Explainer | 5 unanswered questions about the Henan bank crisis

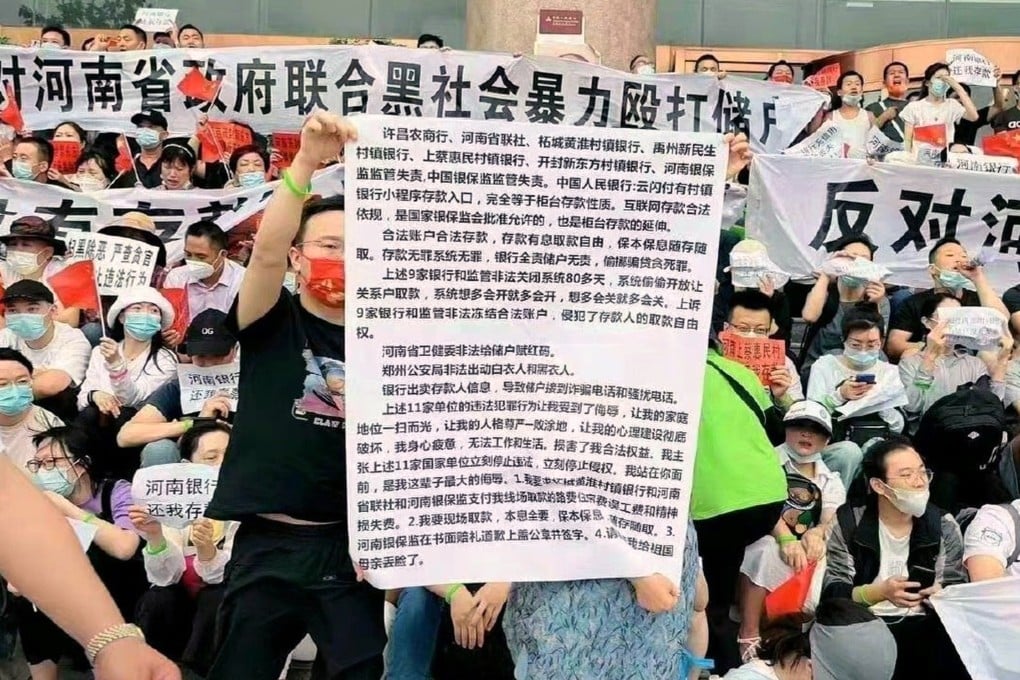

- Customers took to the streets in protest after finding savings at four rural banks in Henan province and one in neighbouring Anhui had been frozen

- President Xi Jinping has placed economic stability as a top priority and vowed to strengthen supervision within the state-dominated financial system

But what are the other issues surrounding one of the nation’s biggest financial scandals? Here we look at five unanswered questions as concerns mount over the small bank sector as well as social stability in China.

1. Is the cash held at the banks actually in the form of deposits?

In China, deposits up to 500,000 yuan (US$74,000) are guaranteed by the country’s bank insurance scheme.

But in this case, it is unclear if the cash customers handed over was actually deposited with the banks.

China’s small rural banks have often partnered with non-proprietary online platforms, offering returns that are slightly higher than similar deposit products from larger banks.

Duxiaoman Financial is one such third party distributor and the company has stated that it has never engaged in the sale of wealth management products with the banks, only offering traditional bank deposits.