US, China economic policies like night and day as Fed pushes interest rate skyward and PBOC eyes stabilisation

- World’s biggest economic superpowers are taking polar opposite approaches in their policy road maps, with contrasting concerns over inflation and monetary loosening

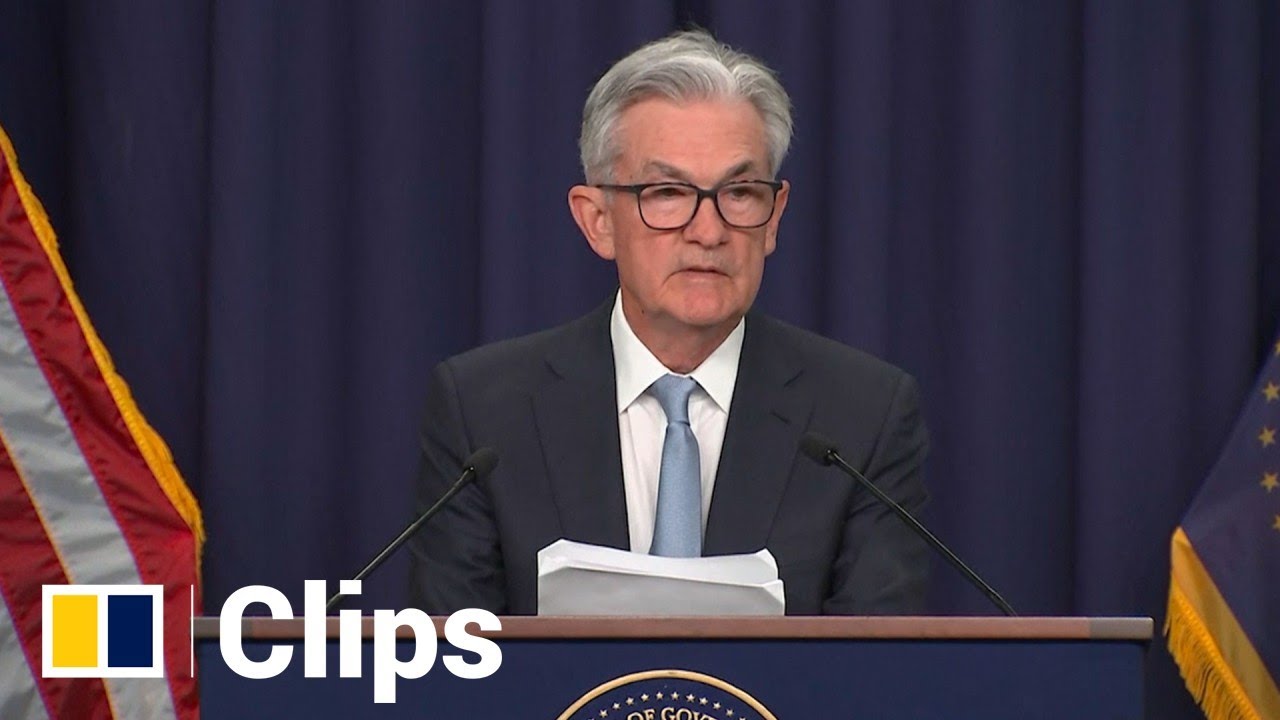

- US Federal Reserve has announced the largest hike to benchmark interest rate in 28 years, but analysts expect China to stay the course on its easing stance

The US Federal Reserve’s largest rate hike since 1994 may have temporarily halted Beijing’s headline rate reductions, but analysts do not expect it to derail China proceeding with its easing stance and economic stimulus plan.

The policy divergence between the two biggest economic superpowers is owing to their different economic cycles, as Washington is doing all it can to curb inflation while Beijing continues to double down on stabilisation.

MLF loans are a key tool used by the central bank to release medium-term liquidity into the interbank market. Any cut to its interest rate would have been viewed as a clear signal to boost the economy.

China’s central bank also maintained the rate of the seven-day reverse repurchase agreement – the purchase of securities with an agreement to sell them at a higher price at a specific future date – during Thursday’s 10 billion yuan worth of sales.