus worsened the fiscal situations of many local governments – reducing their revenues even as Beijing mandated new spending to support the economy – while seemingly risk-free state-owned enterprises became a source of bond defaults, making Chinese securities less appealing to foreign investors, said Alicia Garcia-Herrero, chief economist for Asia Pacific at Natixis Bank.

Uncertainty surrounding the outlook for troubled China Huarong Asset Management, the country’s largest manager of distressed debt, as well as state-owned energy firm Chongqing Energy Investment recently caused ripples throughout Asian corporate bond markets.

Questions have been raised if the contagion could spread to other parts of China’s debt market as global investors begin to worry that state firms, particularly those backed by financially strapped local governments, will suddenly be cut off from the implicit government guarantee that had previously supported their bond issues, analysts said.

In addition, China’s domestic equity markets have been the worst performers among Asian markets in 2021, even as the yuan weakened by 1.54 per cent against the US dollar in March.

Norway’s US$1.3 trillion wealth fund, the world’s largest sovereign investment vehicle, is seeking to adjust its portfolio to impose the same ethical and environmental standards across all its investments, that would stop adding securities from many emerging markets like China because they are “often characterised by weaker institutions, less openness and weaker protection of the interests of minority shareholders,” Finance Minister Jan Tore Sanner said last week.

Taiwan leads Asia in ESG investments, but domestic funds fall short

More foreign investors are concerned about the poor ESG performance of Chinese companies, especially state-owned firms, due to the lack of transparency resulting from Chinese laws prohibiting them from opening their books to US auditors, Smartkarma’s Rudden said.

Still, China’s overall ESG scores have improved enormously in recent years with the government’s drive to steer the economy away from traditional, high pollution manufacturing industries.

Among China’s biggest firms, the ESG score of Ping An Insurance Group jumped to 60.97 in 2019 from 32.11 in 2015, China Construction Bank’s rose to 61.69 from 55.93 and the Bank of China was up at 51.79 from 36.62, according data from data provider Refinitiv.

However, Industrial and Commercial Bank of China, the world’s largest bank by assets, slipped to 66.48 in from 70.34.

In the US, ESG scores of its biggest firms in 2019 were 92.86 for Microsoft, 88.66 for Amazon and 66.80 for Apple. In Germany, SAP scored 93.57, Allianz 92.13 and Siemens 84.81, while in Japan, they were 80.06 for Toyota, 47 for SoftBank Group and 58.76 for Nippon Telegraph and Telecom.