China and the US expected to strike conciliatory chord at G20 summit amid need for global economic cooperation

- Chinese Vice-Premier Liu He and US Treasury Secretary Janet Yellen exchanged views about further cooperation under G20 framework in virtual meet

- This weekend’s leaders meeting could see historic agreement on a long-awaited global minimum corporate tax

With all eyes on the G20 leaders summit this weekend, China and the United States are expected to strike a conciliatory chord at the multilateral gathering, which could see an agreement on a long-awaited global minimum corporate tax.

During a virtual conference between Chinese Vice-Premier Liu He and US Treasury Secretary Janet Yellen earlier this week, the two sides exchanged views about further cooperation under the G20 framework, Shu Yuting, a spokeswoman for the Chinese commerce ministry, said on Thursday.

“The two sides exchanged views on the macroeconomic situation and related policies in China and the US, including the growth situation, inflation pressures, financial stability, supply chains and other issues,” said Shu. “Both sides believe that the world economic recovery is at a crucial stage, and it is very important for China and the US to strengthen macro policy communication and coordination.”

“The G20 summit is coming, the two countries need to sync up with each other on financial areas, including the global minimum corporate tax, which China has also agreed to,” said Wang Huiyao, president of the Beijing-based Centre for China and Globalisation.

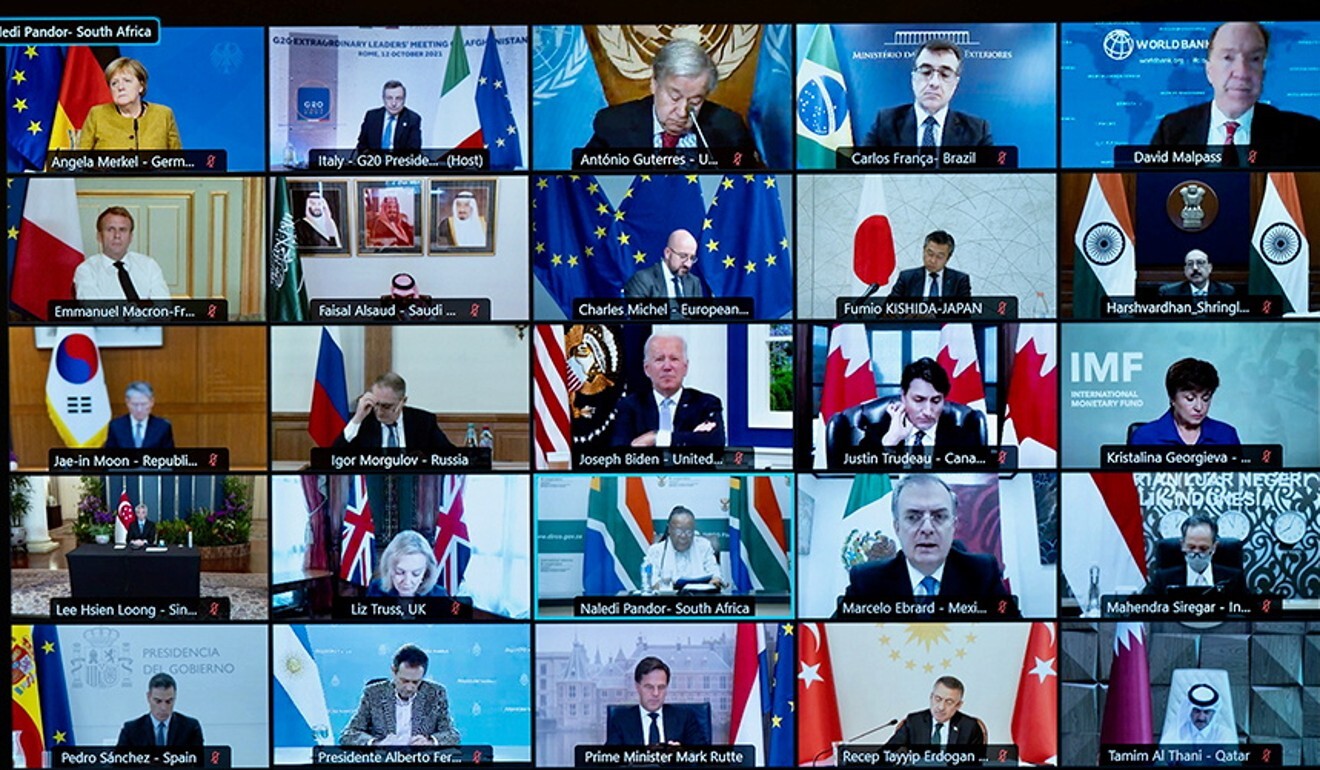

G20 leaders will gather in Rome on October 30-31 in the first in-person meeting of leaders from the world’s biggest economies since the Covid-19 pandemic started, although the heads of China and Russia will not attend in person.

Global heads of government are expected to endorse an historic overhaul of international corporate taxes although analysts have warned that any new rules would take a long time to implement.

US chides Xi Jinping for his anticipated absence from G20 and COP26

Prior to the summit, G20 finance and health ministers will gather in Rome on Friday, after G20 finance chiefs and central bank governors on October 13 backed a global minimum corporate tax rate of 15 per cent and other new rules to address tax avoidance by global tech giants.

“China will continue to uphold the spirit of multilateralism and an open and cooperative attitude, to promote establishing a more fair, stable and sustainable international tax system, and advance the steady recovery of the world economy,” Chinese finance minister Liu Kun said at the meeting on October 13.

03:38

COP26 Glasgow, the UN Climate Change Conference: last chance to save the planet?

However, the new rules would likely force leading multinational companies registered in “tax havens” to restructure their global supply chains, which could impact Hong Kong as the city’s effective corporate income tax rate is lower than 15 per cent, said Li Chengjian and Li Ruolin, analysts at China’s Development Research Center of the State Council, an advisory body that is affiliated with the central government.

“However, based on its advantages in location, environment and supporting facilities, [Hong Kong] is also likely to benefit from the adjustment of investment by multinationals,” said the two analysts in a September research note.

Meanwhile, Mofcom’s Shu shed more light on the talks between Liu and Yellen in her press conference. She said that the two sides also discussed financial stability and bilateral coordination on financial market regulation, alluding to the Evergrande debt crisis and Chinese companies listed on US exchanges.

G20 countries’ policies make it difficult to attract green investment

“The two sides have agreed to continue communication at all levels on next steps, and to advance pragmatic cooperation and resolve specific problems from the perspective of benefiting both the two countries and the world,” added Shu. “We have always maintained an open attitude towards dialogue and communication between Chinese and US commerce ministers.”

Despite the positive note struck by Shu, there was a recent escalation in China-US trade tensions after the US Federal Communication Commission (FCC) revoked the license of China Telecom on Tuesday.

Commenting on this topic, Shu said the US move had “generalised the concept of national security, abused state power, maliciously suppressed Chinese enterprises in the absence of a factual basis, violated market principles and undermined the atmosphere of bilateral cooperation”.

“The Chinese economic and trade team has made solemn representations to the US side in this regard,” added Shu.