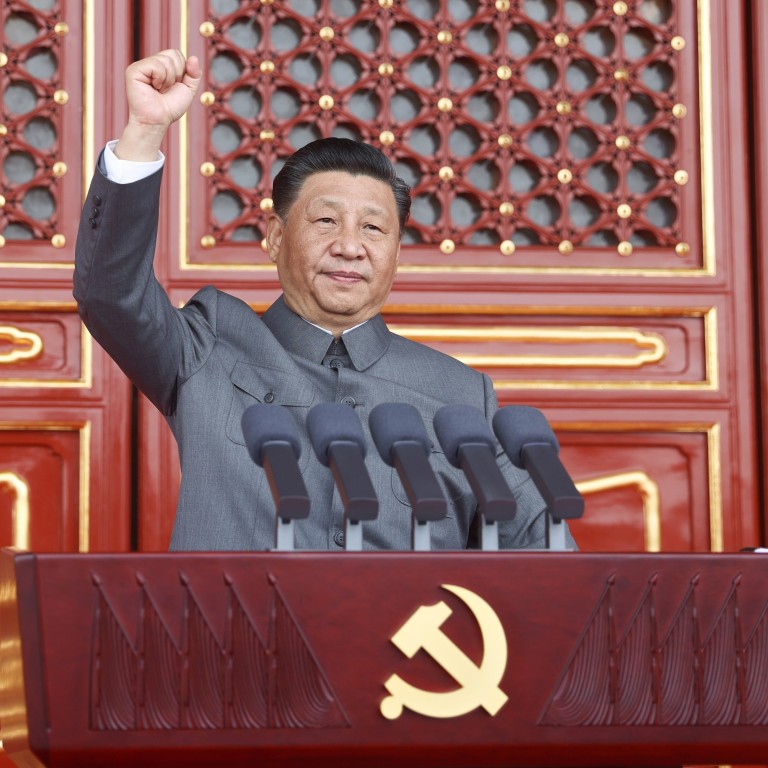

China’s economy at an ‘inflection point’ as Xi Jinping embarks on sweeping regulatory crack down

- Beijing has in recent weeks issued a deluge of new regulations on industries ranging from Big Tech to private education

- Some analysts say tighter government control of the increasingly tech-driven economy could have long-term ‘consequences’

The regulatory storm sweeping across China’s economy has raised concerns about the scale of government intervention in local markets, while some analysts question whether the changes are enough to boost innovation and ensure “quality growth” amid an increasingly challenging external environment.

“We are witnessing an inflection point in Chinese economic life that could prove every bit as significant as Deng Xiaoping’s Southern Tour nearly 30 years ago,” said Larry Brainard, chief emerging markets economist at TS Lombard in a research note on Monday. In 1992, the former Communist Party leader toured key Special Economic Zones in the south to reinforce China’s reform and opening up.

“While Deng sought to give China a socialist market economy with Chinese characteristics, Xi appears to be aiming to give China a real socialist economy, not just its characteristics.”

The macroeconomic consequences of these actions are difficult to project

While Beijing’s new regulations, such as its antitrust push against China’s digital giants, could potentially introduce more competition that benefits consumers, there are also worries tighter government control could harm the increasingly tech-driven economy.

“The macroeconomic consequences of these actions are difficult to project,” said Nicholas Borst, vice-president and director of China research at Seafarer Capital Partners. “If state control over a sector becomes too overbearing, or too unpredictable, it certainly has the potential to damage entrepreneurial dynamism and investor confidence.

“A sector that was subject to low amounts of state control is now becoming much more tightly regulated. It doesn’t matter that most of these companies are privately owned, they are still subject to Beijing’s influence.”

China’s economy is shaped by a mixture of private enterprise and state intervention, which economists refer to as state capitalism. But unlike the command economy of the former Soviet Union, China has a much larger private sector, accounting for more than 60 per cent of its gross domestic product and over 80 per cent of employment.

05:27

‘Socialism with Chinese characteristics’ explained

“What distinguishes China is the overt politicisation of the party role in the economy and society, and this is important when we come to think about governance, incentives, regulations, rule by law, and other things that drive commerce, entrepreneurship and innovation,” said George Magnus, an associate at Oxford University’s China Centre and research associate at SOAS, London.

Larry Hu, chief China economist at Macquarie Group, said the ongoing regulatory crackdown does not signal the private sector is being squeezed out, but Beijing is making one of its periodic economic adjustments.

“The state part could not thrive alone if the private sector is under trouble,” Hu said in a note early this month. “That said, from time to time, the state tends to realign its relationship with the private part, to alleviate inequality, curb risk or regain control. The regulatory storm this year is the latest example.”

I think the current crackdown on tech is as populist as it is myopic. And it’ll cost China in this decade

“China needs that productivity growth more than anything,” he said. “So I think the current crackdown on tech is as populist as it is myopic. And it’ll cost China in this decade.”

“In the harshest external environment China has known since the Mao era, it is by no means certain that China’s reliance on foreign technologies and goods and services can be reduced and compensated for domestically,” he said.

With China’s booming tech and private education industries on notice, President Xi Jinping has also called for tougher regulation of high incomes, emphasising the idea of “common prosperity” for all, rather than just a few.

02:28

Tencent narrows kids’ playing time on video games labelled ‘spiritual opium’ by Chinese state media

Planned reforms such as raising wages, enlarging the middle class and boosting birth rates, along with efforts to reallocate capital away from traditional polluting industries towards greener and more productive sectors, could help lay the foundation for long-term growth, said Rory Green, chief China economist at TS Lombard.

“Ultimately, the net long-run economic result will come down to implementation,” he said. “Presently it is easier to crack down on large platform tech companies and high earners. Structural changes are far harder.

“Reform and social welfare need to accelerate if Beijing wants to offset the negative impact of a wide-ranging regulatory crackdown.”

Luo Zhiheng, chief macroeconomic analyst at the research institute of Yuekai Securities, said a major risk of the regulatory crackdown was the lack of reform in the domestic capital market, which could hold back economic growth.

“It is also necessary to establish a smooth system for the return of overseas listed companies to coordinate the promotion of financial opening and financial security, to maintain the bottom line of preventing financial risks, and to enhance the ability of the financial sector serving the real economy,” Luo said in a research note early in August.

Much of China’s long-term economic growth prospects are dependent on Beijing’s ability to reduce mounting public debt, improve productivity and tackle its impending demographic crisis, analysts said. But these changes will require considerable political reform, which could be comparable to those introduced by Deng more than 40 years ago.

“If under Deng and after, China prospered because its leaders were willing to blend market phenomena with a state-centric economy, then under Xi Jinping, we have now to conclude that it is executing a sharp handbrake turn in the other direction,” Magnus said.

“Partly for this reason, but there are many others related to development accomplishments that are one-offs and difficult future challenges, I think the extrapolation of China’s past performance into the 2020s and beyond is no longer possible.”