Advertisement

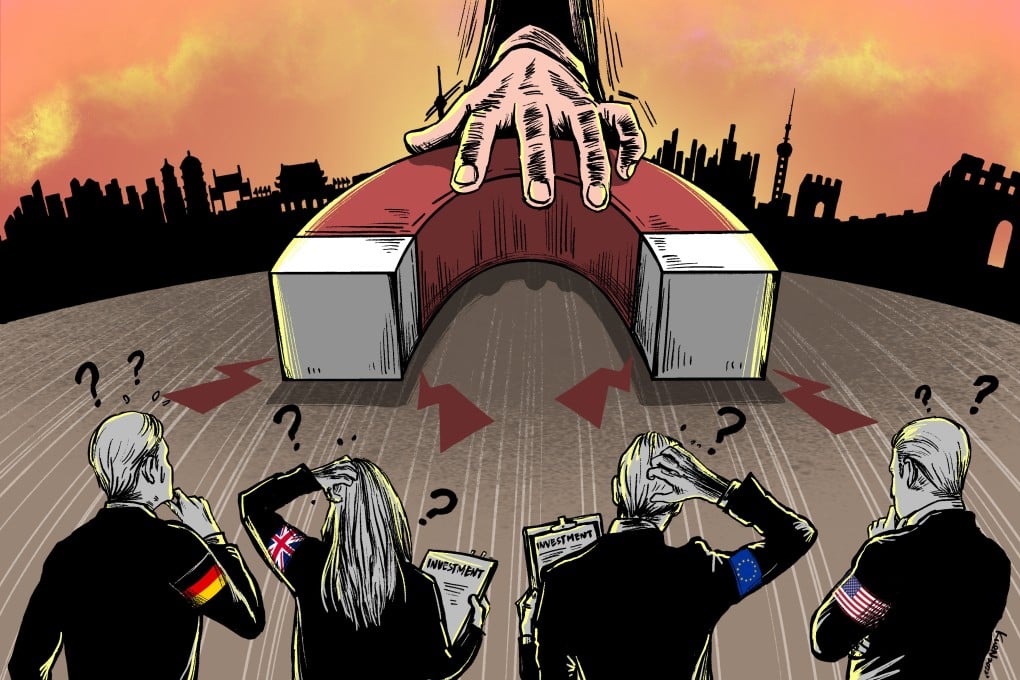

‘Completely underinvested’ China woos foreign investors but still withholds what they want most

- An outpouring of money and assets has Beijing scrambling to lure back capital by touting China’s massive market and lucrative opportunities

- But getting foreigners to once again invest in China is an uphill struggle as zero-Covid, geopolitical tensions and other risks make second-largest economy less attractive

Reading Time:6 minutes

Why you can trust SCMP

70

In the midst of rising concerns over an exodus of foreign capital, China continues to remain “highly investible” to the world, at least in the eyes of analysts and insiders.

But even as Beijing mounts a charm offensive to woo overseas investors, its political decisions are complicating the landscape for inbound capital flows, making would-be investors more reluctant to move assets into China or keep them there, even as experts attest that the country remains “completely underinvested”.

To combat the trend, which threatens to further strain China’s already precipitous economic recovery, the commerce ministry is imploring local-level task forces across the country to step up exchanges with foreign-invested enterprises, offering them better services and support in the hope that such efforts will see them write more cheques, including for foreign-invested infrastructure.

Advertisement

“[Local teams should] intensify efforts to attract more investment and to secure more commitments of investment intentions,” a ministry statement said on Monday, following its meeting on Thursday.

However, a bevy of reports from European and American lobby groups in recent weeks have warned that the foreign business community’s confidence in the world’s second-largest economy has faltered, resulting in the postponement or cancellation of investment plans in China this year.

Advertisement

While many of the foreign firms say they have no intention of leaving China altogether, they continually point to lingering and unpredictable disruptions from its zero-Covid policy, as well as from geopolitical entanglements.

Advertisement

Select Voice

Select Speed

1.00x