China’s economic slowdown prompts Beijing to reaffirm commitment to opening up financial markets

- The State Council on Wednesday reaffirmed its commitment to open up to foreign investments

- Since the start of the US-China trade war in 2018, Beijing has been attempting to open up its financial markets

China will step up its plans to further open up the financial industry to foreign investments as a means of shoring up its post-coronavirus economic recovery and to also help tackle the prospect of a slow down later in the year.

The country must push on with its commitments to open up the banking and insurance sectors, while leveraging both the international and domestic markets, to establish itself as “a popular destination for foreign investment”, the State Council, China’s cabinet, said in an executive meeting on Wednesday.

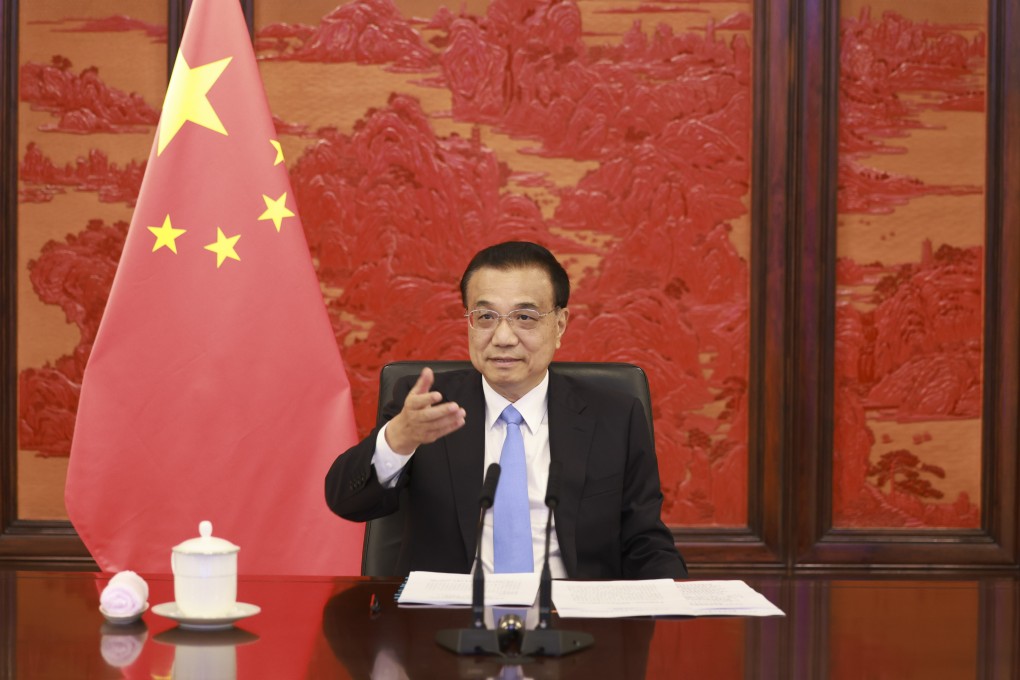

“As a developing country, China’s development must rely on the real economy. Greater financial openness should better serve the real economy, which is of great importance to maintaining the country’s economic stability,” said Chinese Premier Li Keqiang.

The wider opening-up of the financial sector will help foreign institutions to share the dividends of China’s economic development and will also help promote the further development of the

But Li also warned that the government should safeguard economic and financial security as its economy opens up further.