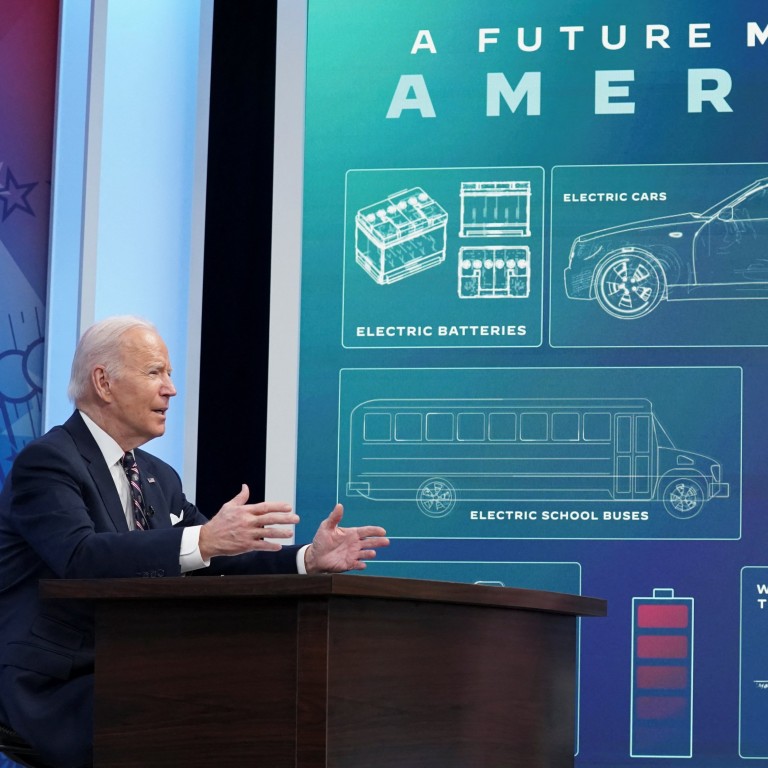

US-China trade: will Biden’s call to break free of China for rare earths help counter opposition to US mines?

- Merely mentioning China and calling to oppose its supply-chain dominance helps Washington push back against domestic opposition to controversial mining operations, according to Chinese experts

- Strategic minerals such as lithium are becoming increasingly essential, and Chinese companies control much of the global supply

“China controls most of the global market in these minerals,” Biden said at the Tuesday event. “We can’t build a future that’s made in America if we, ourselves, are dependent on China for the materials that power the products of today and tomorrow.

“And this is not anti-China or anti anything else; it’s pro-American.”

Despite the Biden administration’s commitment to reshore the clean-energy supply chain, mining projects in the US have long faced opposition from indigenous groups, labour leaders, local communities and environmental groups over concerns such as pollution and labour protection.

In the world of US domestic politics, ‘just say China’ seems to work when it comes to governmental support to [mining] operations

And Zha Daojiong, a professor with the School of International Studies at Peking University, said that the US’ highlighting of the dependence on China, regardless of its veracity, is partly aimed at countering that opposition to extractive reshoring.

“The political-business campaign to break free of a reliance on China for lithium and other materials has been going on for almost two decades,” Zha said.

“Still, in the world of US domestic politics, ‘just say China’ seems to work when it comes to governmental support to operations mentioned in that report.”

Similarly, a researcher and adviser to the Chinese government in the field of energy security, speaking on condition of anonymity due to the sensitivity of the issue, said it has been overly politicised in the US, as the buck-passing to China is being done out of political consideration to foster domestic unity.

Is China’s lithium quest fuelled by business or politics?

“Politics and economics are deeply intertwined,” the adviser said. “Oftentimes [the US’] supply-chain problems, including the supply-chain crisis last year, are not simply caused by restrictions from other countries. Some internal factors might be the key.”

As home to 37 per cent of the world’s rare earth reserves, China is the biggest producer of the resources and currently controls 87 per cent of the global market for permanent magnets – those that do not lose their magnetic field – according to data from the 2022 Mineral Commodity Summaries from the US Geological Survey and White House.

The US is the world’s second-largest producer of rare earths.

But Zha said some estimates indicate that, outside of the China market, more than half of rare earth elements are supplied by non-Chinese companies.

“Though each set of statistics depends on the methods and data used, to what extent is ‘reliance on China’ or ‘dominance by China’ factually accurate?”

Biden on Tuesday also highlighted his administration’s efforts in helping with projects aimed at extracting lithium from geothermal brine found around California’s landlocked Salton Sea.

Massive lithium deposit found near Everest as demand for critical metal surges

Thanks to the rapid development of the country’s EV market, Chinese companies are currently the biggest buyers and investors of lithium mines around the globe – including in major sourcing regions such as Latin America and Australia – and refine two-thirds of the world’s lithium.

“The high-capacity battery market is arguably one of the most critical to our nation’s interests,” the report said.

Geopolitical tensions aside, Zha said more production in the US would help expand the global supplies of lithium and other materials.

“The winner, if one must identify one, is the electric battery industry of the world,” he said.