5 things you need to know about China’s power crisis

- China has been dealing with power rationing and blackouts since September due to Beijing’s determination to cut emissions and surging prices

- The power crunch has already had an impact on the economy and has raised concerns ahead of the winter heating season

1. China’s state planner is weighing steps to tame prices

Coal futures have nearly halved from a record high on October 19 after the talks on price intervention at Wednesday’s meeting held by the powerful National Development and Reform Commission.

The meeting “focused on the reasonable price range and profit margin that should be maintained to promote the coordinated and sustainable development of the coal industry and downstream power industries,” the planning body said.

It did not disclose what level prices would be set at, but three major coal producers said on Wednesday they would fix ceilings for prices of thermal coal at 1,200 yuan (US$188) a tonne for the winter heating season.

2. It’s increasing China’s demand for natural gas

China’s demand for natural gas for this winter is expected to rise by 10 per cent from a year earlier to 6.3 billion cubic feet, an official from the country’s top oil and gas producer, PetroChina, said on Thursday.

PetroChina has secured 3.7 billion cubic feet of gas supplies for this winter, up 8.4 per cent from a year ago, the official told a seminar organised by China’s state-backed Chongqing Gas Exchange in Tianjin.

3. It’s causing supply issues for Samsung

Samsung Electronics said on Thursday it expects component shortages to affect chip demand from some customers in the current quarter, after reporting its highest quarterly profit in three years.

“A longer-than-expected component supply issue may need to be monitored due to potential impacts” on the manufacturing of devices that use memory chips, Samsung said in a statement, although it added there was “strong fundamental demand for servers from increased investments from technology companies”.

04:01

Chinese manufacturing thrown into disarray as country's electricity crisis rolls on

4. China could build new coal plants overseas even after Xi’s pledge

Chinese state-owned enterprises have a massive pipeline of coal-fired power projects in more than a dozen countries and it remains unclear if they will be scrapped, even after President Xi Jinping’s pledge to stop building plants abroad.

New projects are in place to deliver almost 14 gigawatts (GW) of generating capacity, according to a report by Just Finance, a Denmark-based non-profit organisation that tracked building contracts and agreements.

The state-run firms announced more than 3.6GW of projects this year alone, including around 1.3GW each in South Africa and Indonesia.

Why is coal so important to China's economy?

Some 10GW of projects had previously been finalised and have not yet begun construction, according to the study released on Wednesday. The pipeline spans countries across Southeast Asia, Africa and Europe.

Xi did not clarify whether he was referring to both the financing and construction of new coal plants, and what would become of existing projects at various stages of progress.

“There is a transparency problem for China’s overseas coal deals,” said Wawa Wang, programme director at Just Finance. “It makes the monitoring of critical information specific to project appraisal, project status and financial disclosure difficult.”

03:27

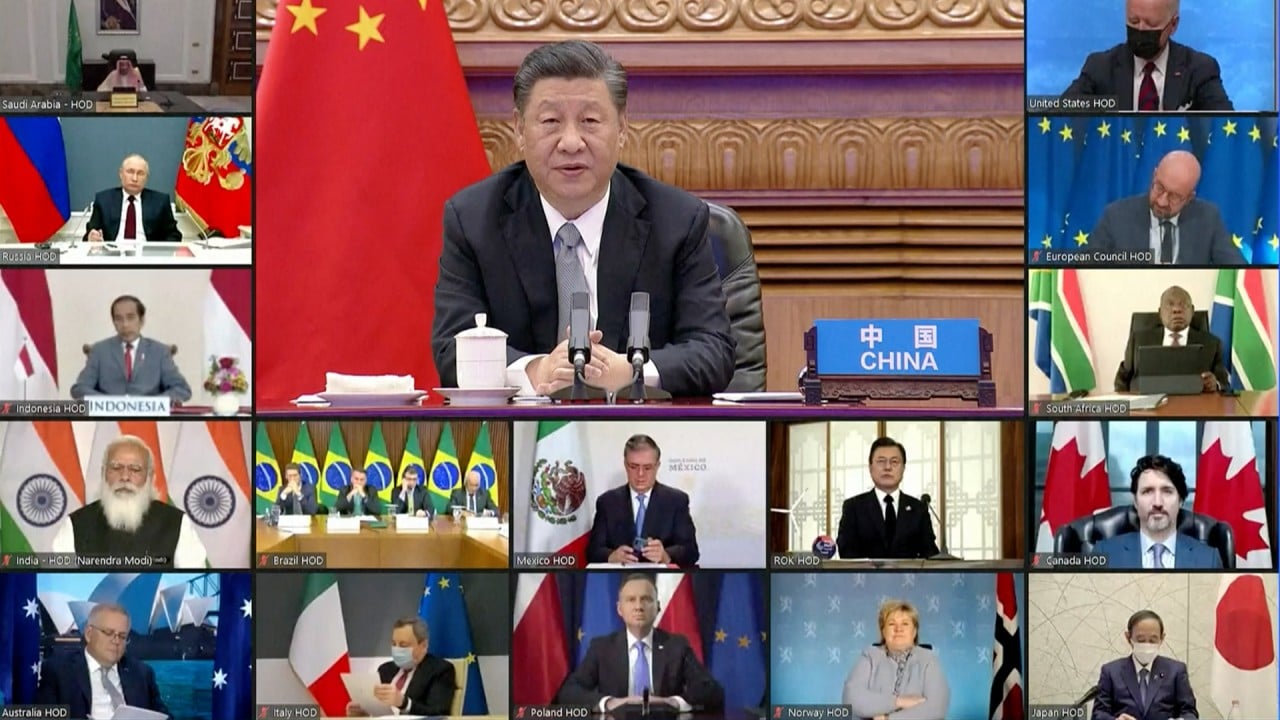

World leaders pledge to cut greenhouse emissions at virtual Earth Day summit

5. China’s wind giant sees demand boom resuming after 2021 blip

The sector has faced a sharp slowdown after delivering a record amount of new capacity last year to beat a deadline for government subsidies. Key incentives for onshore wind ended at the end of 2020, while offshore allowances lapse this year.

A weakening pace was clearly evident in the financial results of the country’s biggest turbine manufacturer, which late on Tuesday reported an 11 per cent drop in revenue for the third quarter.

01:05

China's largest offshore wind farm ready to start operations

Complied with reports from Reuters, Bloomberg

.JPG?itok=J8tgfPmW&v=1659948715)