China on guard as European Central Bank, US Fed interest rate hikes threaten greater spillover effects

- China is now the only major economy maintaining a loose monetary stance, as soaring inflation forces European institute to push up benchmark rate for first time in 11 years

- Beijing is looking to prevent and mitigate ‘external shocks’ from rising capital outflows as investors shy away from yuan

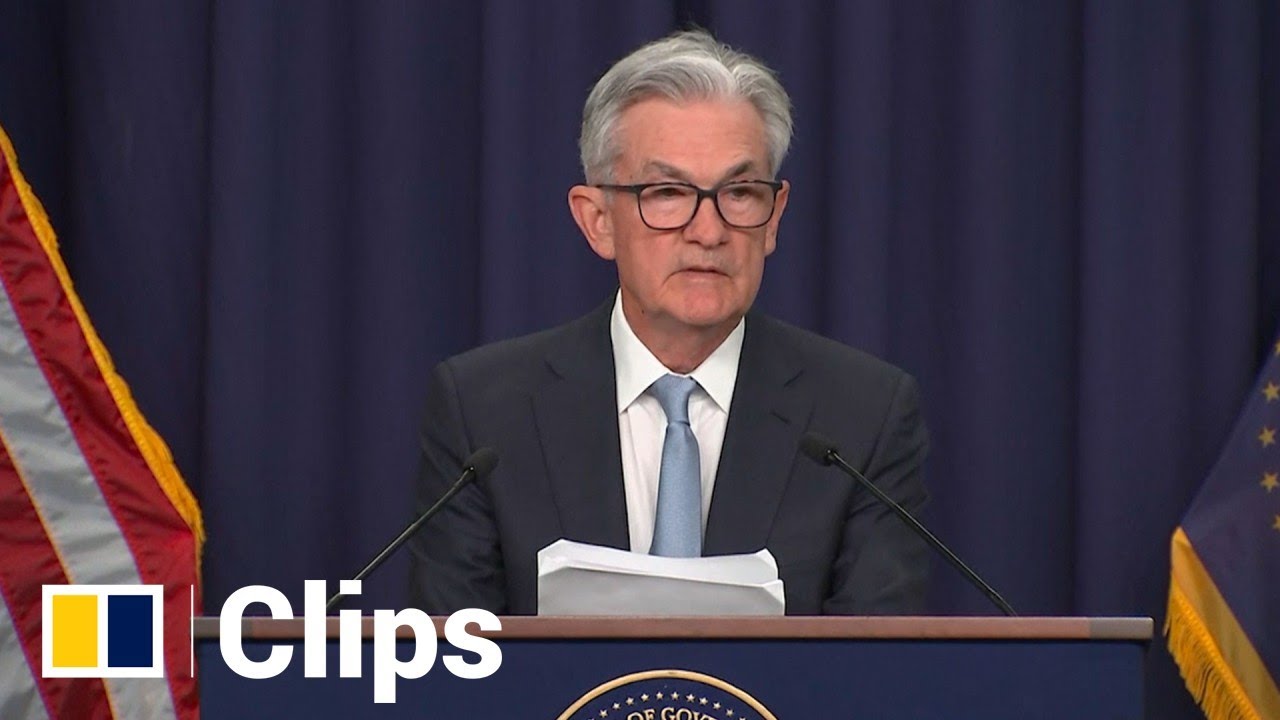

Beijing will “pay close attention” to external monetary policy tightening and conduct a timely assessment of its spillover effects after the European Central Bank joined the US Federal Reserve-led chorus of worldwide interest rate increases.

Following the first increase in 11 years by the European institute, which on Thursday pushed its benchmark rate up by 50 basis points, China has become the only major economy that is maintaining a loose monetary stance. This means it could face further tests in terms of capital outflow, foreign-exchange volatility and market expectations.

“The Fed is also faced with a dilemma between controlling inflation and stabilising the economy. We need to keep an eye on its monetary policy adjustment in the future,” said Wang Chunying, deputy director of the State Administration of Foreign Exchange (SAFE), on Friday.